In a world increasingly reliant on digital systems, the insurance industry is no exception. The need for a standardized identifier for policyholders has led to the development of the National General Insurance Number (NGIN). This unique number serves as a vital link between individuals and their insurance policies, streamlining processes, enhancing security, and fostering greater transparency within the industry.

NGINs are becoming increasingly prevalent across the globe, with countries like the United Kingdom, Germany, and Australia adopting them to manage their insurance landscapes. This article delves into the world of NGINs, exploring their purpose, history, benefits, and future implications for both individuals and the insurance sector.

What is a National General Insurance Number (NGIN)?

A National General Insurance Number (NGIN) is a unique identifier assigned to individuals in certain countries for the purpose of managing and tracking their insurance information. It serves as a central reference point for all insurance-related transactions, making it easier to access and manage insurance policies, claims, and other related services.

Purpose of an NGIN

The primary purpose of an NGIN is to streamline the insurance process for both individuals and insurance providers. By having a single, unique identifier, it simplifies the following:

- Policy Management: NGINs allow individuals to easily track their insurance policies, premiums, and coverage details across different insurance providers.

- Claims Processing: NGINs facilitate faster and more efficient claims processing by providing a quick and reliable way to verify the identity of the policyholder and access their insurance information.

- Fraud Prevention: NGINs can help prevent insurance fraud by making it more difficult for individuals to create multiple identities or falsify insurance claims.

- Data Analysis and Research: NGINs allow insurance providers to collect and analyze data on insurance claims, risk profiles, and other relevant factors, which can be used to improve insurance products and services.

History and Origin of NGINs

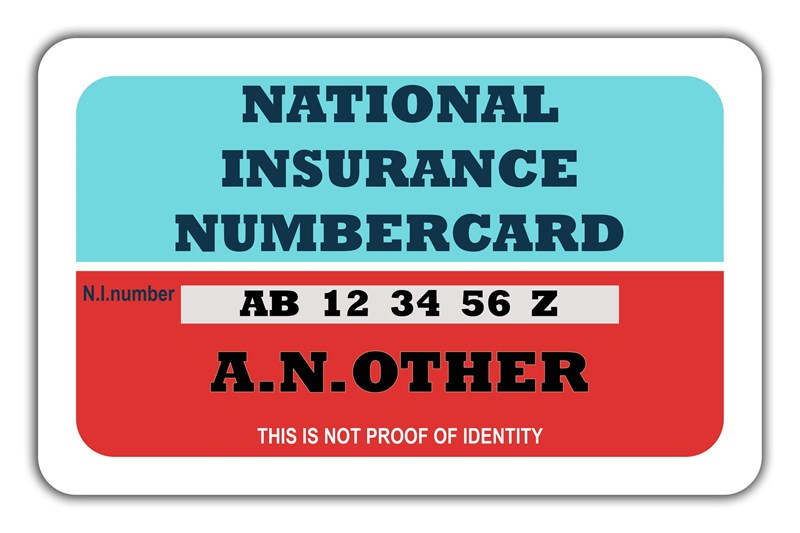

The concept of a national insurance number is not new. Several countries have implemented similar systems over the years, often in conjunction with social security or national identification programs. For example, the United Kingdom introduced the National Insurance number in 1948 as part of its post-World War II social security system. The number is used for various purposes, including access to healthcare, pensions, and other social benefits.

Examples of Countries that Use NGINs

Several countries around the world have implemented national insurance number systems, each with its own specific characteristics and purpose. Some notable examples include:

- United Kingdom: The National Insurance number, introduced in 1948, is used for various purposes, including access to healthcare, pensions, and other social benefits.

- Canada: The Social Insurance Number (SIN) is a nine-digit number assigned to individuals for tax purposes and access to government programs, including social benefits and employment insurance.

- United States: While there is no single national insurance number in the United States, the Social Security number (SSN) is widely used for various purposes, including insurance, banking, and employment.

- India: The Unique Identification Authority of India (UIDAI) issues the Aadhaar number, a 12-digit biometric identifier that is used for various purposes, including insurance, banking, and government services.

The Importance of NGINs in Insurance

The National General Insurance Number (NGIN) plays a crucial role in the insurance industry, serving as a unique identifier for policyholders and streamlining various processes. This unique number acts as a central hub, connecting insurers, policyholders, and other stakeholders within the insurance ecosystem.

