Navigating the healthcare system can be a daunting task, especially when it comes to finding a primary doctor who accepts your insurance. For those with Ambetter insurance, this search can feel even more complex due to the variety of plans and provider networks available. This guide provides a comprehensive overview of Ambetter insurance, resources for finding primary doctors, and essential information to ensure a smooth and informed healthcare experience.

From understanding the different Ambetter insurance plans and their coverage details to navigating the process of finding and choosing a primary doctor, this guide aims to equip you with the knowledge and tools necessary to make informed decisions about your healthcare.

Understanding Ambetter Insurance

Ambetter is a health insurance provider offering a range of plans for individuals and families across various states. Understanding the different plans and their coverage is crucial for making an informed decision.

Ambetter Insurance Plans

Ambetter offers various health insurance plans categorized into different metal tiers, each representing a different level of coverage and premium costs. The most common plan types are:

- Bronze Plans: Bronze plans are the most affordable option, offering the lowest monthly premiums but with the highest out-of-pocket costs. These plans cover essential health benefits, including preventive care, hospitalization, and emergency services, but require a larger share of the costs for medical services.

- Silver Plans: Silver plans offer a balance between premium costs and out-of-pocket expenses. They have a lower premium than gold plans but higher out-of-pocket costs than bronze plans. Silver plans provide a more comprehensive coverage than bronze plans.

- Gold Plans: Gold plans provide more comprehensive coverage than silver plans with lower out-of-pocket expenses but higher premiums. These plans offer a higher level of financial protection against medical costs.

- Platinum Plans: Platinum plans are the most expensive but offer the highest level of coverage with the lowest out-of-pocket expenses. They cover a wide range of medical services with minimal financial burden on the insured.

Benefits and Coverage

Ambetter plans offer a comprehensive range of benefits, including:

- Preventive Care: Ambetter plans cover preventive services like vaccinations, screenings, and annual checkups without any out-of-pocket costs.

- Hospitalization: Ambetter plans cover inpatient and outpatient hospital services, including surgery, intensive care, and emergency room visits.

- Prescription Drugs: Ambetter plans cover prescription medications, with varying coverage levels depending on the plan type.

- Mental Health and Substance Use Disorder Services: Ambetter plans offer coverage for mental health and substance use disorder services, including therapy, counseling, and medication.

- Maternity Care: Ambetter plans cover maternity care, including prenatal visits, labor and delivery, and postpartum care.

Provider Network

Ambetter has a vast network of healthcare providers, including doctors, hospitals, and pharmacies, across its service areas. This network ensures access to quality healthcare services within the plan’s coverage. You can access the provider directory on the Ambetter website or through their customer service line to find in-network providers in your area.

Finding Primary Doctors

Finding a primary care doctor who accepts Ambetter insurance is essential for accessing quality healthcare. Ambetter, a health insurance provider, offers various plans with different networks of doctors. To ensure you can access care under your Ambetter plan, you need to find a doctor within your network.

Resources to Find Ambetter-Accepting Doctors

Ambetter provides several resources to help you find doctors who accept their insurance. These resources include:

- Ambetter’s Website: Ambetter’s website usually has a provider directory that allows you to search for doctors by location, specialty, and other criteria. You can often filter your search results to include only doctors who accept Ambetter insurance.

- Ambetter’s Member Services: You can call Ambetter’s member services to get help finding a doctor in your network. Their representatives can assist you with your search and provide you with the necessary contact information.

- Ambetter’s Mobile App: Some Ambetter plans offer a mobile app that allows you to search for doctors in your network. This app can be a convenient way to find a doctor on the go.

Tips for Finding Doctors

When searching for a primary care doctor, consider the following tips:

- Location: Choose a doctor who is conveniently located for you, considering factors like proximity to your home, work, or other important locations. A doctor’s location can significantly impact your ability to access care.

- Specialty: Consider your specific healthcare needs and choose a doctor who specializes in the area that aligns with your health concerns. This ensures you receive specialized care from a doctor with expertise in your condition.

- Patient Reviews: Read patient reviews and testimonials to gain insights into other patients’ experiences with the doctor. These reviews can provide valuable information about the doctor’s communication style, bedside manner, and overall patient satisfaction.

Verifying Doctor Acceptance of Ambetter Insurance

After finding potential doctors, it’s crucial to verify their acceptance of Ambetter insurance. This ensures you avoid unexpected out-of-network costs.

