Directors and officers (D&O) liability insurance is a critical component of corporate risk management, providing financial protection for individuals and organizations facing legal claims arising from their business decisions. This type of insurance safeguards against potential lawsuits stemming from alleged wrongful acts, negligence, or breaches of fiduciary duty. While D&O insurance is often seen as a necessary safeguard for publicly traded companies, it is increasingly becoming a vital tool for privately held businesses, non-profit organizations, and even individuals serving on boards of directors.

The scope of D&O liability insurance extends beyond the realm of traditional business operations. It encompasses a wide range of potential risks, including financial reporting irregularities, environmental contamination, data breaches, and even shareholder activism. As businesses operate in an increasingly complex and litigious environment, the need for robust D&O coverage has become paramount.

What is D&O Liability Insurance?

D&O liability insurance is a type of insurance that protects directors and officers of corporations, as well as the corporations themselves, from financial losses arising from lawsuits or claims alleging wrongful acts. These acts can include negligence, misfeasance, malfeasance, and breaches of fiduciary duty.

D&O insurance is essential for organizations of all sizes, as it provides crucial financial protection against potentially devastating lawsuits.

Who Needs D&O Liability Insurance?

D&O insurance is typically required by:

- Publicly traded companies

- Private companies, particularly those with significant assets or complex operations

- Nonprofit organizations

- Financial institutions

- Educational institutions

- Healthcare organizations

The need for D&O insurance arises from the increasing scrutiny and potential liability faced by directors and officers in today’s complex business environment.

History of D&O Liability Insurance

D&O liability insurance emerged in the 1930s as a response to the growing number of lawsuits against corporate executives. The early policies focused primarily on protecting individual directors and officers, but the scope of coverage has expanded significantly over time to include the corporation itself.

The evolution of D&O insurance has been driven by several factors, including:

- The increasing complexity of business operations

- The rise of shareholder activism

- The increasing frequency and severity of corporate scandals

- The growth of class-action lawsuits

The early D&O policies were relatively simple and limited in scope. However, as the business environment became more complex, the policies have become more sophisticated to address the evolving needs of policyholders.

Who Needs D&O Liability Insurance?

D&O liability insurance is a crucial component for businesses and individuals facing potential legal risks associated with their decision-making and actions. It provides financial protection against lawsuits alleging negligence, misconduct, or breaches of fiduciary duty. While D&O coverage is valuable for various organizations, certain industries and sectors are particularly susceptible to these risks, making D&O insurance essential.

Industries and Sectors with High D&O Liability Risk

D&O liability insurance is highly prevalent in industries and sectors with a high concentration of directors and officers, complex operations, and regulatory scrutiny. These industries often face significant legal and financial risks, making D&O coverage a critical part of their risk management strategy.

- Financial Institutions: Banks, investment firms, and insurance companies are inherently exposed to D&O liability risks due to their handling of sensitive financial information, investment decisions, and regulatory compliance requirements.

- Healthcare: Hospitals, pharmaceutical companies, and healthcare providers face potential lawsuits related to medical malpractice, patient privacy, and regulatory compliance issues.

- Technology: Software companies, tech startups, and internet-based businesses are exposed to D&O liability risks due to data breaches, intellectual property disputes, and potential antitrust issues.

- Public Companies: Listed companies are subject to heightened scrutiny from shareholders, regulators, and the public, increasing their exposure to D&O liability claims.

- Non-Profit Organizations: Charities, foundations, and other non-profit organizations are not immune to D&O liability risks, particularly regarding financial mismanagement, conflicts of interest, and regulatory compliance.

Situations Where D&O Insurance is Essential

D&O insurance is essential in situations where businesses and individuals are exposed to significant legal and financial risks.

- Mergers and Acquisitions: M&A transactions often involve complex legal and regulatory issues, increasing the risk of D&O liability claims related to due diligence, valuation, and integration.

