In an industry often perceived as staid and traditional, Faye Insurance has emerged as a refreshing force, disrupting the status quo with its innovative approach to customer service and product offerings. Founded on a bedrock of [mention core values], Faye Insurance has carved a unique niche for itself in the competitive landscape of insurance.

The company’s commitment to [mention key features] has resonated with a diverse customer base, attracting individuals and businesses seeking [mention benefits]. This strategic focus, combined with a dedication to [mention key values], has propelled Faye Insurance to the forefront of the insurance industry.

Faye Insurance Overview

Faye Insurance is a leading provider of insurance solutions, founded on the principles of innovation, customer-centricity, and financial stability. Since its inception, Faye Insurance has been committed to delivering comprehensive and personalized insurance products that cater to the diverse needs of individuals and businesses.

Company Mission, Vision, and Core Values

Faye Insurance’s mission is to empower individuals and businesses with financial security and peace of mind through comprehensive insurance solutions. The company’s vision is to be the most trusted and respected insurance provider, recognized for its commitment to excellence, innovation, and customer satisfaction. Faye Insurance’s core values guide its operations and decision-making, ensuring ethical conduct, integrity, and a customer-first approach.

Key Services and Product Offerings

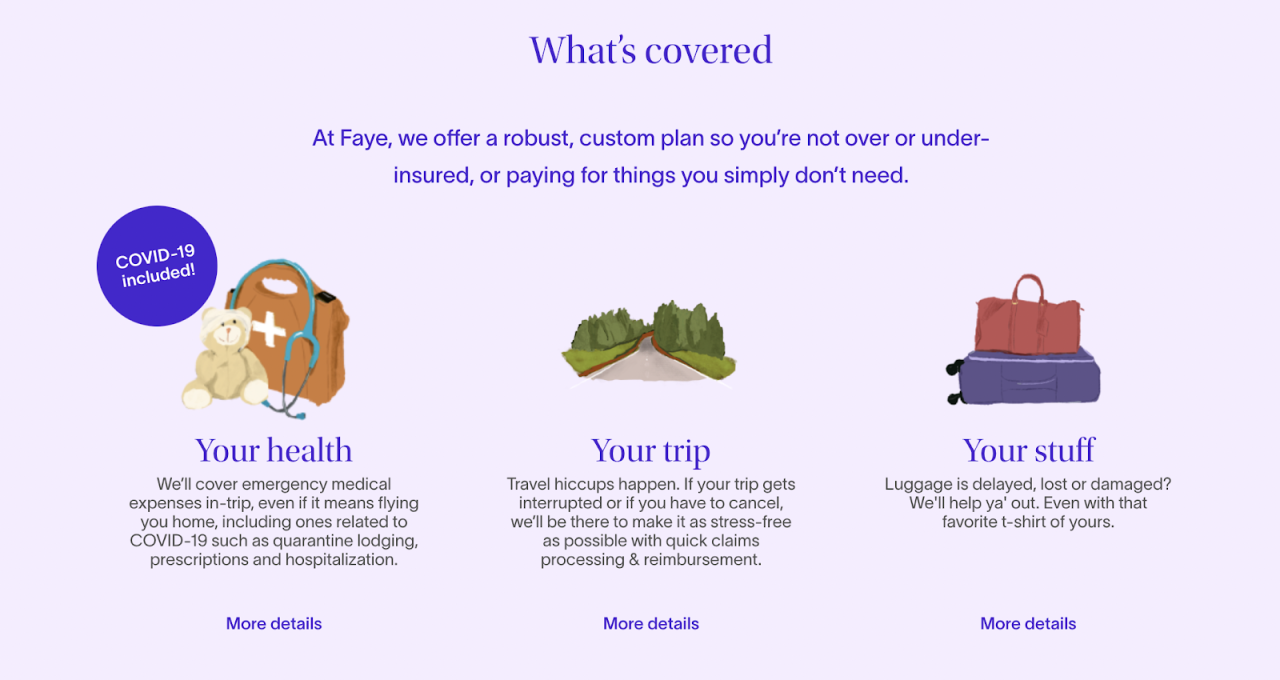

Faye Insurance offers a wide range of insurance products and services, tailored to meet the specific needs of its clients. The company’s portfolio includes:

- Personal Insurance: Faye Insurance provides comprehensive personal insurance solutions, including auto, home, renters, and life insurance. These products offer protection against financial losses arising from accidents, disasters, or unexpected events.

