Navigating the complexities of dental insurance can feel like a root canal itself. But understanding your options is crucial for maintaining oral health without breaking the bank. This deep dive into Spirit dental insurance plans unravels the intricacies of coverage, costs, and customer service, empowering you to make informed decisions about your dental care.

From understanding the different plan tiers and their respective benefits to comparing Spirit with its competitors, this guide provides a clear and concise overview of what you need to know before enrolling. We’ll examine the claims process, network of dentists, and potential limitations, leaving no stone unturned in our quest to demystify Spirit dental insurance.

Defining “Spirit Dental Insurance Plans”

Spirit Dental Insurance plans represent a subset of dental insurance offerings, often characterized by their focus on specific demographics or benefit structures. They are not a single, monolithic entity but rather a collection of plans offered by various insurance providers under the “Spirit” branding or with similar features. These plans aim to provide affordable and accessible dental care, often emphasizing preventative services. A comprehensive understanding requires examining their specific features and comparing them to other market players.

Spirit dental insurance plans typically offer a range of coverage options, from basic preventative care to more extensive coverage encompassing major restorative procedures. The specific benefits and limitations vary considerably depending on the plan selected and the insurer offering it. Unlike some national providers, Spirit plans might be more localized or associated with specific employer groups, impacting their availability and overall reach.

Types of Spirit Dental Insurance Plans

The precise types of Spirit dental insurance plans available are not publicly standardized and vary based on the insurer and geographic location. However, based on common dental insurance models, we can infer likely plan structures. These could include Preventive & Diagnostic plans focusing primarily on cleanings and examinations; Basic plans adding coverage for basic restorative work like fillings; and Premium plans offering the most comprehensive coverage, including orthodontics and major procedures like crowns and bridges. The specific cost and benefits of each tier will vary.

Comparison with Other Dental Insurance Providers

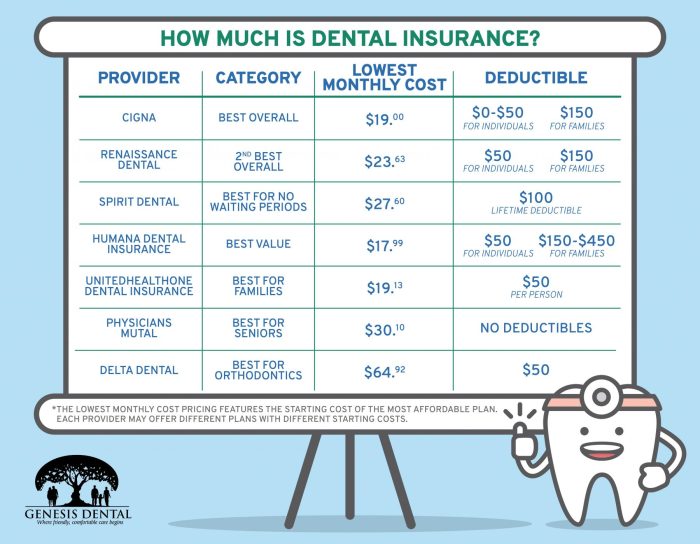

Comparing Spirit dental insurance plans to other providers necessitates knowing the specific Spirit plan in question. However, general comparisons can be made based on common features. For example, Spirit plans may compete with national providers like Delta Dental or Cigna on price, offering a more budget-friendly option, or they may focus on niche markets, providing more specialized coverage not offered by larger companies. A key differentiator might be the network of dentists participating in the plan, impacting the choice of providers for individuals. Factors like deductibles, annual maximums, and waiting periods will also influence the comparison, and these details would need to be examined on a plan-by-plan basis to provide accurate insights.

Coverage and Benefits

Spirit Dental insurance plans offer a range of coverage options designed to meet varying budgetary needs and dental health requirements. Understanding the specific benefits included in each plan is crucial for consumers to make informed decisions about their dental care. The plans aim to provide comprehensive coverage for preventative, basic, and major dental services, although the extent of coverage varies depending on the chosen plan tier.

Spirit Dental’s coverage encompasses a wide array of common dental procedures. The specific procedures covered and the extent of reimbursement will depend on the chosen plan. However, generally, preventative care is usually well-covered across all tiers.