- Corporate Governance Issues: Companies with weak corporate governance practices are more vulnerable to D&O liability claims, especially those involving conflicts of interest, insider trading, and fraud.

- Environmental Liability: Companies involved in industries with a high environmental impact, such as oil and gas, mining, and manufacturing, face potential D&O liability claims related to environmental damage and pollution.

- Product Liability: Companies that manufacture or distribute products are exposed to D&O liability claims arising from product defects, injuries, or safety concerns.

- Cybersecurity Breaches: Businesses experiencing data breaches or cyberattacks are susceptible to D&O liability claims related to data privacy violations, security negligence, and reputational damage.

Potential Risks and Liabilities

D&O liability insurance protects businesses and individuals from a wide range of potential risks and liabilities, including:

- Financial Mismanagement: Directors and officers can be held personally liable for financial mismanagement, including accounting errors, fraud, and embezzlement.

- Breach of Fiduciary Duty: Directors and officers have a fiduciary duty to act in the best interests of the company and its shareholders. Breaches of this duty can lead to D&O liability claims.

- Misleading Statements: False or misleading statements made by directors and officers in financial reports, press releases, or other public disclosures can expose them to D&O liability.

- Environmental Violations: Companies that violate environmental regulations or cause environmental damage can face D&O liability claims related to the actions of their directors and officers.

- Product Liability: Directors and officers can be held liable for product defects, injuries, or safety concerns, particularly if they were aware of the risks but failed to take action.

- Cybersecurity Breaches: Directors and officers can be held liable for data breaches and cyberattacks if they failed to implement adequate cybersecurity measures.

Types of D&O Liability Insurance Coverage

D&O liability insurance is a critical tool for protecting directors and officers of corporations from financial ruin. It offers a range of coverage options, each designed to address specific types of risks. Understanding the different types of D&O liability insurance coverage is crucial for ensuring adequate protection for both the individual directors and officers and the company itself.

Side A Coverage

Side A coverage is the most common type of D&O liability insurance coverage. It protects directors and officers against personal liability for wrongful acts, even if the company itself is not liable.

This coverage is essential because directors and officers can be held personally liable for their actions, even if they acted in good faith and in the best interests of the company.

Side A coverage is a critical component of D&O liability insurance, providing a critical layer of protection for directors and officers in the event of a claim.

- Coverage: Side A coverage typically covers defense costs and settlements for claims against directors and officers, even if the company is not liable.

- Examples: Examples of scenarios where Side A coverage would be applicable include:

- A director is sued for making a decision that was later found to be incorrect, even though they acted in good faith and in the best interests of the company.

- An officer is sued for making a statement that was later found to be false, even though they believed it to be true at the time.

Side B Coverage

Side B coverage, also known as “Company Reimbursement Coverage,” protects the company against losses it incurs as a result of indemnifying directors and officers for wrongful acts.

This coverage is important because it ensures that the company can reimburse directors and officers for legal expenses and settlements without having to dip into its own funds.

Side B coverage is an important component of D&O liability insurance, as it protects the company from the financial burden of indemnifying directors and officers.

- Coverage: Side B coverage typically covers defense costs and settlements for claims against directors and officers, but only to the extent that the company is legally obligated to indemnify them.

- Examples: Examples of scenarios where Side B coverage would be applicable include:

- A company is sued for a wrongful act by one of its directors, and the company is legally obligated to indemnify the director.

- A company is sued for a wrongful act by one of its officers, and the company is legally obligated to indemnify the officer.

Side C Coverage

Side C coverage, also known as “Entity Coverage,” protects the company itself against losses arising from claims related to the wrongful acts of its directors and officers.

This coverage is important because it ensures that the company is protected from financial ruin in the event of a significant claim.

Side C coverage is a valuable component of D&O liability insurance, as it protects the company from the financial impact of claims against its directors and officers.

- Coverage: Side C coverage typically covers defense costs and settlements for claims against the company itself, arising from the wrongful acts of its directors and officers.