Identifying and Tracking Policyholders

NGINs provide a standardized and efficient method for insurers to identify and track their policyholders. By assigning a unique number to each individual, insurers can easily access and manage their policyholder data. This simplifies the process of verifying policy details, updating contact information, and managing policy renewals.

Streamlining the Insurance Claims Process

NGINs play a vital role in expediting the insurance claims process. When a policyholder files a claim, the NGIN acts as a key identifier, enabling insurers to quickly retrieve relevant policy information and verify the claimant’s identity. This reduces processing time and minimizes delays in claim settlement.

Preventing Insurance Fraud

NGINs contribute significantly to fraud prevention in the insurance industry. By providing a unique identifier for each policyholder, insurers can detect potential fraudulent activities, such as multiple claims filed under the same NGIN or claims filed by individuals who are not authorized policyholders. This helps insurers identify and mitigate fraudulent claims, safeguarding their financial interests.

Obtaining an NGIN

Securing a National General Insurance Number (NGIN) is a crucial step for individuals and businesses seeking to participate in the insurance market. The NGIN serves as a unique identifier, streamlining insurance transactions and facilitating efficient data management. This section provides a comprehensive guide on obtaining an NGIN, outlining the necessary steps, required documentation, and potential associated fees.

Application Process

To obtain an NGIN, individuals and businesses need to submit an application to the designated authority responsible for NGIN issuance. The application process typically involves the following steps:

- Gather Required Documentation: The application process necessitates the submission of specific documents to verify the applicant’s identity and eligibility. These documents may include:

- Proof of Identity (e.g., passport, driver’s license)

- Proof of Address (e.g., utility bill, bank statement)

- Tax Identification Number (if applicable)

- Business Registration Certificate (for businesses)

- Complete the Application Form: The application form typically requires information such as the applicant’s name, address, contact details, and insurance-related preferences.

- Submit the Application: The completed application form, along with the required documentation, should be submitted to the designated authority. This can be done online, through mail, or in person.

- Verification and Processing: The authority will review the application and supporting documents to verify the applicant’s identity and eligibility. This process may take a few days or weeks depending on the jurisdiction and workload.

- Issuance of NGIN: Upon successful verification, the authority will issue the NGIN to the applicant. The NGIN may be provided through mail, email, or through an online portal.

Documentation Requirements

The specific documentation required for NGIN application may vary depending on the jurisdiction and the type of applicant (individual or business). However, common documentation requirements include:

- Proof of Identity: This document verifies the applicant’s identity and is typically a government-issued identification card, such as a passport, driver’s license, or national identity card.

- Proof of Address: This document verifies the applicant’s current residential or business address. Acceptable documents may include utility bills, bank statements, or lease agreements.

- Tax Identification Number: In some jurisdictions, applicants may be required to provide their tax identification number, which is a unique identifier used for tax purposes.

- Business Registration Certificate: For businesses, a business registration certificate is typically required to verify the legitimacy of the business and its legal status.

Fees

Issuing an NGIN may involve associated fees, which can vary depending on the jurisdiction and the type of applicant. These fees are typically charged to cover the administrative costs associated with processing applications, maintaining databases, and providing related services.

The fees for NGIN issuance can range from a nominal amount to a more significant sum, depending on the specific circumstances.

NGINs and Data Privacy

The National General Insurance Number (NGIN) is a crucial identifier in the insurance sector, and its security is paramount. As with any sensitive personal information, protecting NGINs is essential to safeguard individuals’ privacy and prevent fraud.

Legal Framework for NGIN Data Protection

The legal framework surrounding NGINs and data protection varies across jurisdictions. However, common principles include:

- Data Minimization: Only essential NGIN data should be collected and processed.

- Purpose Limitation: NGIN data should only be used for its intended purpose, such as processing insurance claims or managing policies.

- Data Security: Robust security measures should be implemented to protect NGIN data from unauthorized access, use, disclosure, alteration, or destruction.

- Data Subject Rights: Individuals should have the right to access, correct, and delete their NGIN data.

Security Measures for Protecting NGIN Data

Insurers are obligated to implement strong security measures to protect NGIN data. Some common practices include:

- Encryption: NGIN data should be encrypted both in transit and at rest to prevent unauthorized access.