Covered Dental Procedures and Expenses

Spirit Dental plans typically cover preventative services such as routine checkups, cleanings, and X-rays. Many plans also include coverage for basic restorative procedures like fillings for cavities and extractions of damaged teeth. Depending on the plan tier, coverage may extend to more extensive procedures, such as root canals, crowns, bridges, and even orthodontics for children. Examples of common covered expenses include the cost of fillings, cleaning, X-rays, and fluoride treatments. Some plans may also cover the cost of dentures or partial dentures, although this is often subject to specific limitations and may require pre-authorization.

Excluded Dental Procedures and Expenses

While Spirit Dental aims for comprehensive coverage, certain procedures are typically excluded from coverage. These exclusions often include cosmetic procedures such as teeth whitening, veneers, or implants, unless medically necessary. Procedures considered experimental or investigational are also generally excluded. Other potential exclusions could include pre-existing conditions, unless explicitly covered under specific plan terms. Additionally, the plans may have limitations on the frequency of certain procedures, such as cleanings.

Comparison of Spirit Dental Plan Tiers

| Plan Tier | Preventative Care | Basic Restorative | Major Restorative |

|---|---|---|---|

| Bronze | 100% | 80% | 50% |

| Silver | 100% | 90% | 70% |

| Gold | 100% | 100% | 80% |

| Platinum | 100% | 100% | 100% |

Note: Percentage values represent the percentage of covered expenses after meeting the annual deductible. Specific coverage details and exclusions may vary depending on the individual plan and state regulations. This table is for illustrative purposes and should not be considered a comprehensive or binding representation of coverage. Always refer to the official plan documents for complete details.

Premiums and Costs

Spirit dental insurance plan premiums vary significantly based on several key factors. Understanding these factors allows consumers to make informed decisions and choose a plan that best fits their budgetary needs and coverage requirements. This section details the components that influence premium costs and provides illustrative examples.

The cost of a Spirit dental insurance plan is influenced by a complex interplay of variables. Age is a primary factor, with older individuals generally facing higher premiums due to a statistically increased likelihood of requiring more extensive dental care. The specific plan chosen also plays a crucial role; comprehensive plans offering broader coverage naturally command higher premiums than basic plans with limited benefits. Geographic location impacts costs, reflecting variations in healthcare provider fees and operating expenses across different regions. Finally, the individual’s or family’s health history and pre-existing conditions can influence premium calculations, as insurers assess the potential for future claims.

Premium Cost Examples

The following examples illustrate potential premium costs for various age groups and plan types. These figures are illustrative and should not be considered definitive quotes. Actual premiums will depend on the specific plan, location, and individual circumstances.

| Age Group | Basic Plan (Monthly Premium) | Comprehensive Plan (Monthly Premium) |

|---|---|---|

| Individual (25-34) | $35 | $60 |

| Individual (55-64) | $50 | $85 |

| Family (2 Adults, 2 Children) | $120 | $200 |

Additional Fees and Charges

Several additional fees or charges may apply beyond the monthly premium. It’s crucial to understand these potential costs to avoid unexpected expenses.

- Deductible: This is the amount you must pay out-of-pocket for covered services before your insurance begins to pay. Deductibles can range from a few hundred dollars to over a thousand, depending on the plan.

- Co-pay: Some plans require a co-payment at the time of service, which is a fixed fee you pay for each visit. This amount varies depending on the service and the plan.

- Co-insurance: After meeting your deductible, you may still be responsible for a percentage of the cost of covered services. This percentage is your co-insurance, and it varies by plan.

- Out-of-Network Charges: If you see a dentist not in your plan’s network, you’ll likely pay a higher percentage of the costs. Your plan may not cover services from out-of-network providers at all.

- Late Payment Fees: Failure to pay premiums on time may result in late payment fees, which can significantly add to the overall cost.

Network of Dentists

Spirit Dental Insurance plans offer access to a wide network of participating dentists across the country. The breadth and depth of this network are crucial factors in determining the overall value and accessibility of the plan. Understanding the network’s composition and how to utilize it effectively is essential for maximizing benefits.

The size and geographic distribution of Spirit’s dental provider network vary depending on the specific plan purchased. Higher-tier plans often provide access to a more extensive network, potentially including specialists not available in lower-tier options. This network includes general dentists, orthodontists, periodontists, and other dental specialists.