- Contact the Doctor’s Office: The most reliable way to confirm a doctor’s acceptance of Ambetter is to contact their office directly. Ask the receptionist or office staff if they accept Ambetter insurance and your specific plan.

- Check the Doctor’s Website: Some doctors list their insurance affiliations on their website. This can be a convenient way to quickly verify their acceptance of Ambetter.

- Use Online Provider Directories: Online provider directories, like those offered by Ambetter or other insurance providers, often include information about a doctor’s insurance acceptance. These directories can be a valuable resource for verifying insurance coverage.

Primary Care Services

Primary care services are the foundation of a healthy life. They encompass a wide range of medical services that focus on preventative care, managing chronic conditions, and addressing acute health issues. These services are crucial for maintaining overall well-being and ensuring timely interventions when necessary.

Importance of Preventive Care and Routine Checkups

Preventive care is essential for identifying potential health problems early, when they are easier to treat. Routine checkups allow doctors to monitor your overall health, assess your risk factors, and provide personalized recommendations for maintaining optimal well-being.

- Annual physical exams: These comprehensive checkups include a review of your medical history, a physical examination, and lab tests to assess your overall health status.

- Vaccinations: Vaccinations protect you from serious and potentially life-threatening diseases. Staying up-to-date with recommended vaccinations is crucial for maintaining immunity.

- Cancer screenings: Regular screenings for common cancers, such as breast cancer, colon cancer, and cervical cancer, can detect these diseases early, when they are most treatable.

- Blood pressure and cholesterol checks: Regular monitoring of these vital signs can help identify and manage high blood pressure and high cholesterol, which are major risk factors for heart disease and stroke.

Scheduling Appointments and Obtaining Referrals

Scheduling appointments with your primary care doctor is usually straightforward. You can typically schedule appointments online, by phone, or through a patient portal. Ambetter insurance may have specific procedures for scheduling appointments, so it’s essential to check their website or contact their customer service for details.

- Appointment scheduling: Most primary care doctors offer a range of appointment types, including routine checkups, sick visits, and urgent care appointments.

- Referrals: If your primary care doctor believes you need specialized care, they will provide you with a referral to a specialist. Referrals may be required for certain procedures or services, so it’s important to follow the referral process Artikeld by Ambetter insurance.

Patient-Doctor Relationship

The relationship between a patient and their primary doctor is a crucial aspect of healthcare. A strong patient-doctor relationship fosters trust, open communication, and ultimately, better health outcomes. When choosing a primary doctor, it’s essential to consider factors that align with your individual needs and preferences.

Factors to Consider When Choosing a Primary Doctor

The decision of choosing a primary doctor is personal. It’s important to consider several factors to ensure a comfortable and effective relationship.

- Communication Style: A good doctor listens attentively, explains things clearly, and answers questions thoroughly. Consider how comfortable you feel with their communication style and whether they explain things in a way you understand.

- Personality and Approach: Doctors have different personalities and approaches to patient care. Some are more proactive, while others prefer a more conservative approach. Consider what type of doctor best suits your personality and preferences.

- Experience and Expertise: Doctors have different areas of expertise. If you have specific health concerns, it’s important to choose a doctor with experience in that area. You can research their credentials and areas of specialization.

- Location and Availability: Choose a doctor who is conveniently located and has available appointment slots that fit your schedule. Consider the doctor’s practice hours and availability for emergencies.

- Insurance Coverage: Ensure that the doctor accepts your insurance plan and that the services you need are covered. You can contact the doctor’s office or your insurance provider to verify coverage.

Importance of Communication and Trust

Open and honest communication is vital for a successful patient-doctor relationship. Trust is fundamental, allowing you to feel comfortable sharing personal information and concerns. When you trust your doctor, you are more likely to follow their advice, which can lead to better health outcomes.

Tips for Effective Communication with Your Primary Doctor

Effective communication with your doctor is crucial for good healthcare. Here are some tips to enhance your communication:

- Prepare a List of Questions: Before your appointment, write down any questions or concerns you have. This will help you stay organized and ensure you cover all your topics.

- Bring a Friend or Family Member: Having someone with you can help you remember information and ask questions. They can also provide support and take notes during the appointment.

- Be Honest and Open: Share all relevant information, including your medical history, lifestyle habits, and concerns. This helps your doctor understand your overall health and provide the best care.

- Don’t Be Afraid to Ask Questions: It’s okay to ask questions, no matter how simple they may seem. Your doctor is there to help you understand your health and treatment options.

- Listen Carefully: Pay attention to what your doctor says and ask for clarification if you don’t understand something. Take notes if needed.