- Examples: Examples of scenarios where Side C coverage would be applicable include:

- A company is sued for securities fraud, and the claim is based on the wrongful acts of its CEO.

- A company is sued for environmental damage, and the claim is based on the wrongful acts of its board of directors.

Key Features of D&O Liability Insurance Policies

D&O liability insurance policies are complex documents that Artikel the terms and conditions of coverage. Understanding the key features of these policies is essential for businesses to ensure they have adequate protection.

Coverage Limits

Coverage limits represent the maximum amount the insurer will pay for covered claims during a policy period. They are typically expressed in dollar amounts, and they can be applied to individual claims or to the aggregate of all claims during the policy period. Coverage limits can vary widely depending on the size and risk profile of the insured organization.

Deductibles

Deductibles are the amount of money the insured organization must pay out-of-pocket before the insurer begins to cover claims. They are often expressed as a percentage of the coverage limit or as a fixed dollar amount. Higher deductibles generally result in lower premiums.

Exclusions

Exclusions are specific situations or types of claims that are not covered by the D&O liability insurance policy. Common exclusions include claims arising from:

- Criminal acts

- Fraudulent acts

- Environmental pollution

- Intentional wrongdoing

It’s important to review the exclusions carefully to understand the scope of coverage.

Policy Endorsements and Riders

Policy endorsements and riders are modifications to the standard D&O liability insurance policy that tailor coverage to specific needs. They can be used to:

- Increase coverage limits

- Add coverage for specific risks

- Modify the deductible

- Exclude certain types of claims

Endorsements and riders can be used to customize the policy to meet the unique needs of the insured organization.

Factors Influencing Premium Costs

Several factors influence the cost of D&O liability insurance premiums. These include:

- Size and Industry of the Insured Organization: Larger and more complex organizations typically pay higher premiums due to increased risk exposure. Certain industries, such as financial services and healthcare, are also considered higher risk.

- Financial Performance and History: Companies with a history of financial instability or legal disputes may face higher premiums. Strong financial performance and a clean track record can help reduce premium costs.

- Corporate Governance Practices: Organizations with robust corporate governance practices, such as strong internal controls and independent boards of directors, are generally viewed as lower risk and may qualify for lower premiums.

- Claim History: Organizations with a history of claims, even if they were successfully defended, may face higher premiums due to increased risk perception.

- Market Conditions: The overall market for D&O liability insurance can also impact premium costs. Factors such as competition among insurers and the availability of reinsurance can influence premiums.

Understanding these factors can help businesses negotiate favorable premium rates and ensure they have adequate coverage.

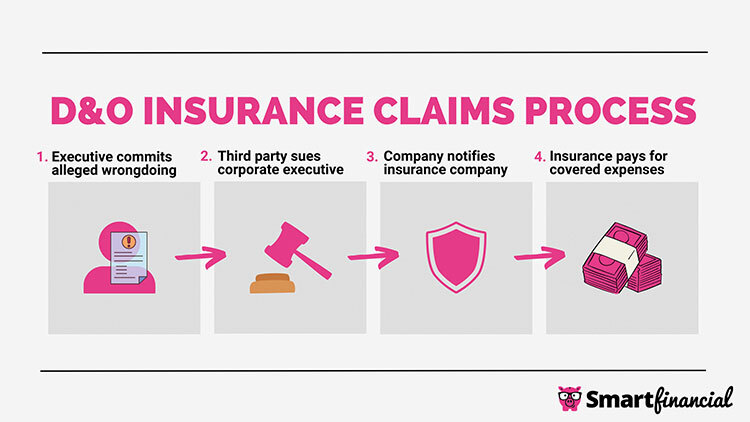

The Claims Process and D&O Liability Insurance

Navigating a claim under a D&O liability insurance policy can be complex, requiring a thorough understanding of the process and the insurer’s role. This section Artikels the key steps involved in filing a claim, the insurer’s responsibilities, and potential outcomes.