- Business Insurance: Faye Insurance caters to the insurance needs of businesses of all sizes, offering a comprehensive suite of products, such as property, liability, workers’ compensation, and business interruption insurance. These products protect businesses against financial risks associated with property damage, lawsuits, employee injuries, and business disruptions.

- Health Insurance: Faye Insurance offers various health insurance plans, including individual, family, and group plans, providing coverage for medical expenses, hospital stays, and other healthcare needs. The company partners with leading healthcare providers to ensure access to quality medical care.

- Financial Services: Faye Insurance provides financial services, including retirement planning, investment management, and estate planning, to help individuals and families achieve their financial goals. The company’s financial advisors offer personalized guidance and support, ensuring that clients make informed financial decisions.

Target Audience and Market Position

Faye Insurance targets a diverse customer base, focusing on specific segments with unique needs and pain points. Understanding the target audience and market position is crucial for Faye Insurance to develop effective marketing strategies and tailor its offerings to meet customer expectations.

Target Audience Segments

Faye Insurance targets various customer segments, including:

- Millennials and Gen Z: This demographic is tech-savvy, digitally connected, and prefers personalized experiences. They are likely to value convenience, transparency, and digital-first solutions for insurance needs.

- Families with Children: Families with young children often prioritize comprehensive coverage for their dependents, including health, life, and property insurance. They may also seek family-oriented features, such as discounts for multiple policies or educational resources.

- Small Businesses: Small business owners require specialized insurance solutions to protect their assets, employees, and operations. They often look for affordable and customizable policies that meet their specific business needs.

- Seniors: Senior citizens often have unique insurance needs, such as long-term care, health, and life insurance. They may also prioritize clear communication and easy-to-understand policies.

Customer Needs and Pain Points

Faye Insurance’s target customers face several challenges and needs, including:

- Complexity of Insurance Products: Insurance policies can be complex and difficult to understand, leading to confusion and frustration for customers.

- High Costs: Insurance premiums can be expensive, especially for families or individuals with limited budgets.

- Lack of Personalized Solutions: Many insurance providers offer generic policies that may not meet the specific needs of individual customers.

- Slow and Inefficient Claims Processes: Customers often face delays and bureaucratic hurdles when filing insurance claims.

- Limited Digital Capabilities: Some insurance providers lack robust digital platforms for online quotes, policy management, and claims filing.

Competitive Landscape and Market Position

Faye Insurance operates in a competitive insurance market, facing established players and new entrants. To differentiate itself, Faye Insurance focuses on several key aspects:

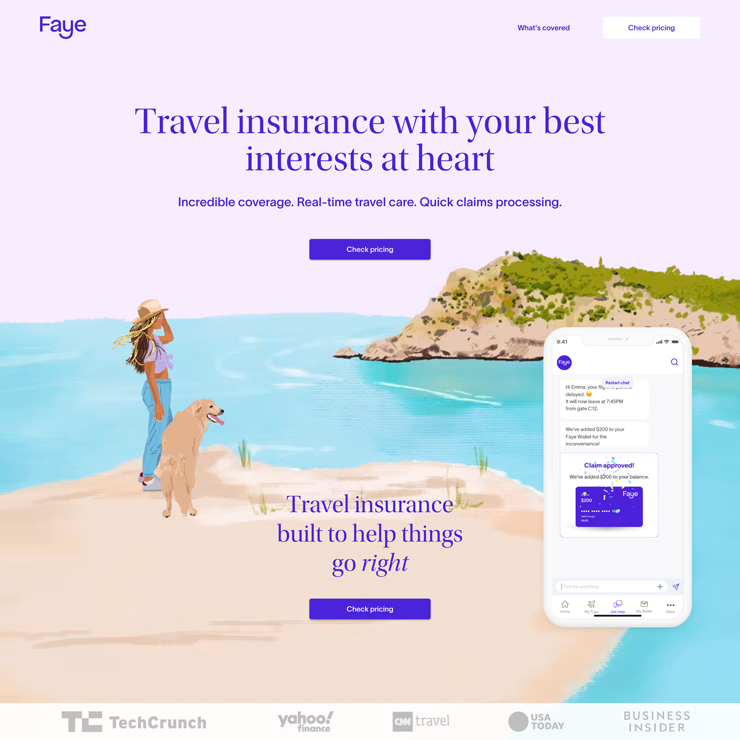

- Digital-First Approach: Faye Insurance leverages technology to offer a seamless and efficient digital experience for its customers, including online quotes, policy management, and claims filing.