- Be Respectful: Treat your doctor with respect, even if you disagree with their recommendations. A respectful approach fosters a more productive conversation.

Navigating Insurance Coverage

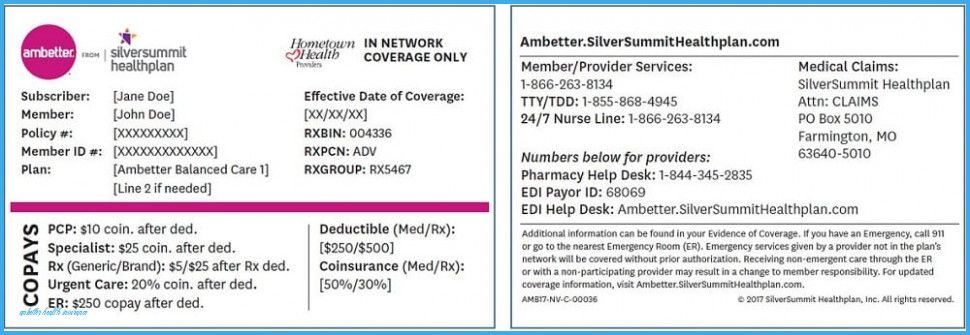

Navigating insurance coverage can seem daunting, but understanding the basics of Ambetter insurance can make the process smoother. This section will provide a clear overview of how Ambetter insurance works, including common medical procedures and their coverage, claim filing, and the role of your primary doctor in managing your coverage.

Coverage for Common Medical Procedures

Ambetter insurance offers coverage for a wide range of medical procedures, including preventative care, diagnostic tests, and treatment for various conditions. The table below provides a general overview of common procedures and their coverage under Ambetter insurance. Please note that specific coverage details may vary depending on your individual plan.

| Procedure | Coverage | Notes |

|---|---|---|

| Preventative Care (e.g., annual check-ups, vaccinations) | Typically covered at 100% | May require pre-authorization depending on the specific service. |

| Diagnostic Tests (e.g., blood work, imaging scans) | Typically covered with co-pay or coinsurance | May require pre-authorization depending on the specific test. |

| Treatment for Chronic Conditions (e.g., diabetes, asthma) | Covered with co-pay or coinsurance | May require pre-authorization for certain medications and therapies. |

| Hospitalization | Covered with co-pay or coinsurance | May require pre-authorization for elective procedures. |

| Surgery | Covered with co-pay or coinsurance | May require pre-authorization and may have a deductible. |

Filing Claims and Understanding Co-pays

When you receive medical services, your provider will typically file a claim with Ambetter insurance on your behalf. You will receive a bill outlining your out-of-pocket costs, including any co-pays or coinsurance.

A co-pay is a fixed amount you pay for each medical service, while coinsurance is a percentage of the cost you pay after meeting your deductible.

It is important to keep track of your co-pays and deductible to avoid unexpected costs. You can also contact Ambetter customer service for assistance with understanding your coverage and billing.

Role of Primary Doctor in Managing Coverage

Your primary doctor plays a crucial role in navigating your insurance coverage. They can help you understand your benefits, choose appropriate medical services, and ensure that necessary pre-authorizations are obtained. They can also advocate for you with insurance companies to resolve any billing issues or coverage disputes.

It is recommended to discuss your insurance coverage with your primary doctor during your first visit. They can provide personalized guidance and support to help you manage your health care effectively.

Health and Wellness Resources

Ambetter insurance provides access to a wealth of health and wellness resources, both online and offline, designed to empower you to take charge of your well-being. These resources are readily available to help you maintain good health, manage chronic conditions, and make informed decisions about your health care.

Online Resources

Online resources offer a convenient and readily accessible platform for health information and support.

- Ambetter Website: The Ambetter website provides access to a comprehensive library of health and wellness articles, videos, and tools. This platform offers information on a wide range of topics, including disease prevention, healthy living, and managing chronic conditions.

- Mobile App: The Ambetter mobile app offers a convenient and portable way to access your health information, schedule appointments, and manage your benefits. The app also features health and wellness tools, such as fitness trackers and medication reminders.

- Health Information Websites: Reputable websites such as the Centers for Disease Control and Prevention (CDC), the National Institutes of Health (NIH), and the American Heart Association offer reliable and up-to-date health information.

Offline Resources

Offline resources provide personalized support and guidance from qualified professionals.