- Access Control: Access to NGIN data should be restricted to authorized personnel based on the principle of “least privilege.”

- Regular Security Audits: Regular security audits should be conducted to identify and mitigate vulnerabilities.

- Data Loss Prevention: Measures should be in place to prevent data loss, such as data backups and disaster recovery plans.

- Employee Training: Employees handling NGIN data should receive training on data security best practices.

Best Practices for Individuals to Safeguard their NGINs

Individuals can take steps to protect their NGINs:

- Do not share your NGIN with anyone except authorized entities.

- Be cautious of phishing scams and other fraudulent attempts to obtain your NGIN.

- Report any suspected NGIN misuse to the relevant authorities.

- Keep your NGIN in a safe and secure location.

NGINs in the Digital Age

The rise of online insurance platforms and mobile applications has ushered in a new era of convenience and accessibility in the insurance sector. This digital transformation has also highlighted the crucial role of National General Insurance Numbers (NGINs) in streamlining insurance processes and enhancing customer experiences.

NGINs in Online Insurance Platforms

The integration of NGINs into online insurance platforms has significantly simplified the process of obtaining insurance quotes, purchasing policies, and managing insurance claims. Online platforms leverage NGINs to verify customer identities, retrieve insurance history, and facilitate seamless transactions.

- Simplified Quote Generation: Online platforms can automatically retrieve relevant information about a customer’s insurance history and risk profile using their NGIN. This enables them to provide personalized quotes tailored to individual needs, reducing the time and effort required for manual data entry.

- Streamlined Policy Purchase: NGINs act as a unique identifier, allowing online platforms to process policy purchases efficiently. By verifying the customer’s identity and retrieving relevant information, platforms can automate policy issuance and eliminate the need for cumbersome paperwork.

- Efficient Claims Management: When filing a claim online, customers can use their NGIN to provide essential information, including policy details and contact information. This simplifies the claims process, allowing insurance companies to quickly assess the claim and initiate the settlement procedure.

NGINs in Mobile Insurance Applications

Mobile insurance applications have become increasingly popular, offering users on-the-go access to insurance services. NGINs play a vital role in enhancing the functionality and user experience of these applications.

- Mobile Policy Management: Mobile apps leverage NGINs to provide users with a secure and convenient platform to manage their insurance policies. Users can access policy documents, view coverage details, and make payments directly through the app, all while ensuring data privacy and security.

- Real-Time Claims Reporting: Mobile apps with NGIN integration enable users to report claims instantly from their smartphones. By using their NGIN, users can provide necessary information and even upload photos or videos of the incident, expediting the claims process and reducing the time required for claim settlement.

- Personalized Insurance Recommendations: Mobile apps can utilize NGINs to analyze user data, such as driving history or health records, and provide personalized insurance recommendations. This helps users identify potential gaps in their coverage and make informed decisions about their insurance needs.

NGINs and E-commerce Transactions in Insurance

NGINs are instrumental in facilitating secure and efficient e-commerce transactions in the insurance sector. They serve as a vital link between insurance companies, online platforms, and customers, ensuring data integrity and protecting sensitive information.

- Secure Payment Processing: NGINs can be integrated with online payment gateways to verify customer identities and ensure secure payment processing. This reduces the risk of fraud and protects customer financial data.

- Data Security and Privacy: NGINs play a crucial role in maintaining data privacy and security in online insurance transactions. They act as a unique identifier, allowing insurance companies to verify customer identities and access relevant information while ensuring data is not shared with unauthorized parties.

- Enhanced Transparency and Accountability: NGINs contribute to greater transparency and accountability in the insurance sector. By providing a standardized system for identifying and verifying customers, NGINs help reduce the potential for fraud and ensure that insurance transactions are conducted fairly and transparently.

The Future of NGINs

The National General Insurance Number (NGIN) is poised to play an increasingly pivotal role in the evolving insurance landscape. As technology advances and the insurance industry undergoes digital transformation, NGINs are expected to adapt and evolve, shaping the future of insurance.

NGINs and Emerging Technologies

Emerging technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), are expected to significantly impact the use and functionality of NGINs.