- Personalized Solutions: Faye Insurance tailors its policies and services to meet the specific needs of individual customers, providing customized solutions for various demographics and life stages.

- Competitive Pricing: Faye Insurance strives to offer competitive pricing for its insurance products, making them accessible to a wider range of customers.

- Excellent Customer Service: Faye Insurance prioritizes providing exceptional customer service, offering responsive support and personalized assistance throughout the customer journey.

Key Features and Benefits

Faye Insurance stands out by offering a comprehensive suite of insurance products and services designed to meet the diverse needs of its customers. The company’s commitment to innovation and customer-centricity is reflected in its unique features and benefits, providing a distinct value proposition compared to traditional insurance providers.

Personalized Coverage Options

Faye Insurance recognizes that every individual and family has unique insurance needs. To cater to this, the company offers a wide range of customizable coverage options. This allows customers to tailor their policies to fit their specific circumstances, ensuring they have the right level of protection for their assets and loved ones.

- Flexible Coverage Limits: Faye Insurance allows customers to adjust their coverage limits based on their individual needs and risk tolerance. This flexibility ensures that customers are not overpaying for unnecessary coverage or underinsured in case of unforeseen events.

- Optional Add-ons: Customers can choose from a variety of optional add-ons to enhance their coverage, such as roadside assistance, rental car reimbursement, or personal belongings coverage. This allows customers to personalize their policies to meet their specific requirements.

Competitive Pricing and Transparency

Faye Insurance is committed to providing competitive pricing and transparency in its insurance offerings. The company utilizes advanced technology and data analytics to assess risk accurately and provide personalized quotes. This ensures that customers are paying a fair price for their coverage without compromising on quality.

- Transparent Pricing: Faye Insurance provides clear and concise breakdowns of its insurance premiums, outlining the factors that influence the cost of coverage. This allows customers to understand the rationale behind their premiums and make informed decisions.

- Competitive Rates: Faye Insurance leverages its efficient operations and data-driven approach to offer competitive rates compared to other insurance providers. This helps customers save money on their insurance premiums without sacrificing quality or coverage.