- Primary Care Physician: Your primary care physician is your first point of contact for health concerns. They can provide personalized advice, manage chronic conditions, and refer you to specialists if necessary.

- Community Health Centers: Community health centers offer a range of health services, including preventive care, chronic disease management, and mental health support. They often provide services on a sliding scale based on income.

- Support Groups: Support groups offer a safe and supportive environment to connect with others who share similar health concerns. They can provide emotional support, practical advice, and a sense of community.

Maintaining Good Health

Maintaining good health involves adopting healthy habits and making informed choices about your lifestyle.

- Healthy Diet: A balanced diet rich in fruits, vegetables, whole grains, and lean protein can help prevent chronic diseases and maintain a healthy weight.

- Regular Exercise: Aim for at least 30 minutes of moderate-intensity exercise most days of the week. Physical activity helps improve cardiovascular health, manage weight, and reduce the risk of chronic diseases.

- Adequate Sleep: Getting enough sleep is crucial for physical and mental health. Aim for 7-8 hours of quality sleep each night.

- Stress Management: Chronic stress can negatively impact your health. Practice stress-reducing techniques such as yoga, meditation, or spending time in nature.

Managing Chronic Conditions

Managing chronic conditions requires ongoing care and attention to maintain your health and quality of life.

- Follow Your Treatment Plan: Work closely with your doctor to develop a treatment plan that meets your individual needs. This may include medication, lifestyle changes, and regular check-ups.

- Monitor Your Symptoms: Keep track of your symptoms and report any changes to your doctor promptly. This can help identify potential problems early on.

- Ask Questions: Don’t hesitate to ask your doctor questions about your condition and treatment. Understanding your condition is essential for managing it effectively.

Preventive Measures

Preventive measures are essential for maintaining good health and reducing the risk of chronic diseases.

- Regular Check-ups: Schedule regular check-ups with your primary care physician to monitor your overall health and detect any potential problems early on.

- Immunizations: Stay up-to-date on recommended immunizations to protect yourself from preventable diseases.

- Screenings: Participate in recommended screenings for common health conditions, such as cancer, heart disease, and diabetes.

Healthy Lifestyle Choices

Making healthy lifestyle choices can significantly impact your overall health and well-being.

- Limit Alcohol Consumption: Excessive alcohol consumption can increase your risk of various health problems.

- Avoid Smoking: Smoking is a major risk factor for lung cancer, heart disease, and other health issues.

- Practice Safe Sex: Use condoms to protect yourself from sexually transmitted infections.

Choosing a Primary Doctor

Choosing the right primary care doctor is a crucial step in managing your health. A primary care doctor acts as your health advocate, providing comprehensive care and coordinating your medical needs. You can choose from different types of primary care providers, each with its own strengths and specialties.

Types of Primary Care Doctors

Understanding the different types of primary care doctors and their respective strengths can help you make an informed decision. Here’s a table comparing the different types of primary care doctors:

| Type of Doctor | Description | Strengths | Weaknesses |

|—|—|—|—|

| Family Physician | Provides comprehensive care for all ages, from newborns to seniors. | – Offers a broad range of services, including preventive care, diagnosis and treatment of common illnesses, and management of chronic conditions. – Can provide care for the entire family. | – May not have specialized training in specific areas. |

| Internal Medicine Physician | Specializes in the care of adults, focusing on the diagnosis and treatment of complex medical conditions. | – Has extensive knowledge of adult diseases and conditions. – Can provide comprehensive care, including preventive care, diagnosis, and treatment. | – May not be suitable for children or adolescents. |

| Pediatrician | Specializes in the care of children from birth to adolescence. | – Has specialized training in child development and health. – Can provide comprehensive care, including vaccinations, well-child checkups, and treatment of childhood illnesses. | – May not be suitable for adults. |

| Geriatrician | Specializes in the care of older adults, focusing on the unique health needs of seniors. | – Has specialized training in age-related diseases and conditions. – Can provide comprehensive care, including preventive care, diagnosis, and treatment, and management of age-related health issues. | – May not be suitable for younger adults. |

| Nurse Practitioner (NP) | Provides comprehensive care for patients of all ages. | – Can provide a wide range of services, including preventive care, diagnosis and treatment of common illnesses, and management of chronic conditions. – Often have a more holistic approach to patient care. | – May not have the same level of training as physicians. |

| Physician Assistant (PA) | Works under the supervision of a physician, providing a range of healthcare services. | – Can provide a wide range of services, including preventive care, diagnosis and treatment of common illnesses, and management of chronic conditions. – Often have a more holistic approach to patient care. | – May not have the same level of training as physicians. |

Factors to Consider When Choosing a Primary Doctor

Several factors should be considered when choosing a primary care doctor:

– Location: Choose a doctor who is conveniently located and accessible.