- AI-Powered Risk Assessment: AI algorithms can analyze vast amounts of data, including NGIN-linked information, to create more accurate and personalized risk assessments. This can lead to more tailored insurance policies and potentially lower premiums for low-risk individuals. For example, an AI-powered system could use NGIN data to assess driving behavior, home security measures, and health records to determine individual risk profiles.

- Blockchain for Secure Data Management: Blockchain technology offers a secure and transparent platform for storing and managing NGIN data. It can help prevent fraud and ensure the integrity of insurance records, enhancing trust and efficiency in the insurance ecosystem. For instance, blockchain could be used to create an immutable record of NGIN transactions, making it difficult to alter or falsify data.

- IoT Integration: The integration of NGINs with IoT devices can provide real-time data about insured assets and individuals. This can enable insurers to offer dynamic insurance policies that adjust based on real-time risk factors. For example, a connected car equipped with sensors could transmit data about driving behavior, allowing insurers to adjust premiums based on safe driving practices.

Impact of NGINs on the Insurance Industry

The widespread adoption of NGINs is likely to bring about significant changes in the insurance industry.

- Enhanced Customer Experience: NGINs can streamline insurance processes, making it easier for customers to obtain quotes, file claims, and manage their policies. For instance, customers could use their NGIN to access their insurance information online or through mobile apps, eliminating the need for paper documents.

- Improved Fraud Detection: NGINs can be used to verify the identity of policyholders and detect fraudulent claims. By linking NGINs to comprehensive databases, insurers can cross-reference information and identify potential discrepancies. This can lead to reduced insurance fraud and lower premiums for honest policyholders.

- Personalized Insurance Products: NGINs can enable insurers to develop personalized insurance products tailored to individual needs and risk profiles. By analyzing NGIN-linked data, insurers can create more relevant and competitive policies, potentially attracting a wider customer base.

NGINs and Other Identification Systems

The National General Insurance Number (NGIN) is a unique identifier assigned to individuals for insurance purposes. It is important to understand how NGINs relate to other identification systems, particularly the Social Security Number (SSN), which is used for a wide range of purposes, including taxation and social benefits.

Comparison of NGINs and SSNs

SSNs and NGINs are both numerical identifiers, but they serve distinct purposes. SSNs are primarily used for government-related functions, while NGINs are specifically designed for insurance purposes. The table below highlights key differences:

| Feature | NGIN | SSN |

|---|---|---|

| Purpose | Insurance | Taxation, social benefits, identification |

| Issuer | Insurance industry | Social Security Administration |

| Usage | Insurance transactions, claims processing | Tax returns, government benefits, credit applications |

| Privacy | Generally restricted to insurance purposes | Widely used, leading to potential privacy risks |

Advantages and Disadvantages of Using NGINs

Using NGINs offers several advantages:

- Improved efficiency and accuracy: NGINs streamline insurance processes by providing a unique identifier for each individual, reducing errors and duplication.

- Enhanced fraud prevention: NGINs can help detect and prevent insurance fraud by providing a consistent and verifiable identifier.

- Simplified claims processing: NGINs facilitate faster and more efficient claims processing by enabling quick identification of policyholders.

However, NGINs also present some disadvantages:

- Potential for misuse: Like any identifier, NGINs could be misused if not properly protected, leading to identity theft or fraud.

- Limited scope: NGINs are primarily used for insurance purposes, limiting their applicability to other sectors.

- Data privacy concerns: The use of NGINs raises data privacy concerns, particularly regarding the potential for misuse or unauthorized access.

Interoperability Challenges and Opportunities

Interoperability between NGINs and other identification systems presents both challenges and opportunities.

- Data sharing and privacy: Sharing data between different systems requires careful consideration of data privacy and security protocols.

- Standardization: Standardization of data formats and communication protocols is essential for seamless interoperability.

- Technological infrastructure: Robust technological infrastructure is necessary to support data exchange between different systems.

Despite these challenges, interoperability offers significant potential benefits:

- Improved customer experience: Seamless integration between systems can provide a more convenient and streamlined experience for customers.

- Enhanced efficiency: Interoperability can reduce redundancies and streamline processes across different sectors.

- Innovation: Interoperability can foster innovation by enabling the development of new applications and services that leverage data from different systems.

NGINs and International Insurance

The National General Insurance Number (NGIN) plays a crucial role in streamlining and facilitating international insurance transactions. It serves as a unique identifier for individuals and entities, simplifying the exchange of information and facilitating cross-border insurance claims.