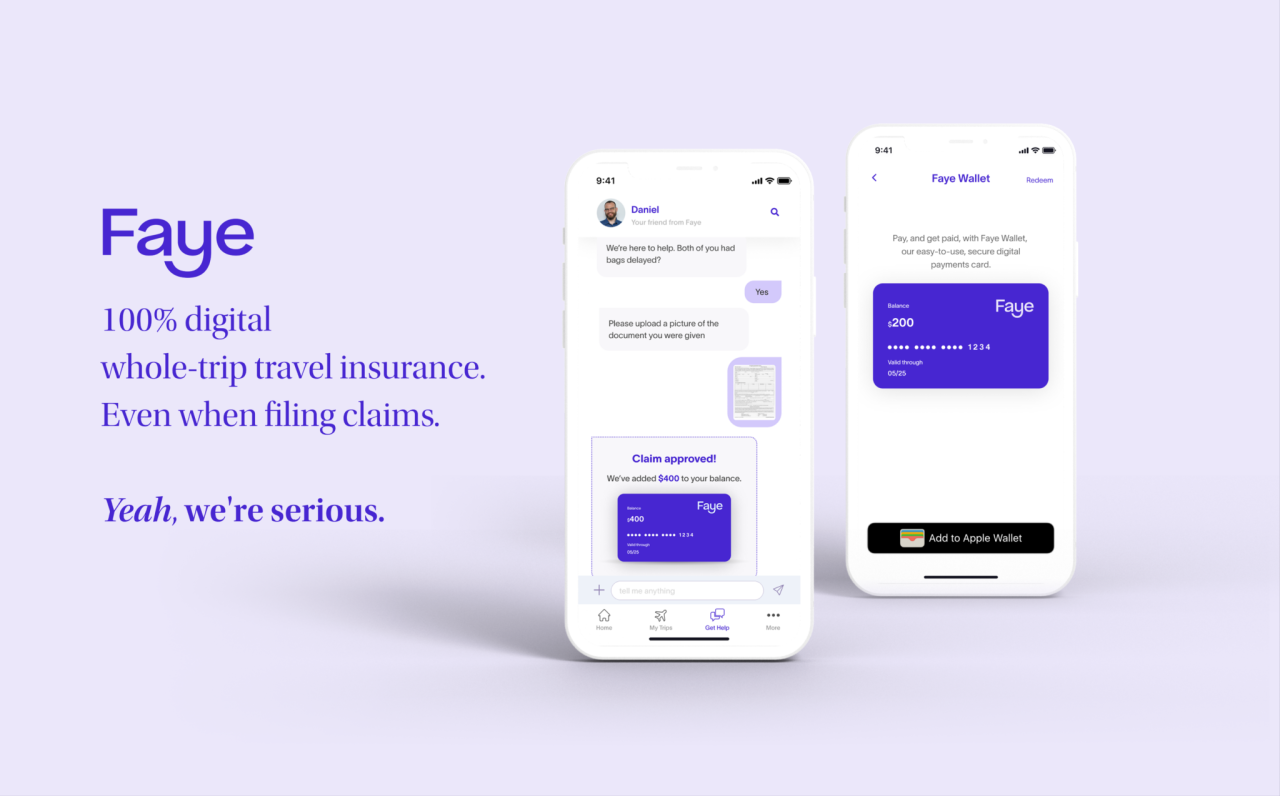

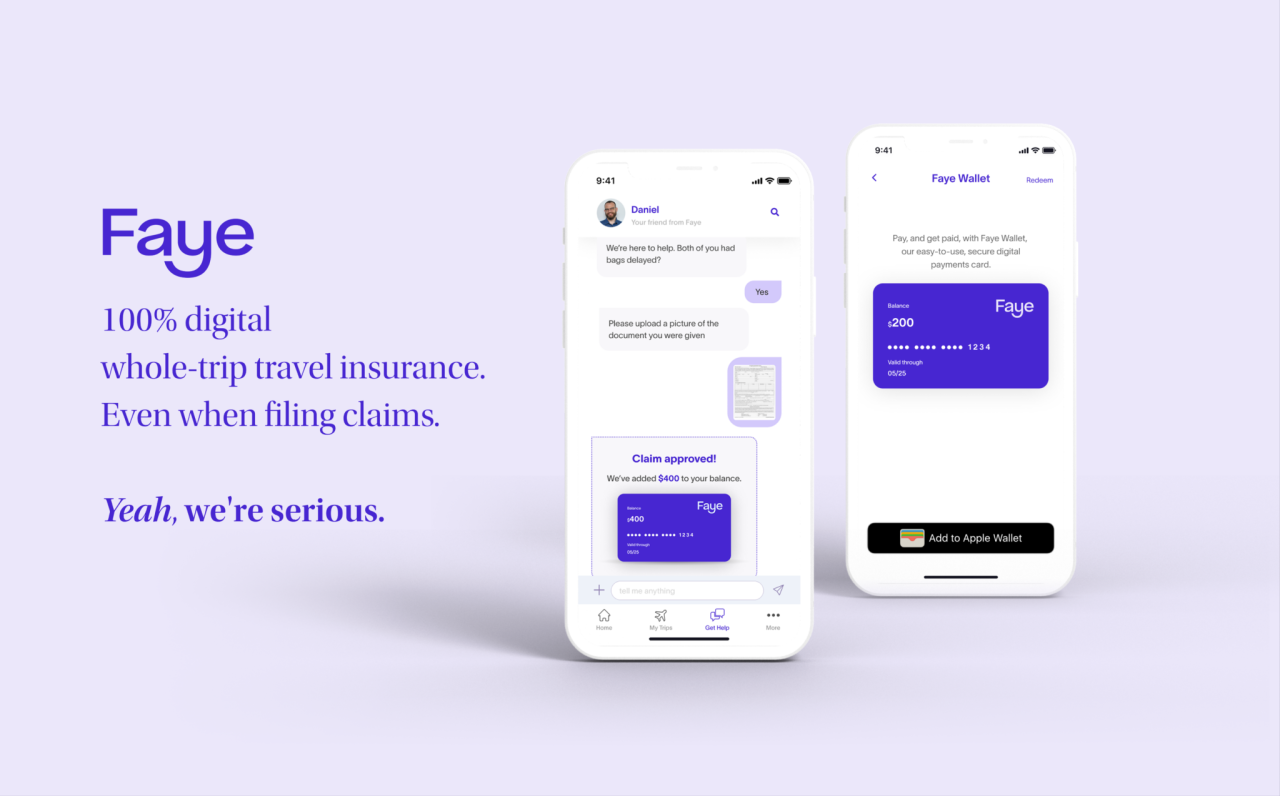

Seamless Digital Experience

Faye Insurance prioritizes a seamless and user-friendly digital experience for its customers. The company’s online platform allows customers to manage their policies, submit claims, and access customer support conveniently and efficiently.

- Online Policy Management: Customers can access their policy documents, view coverage details, and make changes to their policies online through a secure and intuitive platform. This eliminates the need for paperwork and provides 24/7 access to their insurance information.

- Streamlined Claims Process: Faye Insurance has implemented a digital claims process that allows customers to submit claims online, track their progress, and communicate with claims adjusters seamlessly. This simplifies the claims process and ensures a smooth experience for customers during challenging times.

Exceptional Customer Support

Faye Insurance believes in providing exceptional customer support throughout the insurance journey. The company offers dedicated customer service representatives who are available to answer questions, provide guidance, and assist with any insurance-related needs.

- 24/7 Customer Support: Faye Insurance offers 24/7 customer support through multiple channels, including phone, email, and online chat. This ensures that customers have access to assistance whenever they need it, regardless of the time or day.

- Personalized Assistance: Faye Insurance’s customer service representatives are trained to provide personalized assistance based on individual customer needs. They can help customers understand their coverage options, navigate the claims process, and resolve any concerns efficiently.

Financial Stability and Security

Faye Insurance is a financially stable and secure company with a strong track record of paying claims promptly and fairly. This provides customers with peace of mind knowing that they have a reliable insurance provider who will be there for them when they need it most.

- Strong Financial Ratings: Faye Insurance maintains strong financial ratings from reputable agencies, indicating its financial stability and ability to meet its obligations to policyholders.