The Claims Process

When a claim is filed, the insurer undertakes a comprehensive investigation to assess the validity of the allegations and determine the extent of coverage. The process typically involves the following steps:

- Notice of Claim: The insured party must promptly notify the insurer of any potential claim, providing details about the nature of the allegations, the parties involved, and any relevant documentation.

- Investigation: The insurer will investigate the claim, gathering information from the insured party, the claimant, and other relevant sources. This may involve reviewing documents, conducting interviews, and hiring independent experts to assess the allegations.

- Evaluation of Coverage: Based on the investigation, the insurer will evaluate whether the claim falls within the scope of the D&O policy’s coverage. This assessment considers the policy’s terms and conditions, the nature of the allegations, and the insured’s actions.

- Negotiation and Settlement: If the claim is covered, the insurer will attempt to negotiate a settlement with the claimant. This process may involve mediation or other forms of alternative dispute resolution.

- Litigation: If settlement negotiations fail, the claim may proceed to litigation. The insurer will defend the insured party in court, paying for legal fees and other related expenses.

The Insurer’s Role

The insurer plays a crucial role in handling D&O claims. Their responsibilities include:

- Investigation and Evaluation: As mentioned above, the insurer conducts a thorough investigation to determine the validity of the claim and assess coverage.

- Defense: The insurer provides legal defense for the insured party, covering legal fees, court costs, and other expenses related to defending the claim.

- Settlement Negotiations: The insurer negotiates with the claimant to reach a settlement agreement, aiming to resolve the claim efficiently and cost-effectively.

- Litigation Management: If the claim proceeds to litigation, the insurer manages the legal process, including selecting legal counsel, overseeing the litigation strategy, and managing the defense.

Potential Outcomes

The outcome of a D&O claim can vary depending on the circumstances, the strength of the allegations, and the insurer’s evaluation of the claim. Potential outcomes include:

- Settlement: The insurer may negotiate a settlement with the claimant, resolving the claim without going to court. Settlements typically involve the insurer paying a sum of money to the claimant in exchange for a release of claims.

- Judgment: If the claim proceeds to litigation, the court may issue a judgment in favor of the claimant, requiring the insurer to pay damages.

- Defense Costs: Even if the claim is ultimately dismissed or the insured party is found not liable, the insurer will still pay for the legal defense costs incurred during the litigation process.

D&O Liability Insurance and Corporate Governance

D&O liability insurance plays a crucial role in fostering good corporate governance practices. It provides financial protection to directors and officers against lawsuits stemming from their decisions and actions, creating an environment where they can act in the best interests of the company without undue fear of personal liability. This insurance coverage serves as a powerful tool for promoting ethical behavior, risk management, and overall corporate accountability.

Impact of D&O Insurance on Corporate Governance

D&O liability insurance can significantly impact corporate governance by influencing the behavior of directors and officers. It can incentivize them to make informed decisions, prioritize ethical conduct, and implement robust risk management practices. This impact is driven by the following key aspects:

- Reduced Fear of Personal Liability: D&O insurance protects directors and officers from the financial consequences of lawsuits, enabling them to focus on their core responsibilities without the constant threat of personal financial ruin. This reduced fear of liability encourages them to take calculated risks and make decisions that are in the best interests of the company, even if those decisions might be controversial or carry potential risks.

- Incentivizes Ethical Behavior: D&O insurance incentivizes directors and officers to adhere to ethical standards and comply with legal regulations. The potential for costly lawsuits and reputational damage associated with unethical conduct can encourage them to act with integrity and transparency, fostering a culture of ethical decision-making within the organization.

- Promotes Risk Management Practices: D&O insurance encourages companies to implement strong risk management practices. Insurers often require their policyholders to demonstrate adequate risk management procedures as a condition for coverage. This requirement motivates companies to proactively identify, assess, and mitigate potential risks, leading to improved corporate governance and reduced exposure to liability.