Challenges of Using NGINs in Cross-Border Insurance

NGINs face challenges in international insurance transactions, mainly due to differences in regulatory frameworks and data privacy regulations across countries. These challenges can create hurdles in sharing and accessing NGIN information for cross-border insurance purposes.

“The use of NGINs in international insurance is subject to the complexities of varying regulatory frameworks and data privacy concerns across different jurisdictions.”

Examples of NGINs in International Insurance Markets

Several international insurance markets leverage NGINs to facilitate cross-border transactions.

- EU’s Insurance Directive: The EU’s Insurance Directive promotes the use of NGINs for cross-border insurance transactions within the European Union. This directive aims to simplify insurance procedures and reduce administrative burdens for insurance companies operating in different EU countries.

- ASEAN Insurance Market: The Association of Southeast Asian Nations (ASEAN) is exploring the use of NGINs to standardize insurance processes and facilitate cross-border insurance transactions within the region. This initiative aims to promote a more integrated and efficient insurance market in Southeast Asia.

- Global Insurance Networks: Several global insurance networks are exploring the use of NGINs to simplify international insurance transactions. These networks are working to establish common standards and procedures for sharing and accessing NGIN information, making it easier for insurers to operate across borders.

The Impact of NGINs on Policyholders

The introduction of National General Insurance Numbers (NGINs) has ushered in a new era of efficiency and convenience for policyholders in the insurance sector. This unique identification system simplifies insurance processes, fosters transparency, and empowers policyholders to manage their insurance needs with greater ease.

Benefits of Having an NGIN for Policyholders

An NGIN acts as a digital passport for policyholders, streamlining various insurance-related interactions. Here’s how it benefits policyholders:

- Simplified Policy Management: Policyholders can easily access and manage their insurance policies online or through mobile apps using their NGIN. This eliminates the need for paperwork and simplifies the process of updating policy details, making claims, and tracking policy information.

- Enhanced Security and Fraud Prevention: NGINs provide a secure and verifiable identity, reducing the risk of fraud and ensuring that only authorized individuals can access policy information. This safeguards policyholders’ personal data and protects them from unauthorized access.

- Improved Customer Service: Insurance companies can leverage NGINs to provide personalized and efficient customer service. With access to a policyholder’s complete insurance history, insurers can quickly resolve inquiries, process claims, and offer tailored solutions based on individual needs.

- Faster Claim Processing: NGINs expedite the claims process by simplifying identity verification and eliminating the need for multiple forms and documentation. This allows insurers to process claims more efficiently and provide policyholders with faster payouts.

NGINs and Improved Customer Service in the Insurance Sector

NGINs are transforming customer service in the insurance sector by facilitating personalized and efficient interactions. Here’s how:

- Personalized Service: By leveraging NGINs, insurance companies can access comprehensive policyholder information, including past claims, policy details, and preferences. This enables insurers to offer tailored advice, personalized quotes, and customized solutions based on individual needs.

- Faster Response Times: With NGINs, insurance companies can quickly verify a policyholder’s identity and access their insurance information, leading to faster response times for inquiries, claims, and policy updates. This reduces waiting times and improves customer satisfaction.

- Proactive Communication: NGINs enable insurance companies to send targeted and timely communication to policyholders, such as renewal reminders, policy updates, and relevant offers. This proactive approach improves customer engagement and fosters trust.

- Omnichannel Support: NGINs facilitate seamless communication across multiple channels, including online platforms, mobile apps, and call centers. This allows policyholders to access insurance services conveniently and efficiently, regardless of their preferred channel.

NGINs Empower Policyholders to Manage Their Insurance Policies

NGINs empower policyholders by providing them with greater control and visibility over their insurance policies. This includes:

- Online Access to Policy Information: Policyholders can access their policy details, claims history, and payment information online through secure portals using their NGIN. This provides transparency and allows them to track their insurance needs easily.

- Real-time Policy Updates: NGINs enable policyholders to receive real-time updates on their policies, such as renewal notices, claim status updates, and policy changes. This keeps them informed and empowers them to manage their insurance needs effectively.

- Self-Service Options: NGINs allow policyholders to perform various self-service tasks online, such as updating policy details, making payments, and filing claims. This reduces reliance on traditional customer service channels and offers greater convenience.