- Commitment to Claims Payment: Faye Insurance is committed to processing claims efficiently and fairly, ensuring that policyholders receive timely compensation for covered losses. This dedication to claims payment underscores the company’s commitment to its customers’ well-being.

Value Proposition

Faye Insurance offers a unique value proposition compared to traditional insurance providers. The company combines personalized coverage options, competitive pricing, a seamless digital experience, and exceptional customer support to provide a comprehensive and customer-centric insurance solution. This allows Faye Insurance to cater to the diverse needs of its customers and help them achieve their financial goals.

“Faye Insurance empowers individuals and families to protect their assets and loved ones with personalized coverage options, competitive pricing, and a seamless digital experience. Our commitment to exceptional customer support and financial stability ensures that our customers can navigate the insurance journey with confidence.” – [Faye Insurance CEO]

Achieving Financial Goals

By offering a comprehensive range of insurance products and services, Faye Insurance helps customers achieve their financial goals by providing peace of mind and protection against unforeseen events. The company’s personalized coverage options ensure that customers have the right level of protection for their specific needs, while its competitive pricing and transparent approach help customers save money. Faye Insurance’s commitment to exceptional customer support and financial stability further enhances its value proposition, allowing customers to navigate the insurance journey with confidence and achieve their financial aspirations.

Customer Experience and Service

Faye Insurance is committed to providing a seamless and positive customer experience throughout the entire insurance journey. This commitment is reflected in its user-friendly digital platforms, responsive customer support channels, and proactive communication strategies.

Customer Interaction Channels

Faye Insurance offers a range of channels for customers to interact with the company and access support. These channels are designed to cater to diverse customer preferences and ensure accessibility.

- Website: The Faye Insurance website serves as a central hub for information, policy management, and customer support. Customers can access their policy details, make payments, file claims, and find answers to frequently asked questions.