Finding In-Network Dentists

Spirit Dental provides several convenient tools to locate in-network dentists. The primary method is through their online dentist finder tool, accessible on the Spirit Dental website. This tool allows users to search by zip code, city, state, or even specific dental services needed. The search results display a list of participating dentists, their contact information, office hours, and sometimes even patient reviews or ratings. Additionally, Spirit often provides a downloadable directory of participating dentists, either as a PDF or in a searchable format. Members can also contact Spirit’s customer service department for assistance in locating a nearby in-network provider.

Benefits of In-Network vs. Out-of-Network Dentists

Utilizing in-network dentists significantly impacts the cost of dental care under a Spirit Dental plan. In-network dentists have pre-negotiated rates with Spirit, resulting in significantly lower out-of-pocket expenses for the insured individual. These pre-negotiated rates are often substantially less than what an out-of-network dentist might charge. For example, a routine cleaning might cost $150 at an in-network dentist covered at 80% by the plan, resulting in a $30 out-of-pocket cost for the patient. The same cleaning at an out-of-network dentist could cost $200, with significantly less coverage, leading to a much higher out-of-pocket expense. Furthermore, pre-authorization and claim processing are often streamlined for in-network providers, reducing administrative burdens for both the dentist and the patient. While using an out-of-network dentist is possible, it usually involves significantly higher costs and a more complex claims process.

Claims Process and Reimbursements

Filing a claim with Spirit Dental Insurance is a straightforward process designed for efficiency and ease of use. The company offers multiple avenues for submitting claims, ensuring accessibility for all policyholders. Understanding the necessary steps and documentation will expedite reimbursement.

Submitting a claim typically involves providing detailed information about the dental services rendered. Accurate and complete information ensures prompt processing and avoids potential delays. Spirit Dental prioritizes transparency in its claims process, providing clear communication throughout each stage.

Claim Submission Methods

Spirit Dental offers several methods for submitting claims. Policyholders can submit claims online through the member portal, a convenient and trackable option. Alternatively, claims can be submitted via mail using the provided claim form. For those who prefer in-person assistance, claims can be submitted at participating dental offices. Each method requires the same core documentation.

Required Documentation for Claim Submission

The necessary documentation for a claim includes the completed claim form, which requests details such as the policyholder’s information, the date of service, a description of the services provided, and the associated costs. Crucially, the claim form must also include the dentist’s tax identification number and the original receipt or explanation of benefits (EOB) from the dental provider. Failure to provide complete documentation may result in delays.

Step-by-Step Guide for Online Claim Submission

Submitting claims online offers several advantages, including real-time tracking and immediate confirmation of receipt. The online portal simplifies the process.

- Log in to the Spirit Dental member portal using your unique username and password.

- Navigate to the “Submit a Claim” section.

- Complete the online claim form, ensuring all fields are accurately filled. This includes the date of service, procedure codes, and the total amount billed.

- Upload the required supporting documents, including the original receipt or EOB from your dentist.

- Review your submission for accuracy before clicking “Submit.”

- You will receive an immediate confirmation email, and you can track the status of your claim through the portal.

Claim Processing Times and Reimbursement

Once a claim is received with all necessary documentation, Spirit Dental aims to process it within 10-14 business days. The reimbursement amount will be determined based on the policy’s coverage details and the submitted documentation. Reimbursements are typically issued via check or direct deposit, depending on the policyholder’s preference specified during enrollment. Delays may occur if additional information is required. In such instances, Spirit Dental will contact the policyholder directly.

Example Claim Form and Supporting Documentation

The claim form typically includes fields for the policyholder’s name, address, policy number, date of service, dentist’s name and contact information, a description of services rendered (including procedure codes), and the total charges. Supporting documentation includes the original receipt from the dentist, detailing the services provided and the charges. This receipt should clearly state the date of service, the procedures performed, and the amount billed. A copy of the Explanation of Benefits (EOB) from the dentist is also usually required. This document summarizes the services covered by the insurance and the amounts paid by the insurance company.

Customer Service and Support

Spirit Dental Insurance prioritizes accessible and responsive customer service to address policyholder inquiries and concerns efficiently. Multiple channels are available to ensure a seamless experience for all members.

Spirit Dental offers a comprehensive suite of customer support options designed to meet diverse communication preferences. This multi-channel approach aims to resolve issues quickly and effectively, minimizing frustration and maximizing member satisfaction.