- Personalized Recommendations: Based on policyholder data and preferences, insurance companies can use NGINs to provide personalized recommendations for additional coverage, discounts, and other relevant insurance products. This empowers policyholders to make informed decisions about their insurance needs.

NGINs and the Insurance Industry

The National General Insurance Number (NGIN) is poised to revolutionize the insurance industry, bringing about a new era of efficiency, transparency, and data-driven insights. By providing a unique and standardized identifier for every individual and asset, NGINs streamline processes, enhance risk management, and foster a more informed and secure insurance landscape.

Impact on Efficiency and Transparency

The introduction of NGINs has the potential to significantly improve efficiency and transparency within the insurance industry. By eliminating the need for manual data entry and verification, NGINs automate processes, reducing administrative burdens and minimizing errors. This streamlined approach allows insurers to allocate resources more effectively, focus on core business operations, and expedite claim processing. Moreover, the transparency fostered by NGINs enables policyholders to access their insurance information readily and track the progress of their claims.

NGINs and Risk Management and Underwriting

NGINs play a crucial role in enhancing risk management and underwriting practices. By providing a comprehensive and accurate view of an individual’s insurance history and risk profile, NGINs empower insurers to make more informed decisions. This data-driven approach enables insurers to accurately assess risk, tailor policies to individual needs, and set premiums based on objective criteria. The availability of reliable data through NGINs reduces the reliance on subjective assessments and fosters a more equitable and transparent insurance system.

NGINs in Action: Enhancing Insurance Operations

Insurance companies are already leveraging NGINs to enhance their operations in various ways:

- Streamlined Customer Onboarding: NGINs expedite the customer onboarding process by automatically verifying identity and insurance history, reducing paperwork and processing time.

- Improved Claims Management: NGINs facilitate faster and more accurate claim processing by providing access to relevant data and automating verification steps.

- Enhanced Fraud Detection: By enabling the cross-referencing of insurance data, NGINs assist in identifying and preventing fraudulent claims.

- Data-Driven Product Development: NGINs provide insurers with valuable insights into customer needs and preferences, enabling them to develop innovative and targeted insurance products.

Case Studies

NGINs are not just theoretical concepts; they are being implemented and utilized in various countries by different insurance companies, demonstrating their practical value and potential to revolutionize the insurance industry. Examining real-world case studies provides valuable insights into the benefits, challenges, and future directions of NGINs.

NGIN Implementation Across the Globe

The following table showcases examples of how NGINs are being used in different countries and insurance companies, highlighting the key benefits realized through their implementation.

| Country | Insurance Company | NGIN Implementation | Key Benefits |

|---|---|---|---|

| United States | Progressive Insurance | Progressive uses NGINs to streamline the claims process and improve customer service. By verifying the identity of policyholders and claimants through NGINs, Progressive can expedite claims processing, reduce fraud, and enhance customer satisfaction. | Reduced fraud, expedited claims processing, improved customer service. |

| Canada | Intact Financial Corporation | Intact Financial Corporation leverages NGINs to improve risk assessment and underwriting processes. By accessing and analyzing data associated with NGINs, Intact can better assess individual risks, leading to more accurate pricing and underwriting decisions. | Improved risk assessment, more accurate pricing and underwriting. |

| United Kingdom | Aviva | Aviva utilizes NGINs to enhance customer onboarding and policy management. By integrating NGINs into its systems, Aviva can simplify the process of verifying customer identities, enabling faster and more efficient policy issuance and management. | Faster and more efficient policy issuance and management, improved customer onboarding. |

| Australia | Suncorp Group | Suncorp Group utilizes NGINs to improve claims fraud detection and prevention. By cross-referencing NGINs with other databases, Suncorp can identify potential fraudulent claims and take appropriate action, reducing losses and protecting its financial interests. | Improved claims fraud detection and prevention, reduced losses. |

Epilogue

As the insurance industry continues to evolve and embrace digital solutions, NGINs are poised to play an increasingly crucial role. They offer a robust framework for identification, security, and efficiency, facilitating seamless transactions and improving customer experiences. The future of NGINs holds exciting possibilities, with the potential to further revolutionize the insurance landscape, bringing greater accessibility, transparency, and convenience to policyholders worldwide.