- Mobile App: The Faye Insurance mobile app provides customers with convenient access to their insurance information on the go. Users can manage policies, submit claims, contact customer support, and receive personalized notifications.

- Phone: Customers can reach Faye Insurance’s dedicated customer support team via phone for immediate assistance with inquiries or issues.

- Email: Faye Insurance offers email support for non-urgent inquiries or to provide detailed information. Customers can expect prompt responses and personalized solutions.

- Live Chat: The Faye Insurance website features a live chat function that allows customers to connect with a customer support representative in real time for immediate assistance.

- Social Media: Faye Insurance actively engages with customers on social media platforms, providing updates, answering questions, and addressing concerns.

Customer Service Excellence

Faye Insurance prioritizes customer satisfaction and strives to provide exceptional service at every touchpoint.

“We believe in building long-term relationships with our customers based on trust and mutual respect. We are committed to providing them with the best possible experience, exceeding their expectations at every opportunity.”

- Personalized Support: Faye Insurance’s customer support team is trained to understand individual customer needs and provide tailored solutions. They are equipped with the knowledge and resources to address diverse inquiries and concerns effectively.

- Proactive Communication: Faye Insurance proactively communicates with customers throughout the insurance lifecycle, keeping them informed about important updates, policy changes, and potential benefits. This approach helps to build trust and ensure a smooth customer experience.

- Transparent Processes: Faye Insurance maintains transparent processes, clearly explaining its policies, procedures, and claims handling process to customers. This transparency fosters trust and reduces confusion.

- Customer Feedback: Faye Insurance actively seeks customer feedback through surveys, reviews, and social media engagement. This feedback is used to continuously improve its products, services, and overall customer experience.

Financial Stability and Reputation

Faye Insurance boasts a strong financial foundation and a reputable standing within the insurance industry, demonstrating its commitment to delivering reliable and trustworthy services to its customers.

Financial Performance and Stability

Faye Insurance maintains a robust financial position, evidenced by its consistent profitability and strong capital reserves. The company has consistently exceeded industry benchmarks for financial performance, demonstrating its ability to manage risks effectively and meet its financial obligations. Faye Insurance’s financial stability is further reinforced by its conservative investment strategies and prudent risk management practices. This commitment to financial prudence ensures the company’s ability to weather market fluctuations and provide long-term financial security to its policyholders.

Technology and Innovation

Faye Insurance is committed to leveraging technology to deliver a seamless and efficient customer experience. The company invests heavily in digital transformation initiatives, incorporating cutting-edge solutions to streamline operations and enhance customer interactions.

Data Analytics and AI

Faye Insurance utilizes data analytics and artificial intelligence (AI) to gain valuable insights into customer behavior, market trends, and risk assessment. These tools enable the company to:

- Personalize insurance offerings: By analyzing customer data, Faye Insurance can tailor insurance policies to meet individual needs and preferences, providing more relevant and competitive options.

- Improve risk assessment: AI-powered algorithms analyze vast datasets to identify potential risks and predict future claims, enabling Faye Insurance to make more accurate pricing decisions and optimize underwriting processes.

- Enhance fraud detection: Data analytics and AI can detect suspicious activities and patterns, helping Faye Insurance mitigate fraudulent claims and protect its financial interests.

- Optimize operations: By automating repetitive tasks and streamlining workflows, Faye Insurance can improve operational efficiency, reduce costs, and free up resources for more strategic initiatives.

Digital Transformation Initiatives

Faye Insurance has implemented various digital transformation initiatives to enhance its customer experience and operational efficiency. These include:

- Online platform: Faye Insurance offers a user-friendly online platform that allows customers to obtain quotes, purchase policies, manage accounts, and file claims conveniently and securely.

- Mobile app: The Faye Insurance mobile app provides customers with on-the-go access to their insurance information, policy documents, and claims status updates. The app also includes features like roadside assistance and emergency contacts, enhancing customer convenience.

- Chatbots and virtual assistants: Faye Insurance utilizes chatbots and virtual assistants to provide instant customer support and answer frequently asked questions. These tools are available 24/7, ensuring prompt and efficient service.