D&O Liability Insurance and Regulatory Landscape

The D&O liability insurance market is subject to a dynamic regulatory landscape, shaped by evolving legal precedents, legislative changes, and the actions of insurance regulators. These developments have a significant impact on the availability, pricing, and coverage of D&O insurance policies.

Impact of Regulatory Changes and Legal Developments

Regulatory changes and legal developments can significantly influence the D&O liability insurance market. For example, the Sarbanes-Oxley Act of 2002 (SOX) introduced stricter corporate governance requirements, leading to an increase in D&O liability claims. Similarly, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 increased regulatory scrutiny of financial institutions, resulting in a rise in D&O liability exposures.

Role of Insurance Regulators

Insurance regulators play a crucial role in overseeing the D&O insurance market. They establish and enforce regulations related to pricing, coverage, and solvency of insurers. Regulators also monitor the financial stability of insurers and ensure that they have adequate capital reserves to cover potential claims.

- The National Association of Insurance Commissioners (NAIC) is a key organization that develops model laws and regulations for the insurance industry, including D&O liability insurance.

- State insurance departments are responsible for enforcing insurance regulations and overseeing the activities of insurance companies within their respective jurisdictions.

Challenges and Opportunities Facing the D&O Liability Insurance Industry

The D&O liability insurance industry faces several challenges, including:

- Increasing litigation costs and settlement amounts.

- Growing regulatory scrutiny and enforcement actions.

- The emergence of new risks, such as cybersecurity breaches and data privacy violations.

However, the industry also has opportunities for growth, such as:

- Expanding into new markets, such as emerging economies.

- Developing innovative products and services to address evolving risks.

- Leveraging technology to improve efficiency and customer service.

Best Practices for Managing D&O Liability Risks

Managing D&O liability risks is crucial for businesses and individuals to mitigate potential financial and reputational damage. By implementing effective strategies and practices, organizations can minimize the likelihood of claims and protect their directors and officers from personal liability.

Strong Corporate Governance Practices

Robust corporate governance practices serve as the foundation for managing D&O liability risks. Implementing a strong framework of checks and balances helps ensure transparency, accountability, and ethical conduct within an organization.

- Establish a clear and comprehensive code of ethics: This document should Artikel the organization’s values, principles, and expectations for ethical behavior. It should be regularly reviewed and updated to reflect changing business practices and legal requirements.

- Implement robust internal controls: Strong internal controls are essential to prevent fraud, errors, and other misconduct. This includes procedures for financial reporting, asset management, and risk management.

- Develop a comprehensive risk management framework: This framework should identify, assess, and manage potential risks, including those related to D&O liability. It should involve regular risk assessments, mitigation strategies, and ongoing monitoring.

- Foster a culture of compliance: Creating a culture where ethical behavior and compliance are prioritized is essential. This involves providing regular training, communication, and clear channels for reporting concerns.

Risk Assessment and Mitigation

A thorough risk assessment is crucial for identifying potential D&O liability exposures. This involves evaluating the organization’s operations, industry, and regulatory environment.

- Identify key risk areas: Conduct a comprehensive analysis to identify potential D&O liability risks, such as financial reporting errors, environmental violations, employment disputes, or product liability issues.

- Develop mitigation strategies: Once risks are identified, develop and implement strategies to mitigate them. This may include policies, procedures, training programs, or external audits.

- Monitor and evaluate risks: Regularly monitor and evaluate the effectiveness of risk mitigation strategies. This involves assessing the ongoing risk landscape, reviewing compliance efforts, and making adjustments as needed.

Expert Advice and Resources

Seeking expert advice from insurance brokers and legal professionals is critical in managing D&O liability risks.

- Consult with insurance brokers: Insurance brokers can provide valuable insights into D&O liability insurance coverage options, including policy terms, limits, and exclusions. They can help organizations select the appropriate coverage for their specific needs and risk profile.