– Insurance Coverage: Ensure that your chosen doctor accepts your Ambetter insurance plan.

– Availability: Consider the doctor’s availability for appointments, especially if you have a busy schedule.

– Communication Style: Choose a doctor who communicates effectively and in a way that you understand.

– Personal Preferences: Consider your own personal preferences, such as gender, age, and cultural background.

Finding a Primary Doctor

You can find a primary care doctor who meets your needs by using the following resources:

– Ambetter Provider Directory: The Ambetter provider directory lists doctors who accept Ambetter insurance. You can search by specialty, location, and other criteria.

– Your Network: Ask friends, family, and colleagues for recommendations.

– Online Reviews: Read online reviews of doctors to get an idea of their patients’ experiences.

Building a Strong Patient-Doctor Relationship

Once you’ve chosen a primary care doctor, it’s important to build a strong relationship. This involves:

– Open Communication: Be open and honest with your doctor about your health concerns and needs.

– Active Participation: Ask questions and actively participate in your healthcare decisions.

– Trust: Trust your doctor’s expertise and judgment.

Doctor-Patient Communication

Effective communication between doctors and patients is paramount for achieving optimal healthcare outcomes. Clear and open dialogue fosters trust, promotes shared decision-making, and ensures that patients receive the most appropriate care.

Understanding Medical Terminology

Medical terminology can be complex and intimidating for patients. To facilitate effective communication, it’s crucial to ask questions and clarify any unfamiliar terms. Don’t hesitate to request explanations in simple language. Doctors are trained to communicate effectively with patients, and they should be happy to answer questions and provide clarification.

Asking Questions

Patients should actively participate in their healthcare by asking questions and expressing their concerns. Here are some tips for asking questions effectively:

- Prepare a list of questions before your appointment to ensure that you cover all your concerns.

- Don’t be afraid to ask for clarification if you don’t understand something.

- Write down the answers to your questions to ensure that you remember them.

Patient Advocacy

Patients have the right to be active participants in their healthcare decisions. This includes advocating for their own needs and preferences. Here are some ways to practice patient advocacy:

- Research your condition and treatment options to be informed about your care.

- Ask for second opinions if you have concerns about a diagnosis or treatment plan.

- Communicate your preferences for treatment and care to your doctor.

Ambetter Insurance Updates

Ambetter insurance plans are constantly evolving to meet the changing needs of their members. Staying updated on the latest changes is crucial to maximizing your benefits and understanding your coverage. Here’s a look at some recent developments and key information for Ambetter insurance members.

Network Updates

Ambetter insurance regularly updates its network of healthcare providers. These updates can include additions, removals, or changes in provider availability. It’s essential to check the network for your specific plan to ensure your preferred doctors and hospitals are still in-network.

- New Provider Additions: Ambetter insurance frequently adds new healthcare providers to its network, expanding access to care. These additions can include primary care physicians, specialists, and hospitals. You can find a list of new providers on the Ambetter website or through their member portal.

- Provider Changes: Ambetter insurance may also make changes to provider availability, such as modifying hours of operation or updating contact information. It’s crucial to stay informed about any changes to ensure you can access your preferred providers.

- Provider Network Updates: Ambetter insurance may periodically adjust its provider network based on market conditions, member feedback, and other factors. These updates can involve adding new providers, removing providers, or making changes to provider availability.

New Resources and Initiatives

Ambetter insurance is committed to providing its members with the resources and support they need to manage their health and well-being.

- Telehealth Services: Ambetter insurance may offer expanded telehealth services, allowing members to consult with doctors virtually. This can be a convenient option for routine check-ups, follow-up appointments, or consultations with specialists.

- Wellness Programs: Ambetter insurance may introduce new wellness programs to promote healthy lifestyles and preventive care. These programs can include fitness challenges, nutrition counseling, or educational resources on various health topics.

- Member Support: Ambetter insurance may enhance its member support services, offering improved access to customer service representatives, online resources, and mobile applications.

Last Point

Choosing a primary doctor is a significant step in managing your health. By understanding Ambetter insurance plans, utilizing available resources, and prioritizing communication with your doctor, you can navigate the healthcare system with confidence and ensure access to the care you need. Remember, a strong patient-doctor relationship is crucial for maintaining optimal health and well-being.