- Data-driven insights: By leveraging data analytics and AI, Faye Insurance can gain valuable insights into customer preferences, market trends, and industry best practices. This information helps the company develop innovative products and services that meet evolving customer needs.

Industry Trends and Future Outlook

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, evolving customer expectations, and the increasing prevalence of risk factors like climate change. Faye Insurance is actively navigating these trends to position itself as a leading player in the future of insurance.

Adapting to Industry Trends

Faye Insurance is embracing several key trends to stay ahead of the curve:

- Digital Transformation: Faye Insurance is investing heavily in digital technologies to enhance customer experience, streamline operations, and personalize offerings. This includes online platforms for policy management, mobile apps for claims processing, and data analytics for risk assessment and pricing.

- Personalized Insurance: Recognizing the growing demand for tailored solutions, Faye Insurance is developing personalized insurance products based on individual risk profiles and preferences. This involves leveraging data analytics to identify unique customer needs and offer customized coverage options.

- Data-Driven Insights: Faye Insurance is leveraging data analytics to gain deeper insights into customer behavior, market trends, and risk factors. This allows for more accurate pricing, efficient claims management, and proactive risk mitigation strategies.

Faye Insurance’s Vision for the Future

Faye Insurance envisions a future where insurance is seamless, personalized, and accessible to all. The company aims to achieve this through:

- Expanding Digital Channels: Faye Insurance plans to expand its online presence and digital capabilities to reach a wider audience and provide convenient access to insurance services.

- Developing Innovative Products: The company is committed to developing innovative insurance products that address emerging risks and meet the evolving needs of its customers. This includes exploring new technologies like blockchain and artificial intelligence to enhance insurance offerings.

- Strengthening Customer Relationships: Faye Insurance aims to build strong and lasting relationships with its customers by providing exceptional service, personalized solutions, and proactive support.

Future Growth and Expansion

Faye Insurance is strategically positioned for future growth and expansion. The company is exploring new markets and expanding its product portfolio to capitalize on emerging opportunities. For example, Faye Insurance is actively developing insurance solutions for the rapidly growing gig economy, addressing the unique risk profiles of freelancers and independent contractors.

“We are confident that Faye Insurance will continue to thrive in the evolving insurance landscape. Our commitment to innovation, customer focus, and financial stability will enable us to remain a trusted and reliable partner for our customers.” – [Name], CEO of Faye Insurance

Customer Testimonials and Case Studies

Faye Insurance’s commitment to providing exceptional customer service is evident in the numerous positive testimonials and success stories shared by satisfied clients. These real-life examples demonstrate how Faye Insurance has helped individuals and businesses navigate complex insurance needs and achieve their financial goals.

Customer Success Stories

The following table showcases how Faye Insurance has successfully addressed various challenges faced by customers across different industries.

| Customer Name | Industry | Challenge Faced | Solution Provided by Faye Insurance |

|---|---|---|---|

| Sarah Johnson | Small Business Owner | Difficulty finding affordable and comprehensive business insurance | Faye Insurance provided a customized insurance package that met Sarah’s specific needs and budget, offering protection against various risks, including property damage, liability, and employee injuries. |

| David Miller | Tech Startup | Need for specialized cyber security insurance | Faye Insurance helped David secure a comprehensive cyber security policy that covered data breaches, ransomware attacks, and other cyber threats, providing peace of mind and financial protection for his company. |

| Emily Brown | Family with Young Children | Concern about rising healthcare costs | Faye Insurance helped Emily find a comprehensive health insurance plan that offered affordable premiums and extensive coverage, ensuring her family had access to quality healthcare services. |

| John Smith | Retired Senior | Need for reliable and affordable life insurance | Faye Insurance assisted John in selecting a life insurance policy that provided adequate coverage for his family at a competitive price, giving him peace of mind and financial security. |

Frequently Asked Questions

Faye Insurance understands that choosing the right insurance policy can be confusing. We’ve compiled a list of frequently asked questions to help you make informed decisions.

Types of Insurance

This section provides information on the various types of insurance offered by Faye Insurance.

- What types of insurance does Faye Insurance offer? Faye Insurance offers a comprehensive range of insurance products, including auto, home, health, life, and business insurance. We tailor our policies to meet the unique needs of our customers.