Contact Channels

Spirit Dental provides several avenues for contacting customer service. These include a toll-free telephone number staffed by knowledgeable representatives available during extended business hours, a user-friendly website featuring a comprehensive FAQ section and online chat functionality, and a dedicated email address for non-urgent inquiries. For members who prefer written communication, a postal mailing address is also provided.

Examples of Customer Service Interactions

Positive experiences often involve prompt responses to inquiries, clear explanations of policy details, and efficient resolution of claims issues. For instance, a member experiencing a billing discrepancy might receive a prompt call-back from a representative who quickly identifies and corrects the error, providing a detailed explanation and apology for the inconvenience. Conversely, negative experiences may involve long wait times on hold, unhelpful or dismissive representatives, and unresolved issues. A hypothetical example would be a member attempting to submit a claim online, encountering technical difficulties and receiving no response to subsequent email inquiries.

Resolving Common Issues

Claims processing delays can be addressed by contacting customer service directly. Members should have their policy number readily available and be prepared to provide details of the services rendered, including dates, provider information, and any supporting documentation. Billing discrepancies are typically resolved through verification of account information and review of payment history. Members should provide clear documentation of any disputed charges. In cases of complex issues, escalating the concern to a supervisor might be necessary. For example, a member facing difficulty understanding their Explanation of Benefits (EOB) could request a detailed explanation from a customer service representative, potentially leading to a follow-up call with a claims specialist.

Plan Enrollment and Renewal

Securing a Spirit dental insurance plan is a straightforward process designed for ease and efficiency. Understanding the enrollment and renewal procedures ensures uninterrupted access to crucial dental care benefits. This section details the steps involved in both processes, along with essential deadlines and required documentation.

The enrollment process for Spirit dental insurance plans typically begins with an online application or through a designated enrollment agent. Applicants provide personal information, select a plan, and confirm their eligibility. Following submission, Spirit processes the application, and upon approval, enrollees receive their insurance card and a welcome packet outlining their coverage details. The process usually takes between 7 to 10 business days. For those enrolling through an employer-sponsored plan, the process is often streamlined through the company’s HR department.

Enrollment Process

The enrollment process for Spirit dental plans involves several key steps to ensure a smooth transition to coverage. First, applicants must complete an online application form, providing accurate and complete personal information, including name, address, date of birth, and Social Security number. Next, they select a plan that best fits their needs and budget from the available options. Finally, after reviewing and agreeing to the terms and conditions, the application is submitted. Following submission, Spirit Dental reviews the application, and if approved, the applicant receives their insurance card and policy documents.

Renewal Requirements and Deadlines

Renewal of a Spirit dental insurance plan typically occurs annually. Enrollees receive renewal notices well in advance of the expiration date, usually 30-60 days prior. These notices contain information about the renewal process, premium adjustments (if any), and any changes to plan benefits or coverage. Failure to renew before the deadline may result in a lapse in coverage, requiring a new application and potentially a waiting period before benefits become active again.

Required Documents for Enrollment and Renewal

Having the necessary documentation readily available simplifies the enrollment and renewal processes. Providing accurate and complete information ensures a timely and efficient transition.

- Completed application form

- Proof of identity (e.g., driver’s license, passport)

- Social Security number

- Current address verification (e.g., utility bill, bank statement)

- Employer-provided enrollment information (if applicable)

Comparison with Competitors

Choosing a dental insurance plan requires careful consideration of various factors beyond just premiums. A comparative analysis against leading competitors reveals the strengths and weaknesses of Spirit Dental Insurance Plans and helps consumers make informed decisions. This section compares Spirit with Delta Dental and Cigna Dental, two prominent players in the dental insurance market.

Spirit Dental vs. Delta Dental and Cigna Dental: Key Differences

Delta Dental and Cigna Dental, like Spirit, offer a range of plans with varying coverage levels and premium costs. However, significant differences exist in network size, specific benefits, and claims processing procedures. A direct comparison highlights these crucial distinctions.