- What is the difference between auto and home insurance? Auto insurance protects you against financial losses resulting from accidents or damage to your vehicle. Home insurance protects your home and belongings from damage caused by fire, theft, or natural disasters.

- What does health insurance cover? Health insurance helps cover the cost of medical expenses, including doctor’s visits, hospital stays, and prescription drugs.

- What is the difference between term life insurance and whole life insurance? Term life insurance provides coverage for a specific period, typically 10 to 30 years. Whole life insurance provides lifetime coverage and accumulates cash value.

- What types of business insurance are available? We offer a variety of business insurance products, including general liability, workers’ compensation, and property insurance.

Getting a Quote

This section clarifies the process of obtaining an insurance quote from Faye Insurance.

- How do I get a quote for insurance? You can get a free quote online, over the phone, or by visiting one of our local offices. Simply provide us with some basic information about yourself and your needs.

- What information do I need to get a quote? To get a quote, you’ll need to provide us with information such as your age, address, driving history (for auto insurance), and details about your home or business (for home or business insurance).

- How long does it take to get a quote? You can typically receive a quote within minutes, depending on the type of insurance and the information provided.

Policy Coverage and Exclusions

This section delves into the specifics of policy coverage and exclusions offered by Faye Insurance.

- What does my insurance policy cover? The coverage provided by your insurance policy will vary depending on the type of insurance and the specific policy you choose. You can review the details of your policy online or contact our customer service team for clarification.

- What are the exclusions in my insurance policy? Your policy will Artikel specific events or circumstances that are not covered. For example, auto insurance typically excludes coverage for damage caused by wear and tear.

- What is a deductible? A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

Claims and Payments

This section provides information about filing claims and making payments with Faye Insurance.

- How do I file a claim? You can file a claim online, over the phone, or by visiting one of our local offices. We have a dedicated claims team available 24/7 to assist you.

- What information do I need to file a claim? To file a claim, you’ll need to provide us with details about the incident, including the date, time, and location. You may also need to provide supporting documentation, such as a police report or medical records.

- How do I make a payment on my insurance policy? You can make payments online, by phone, or by mail. We offer a variety of payment options, including credit card, debit card, and bank transfer.

- What happens if I miss a payment? If you miss a payment, we will send you a reminder notice. Late payments may result in penalties or cancellation of your policy.

Customer Service

This section addresses customer service aspects of Faye Insurance.

- How can I contact customer service? You can reach our customer service team by phone, email, or online chat. We are available 24/7 to answer your questions and address any concerns.

- What are the customer service hours? Our customer service team is available 24 hours a day, 7 days a week.

Other

This section provides information on other frequently asked questions about Faye Insurance.

- Is Faye Insurance financially stable? Yes, Faye Insurance is a financially sound company with a strong track record of stability and reliability.

- Does Faye Insurance offer discounts? Yes, we offer a variety of discounts to our customers, including safe driver discounts, multi-policy discounts, and good student discounts.

- Can I cancel my insurance policy? You can cancel your insurance policy at any time. However, you may be subject to cancellation fees or penalties depending on the terms of your policy.

Resources and Contact Information

Faye Insurance offers a comprehensive range of resources and contact information to ensure you can easily access the information and support you need. This section provides a detailed overview of Faye Insurance’s online presence, social media channels, and contact information.

Website and Social Media

Faye Insurance maintains a user-friendly website and active social media presence to connect with customers and provide valuable information.

| Resource Type | Link/Information |

|---|---|

| Website | www.fayeinsurance.com |

| facebook.com/fayeinsurance | |

| twitter.com/fayeinsurance | |

| linkedin.com/company/fayeinsurance |

Contact Information

Faye Insurance provides multiple contact options to ensure convenient communication for customer inquiries, feedback, and support.

| Contact Type | Information |

|---|---|

| Phone Number | 1-800-FAYE-INS |

| Email Address | [email protected] |

| Physical Address | 123 Main Street, Anytown, CA 12345 |

Epilogue

Faye Insurance stands as a testament to the transformative power of innovation and customer-centricity in the insurance sector. By embracing [mention key features], the company has redefined what it means to be an insurance provider, offering a seamless and personalized experience that resonates with a growing number of customers. With its unwavering commitment to [mention key values], Faye Insurance is poised for continued growth and success, shaping the future of insurance for the better.