| Feature | Spirit Dental | Delta Dental | Cigna Dental |

|---|---|---|---|

| Annual Maximum Benefit | $1,500 – $2,500 (depending on plan) | $1,000 – $2,000 (depending on plan and state) | $1,500 – $2,500 (depending on plan) |

| Preventive Care Coverage | 100% coverage for cleanings and exams | Typically 100% coverage for cleanings and exams | Typically 100% coverage for cleanings and exams |

| Basic Services Coverage | 80% coverage for fillings and extractions | 70-80% coverage for fillings and extractions (varies by plan) | 75-80% coverage for fillings and extractions (varies by plan) |

| Major Services Coverage | 50% coverage for crowns, bridges, and orthodontics | 50-60% coverage for crowns, bridges, and orthodontics (varies by plan) | 50-60% coverage for crowns, bridges, and orthodontics (varies by plan) |

| Network Size | Moderate network size, varies by geographic location. | Extensive network, particularly strong in certain regions. | Extensive network, with a strong national presence. |

| Average Monthly Premium (Example: Family Plan) | $300 – $450 | $350 – $500 | $325 – $475 |

| Claims Processing | Online and mail options available; typically processed within 2-3 weeks. | Online and mail options; generally efficient processing. | Online and mail options; generally efficient processing. |

Advantages and Disadvantages of Each Provider

Spirit Dental offers competitive pricing for its benefits package, particularly appealing to budget-conscious individuals and families. However, its network size may be smaller compared to Delta Dental and Cigna Dental, limiting the choice of dentists in some areas. Delta Dental boasts a wide network and strong reputation, but premiums can be higher. Cigna Dental provides a balance between network size and affordability, but specific coverage details vary significantly by plan. Consumers should carefully compare plans within each provider to determine the best fit for their individual needs and budget.

Potential Limitations and Exclusions

Spirit Dental insurance plans, like most dental insurance policies, contain limitations and exclusions that affect the extent of coverage. Understanding these restrictions is crucial for policyholders to manage their expectations and avoid unexpected out-of-pocket costs. These limitations are often clearly defined within the plan’s contract, but a thorough review is essential before enrollment.

While Spirit Dental strives to provide comprehensive coverage, certain procedures, treatments, and circumstances may result in reduced or no benefits. These limitations are designed to balance affordability with the overall cost of dental care. Failing to understand these limitations could lead to significant unforeseen expenses.

Pre-Existing Conditions

Many dental insurance plans, including some Spirit Dental offerings, may exclude or limit coverage for pre-existing conditions. This means that problems identified before the policy’s effective date may not be fully covered. For example, if a patient has extensive periodontal disease diagnosed prior to enrolling in a Spirit Dental plan, treatment for that specific condition might be subject to limitations or waiting periods before coverage begins. This limitation is common across the industry and aims to manage the risk of covering significant pre-existing dental issues.

Cosmetic Procedures

Generally, cosmetic procedures are not covered under standard dental insurance plans, including many Spirit Dental options. This category typically includes procedures solely focused on improving the appearance of teeth, rather than addressing dental health. Examples include teeth whitening, veneers for purely aesthetic reasons, and certain types of orthodontics aimed primarily at cosmetic enhancement. While some plans might offer limited coverage for specific cosmetic procedures under certain circumstances, it’s vital to check the plan details carefully.

Orthodontics

While some orthodontic treatments might be partially covered, depending on the specific Spirit Dental plan and the patient’s age, there are usually limitations. Adult orthodontic treatments are often subject to stricter coverage limits than those for children or adolescents. The extent of coverage can vary significantly, often involving a maximum benefit amount or a percentage of the total cost, leaving the patient responsible for a substantial portion of the expense. Additionally, pre-authorization may be required before starting orthodontic treatment.

Waiting Periods

Many Spirit Dental plans include waiting periods before certain types of coverage become effective. This means that after enrolling, there might be a delay before specific procedures are covered. For instance, there could be a waiting period before major restorative work, such as crowns or bridges, is covered. These waiting periods are a common industry practice and are designed to mitigate risk and prevent immediate claims for significant expenses.

Annual and Lifetime Maximums

Spirit Dental plans, like most dental insurance, typically have annual and/or lifetime maximum benefit amounts. This means that there’s a cap on the total amount the insurance company will pay out for covered services within a year or over the lifetime of the policy. Once these maximums are reached, the patient is responsible for all remaining costs. Understanding these limits is crucial for budgeting dental expenses. For example, a plan with a $1,500 annual maximum will not cover expenses exceeding that amount in a given year.

Conclusion

Choosing the right dental insurance plan is a significant financial and health decision. This exploration of Spirit dental insurance plans has aimed to equip you with the knowledge to weigh the pros and cons, compare options, and ultimately make a choice that best suits your needs and budget. Remember to carefully review the plan details, compare it to competitors, and contact Spirit directly with any questions before committing to a policy.