- Engage legal counsel: Legal professionals can provide guidance on corporate governance, risk management, and compliance. They can also assist with legal issues related to D&O liability, such as claims investigations and litigation.

Documentation and Recordkeeping

Maintaining accurate and comprehensive documentation is crucial for defending against potential D&O liability claims.

- Document decision-making processes: Record minutes of board meetings, committee meetings, and other relevant discussions. This documentation can help demonstrate the rationale behind decisions and the due diligence undertaken.

- Maintain records of compliance efforts: Keep records of all compliance activities, including training programs, audits, and internal investigations. This documentation can demonstrate the organization’s commitment to ethical behavior and compliance.

- Preserve relevant communications: Maintain records of all communications related to potential D&O liability issues, including emails, letters, and memos. This documentation can provide valuable context and evidence in the event of a claim.

Communication and Transparency

Open and transparent communication with stakeholders, including employees, investors, and regulators, can help mitigate D&O liability risks.

- Establish clear communication channels: Ensure that there are clear and accessible channels for stakeholders to communicate concerns or report potential misconduct.

- Be proactive in disclosing information: Disclose relevant information to stakeholders in a timely and accurate manner. This helps build trust and minimize the risk of allegations of concealment or misrepresentation.

- Respond promptly to inquiries: Respond to inquiries from stakeholders promptly and thoroughly. This demonstrates the organization’s commitment to transparency and accountability.

D&O Liability Insurance and Emerging Trends

The landscape of D&O liability insurance is constantly evolving, driven by technological advancements, shifting regulatory environments, and evolving risk profiles. Understanding these emerging trends is crucial for directors and officers, as well as insurers, to effectively manage and mitigate potential risks.

Technological Advancements and D&O Liability

Technological advancements have a profound impact on D&O liability insurance, creating both new risks and opportunities.

- Cybersecurity Risks: The increasing reliance on technology and the interconnectedness of businesses have significantly amplified cybersecurity risks. Data breaches, ransomware attacks, and other cyber incidents can expose directors and officers to liability claims related to negligence, failure to implement adequate cybersecurity measures, and breach of privacy laws.

- Artificial Intelligence (AI) and Machine Learning (ML): The adoption of AI and ML technologies presents both opportunities and challenges. While these technologies can enhance efficiency and decision-making, they also introduce new risks related to algorithmic bias, data privacy, and accountability.

- Social Media and Reputation Management: Social media platforms have become powerful tools for communication and reputation management. However, they also present risks for directors and officers, as inappropriate or misleading statements can lead to reputational damage, shareholder lawsuits, and regulatory scrutiny.

Evolving Landscape of Cyber Risks and Data Breaches

Cyber risks and data breaches are among the most significant emerging trends in D&O liability.

- Increased Frequency and Severity: Cyberattacks are becoming more frequent and sophisticated, resulting in significant financial losses, reputational damage, and legal liability.

- Data Privacy Regulations: Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, have increased the potential for liability related to data breaches.

- Third-Party Risk Management: Businesses are increasingly reliant on third-party vendors and service providers, which can expose them to cyber risks. Directors and officers need to ensure that appropriate due diligence and risk management practices are in place for third-party relationships.

Innovative D&O Insurance Products and Services

Insurers are responding to emerging trends by developing new and innovative D&O insurance products and services.

- Cyber Risk Coverage: D&O policies are increasingly including coverage for cyber risks, such as data breaches, ransomware attacks, and network security failures.

- AI and ML Risk Coverage: Some insurers are offering coverage for risks related to AI and ML technologies, including algorithmic bias, data privacy, and accountability.

- Social Media Risk Coverage: D&O policies may include coverage for social media risks, such as reputational damage and shareholder lawsuits arising from inappropriate or misleading statements.

Case Studies of D&O Liability Claims

D&O liability insurance is a crucial aspect of risk management for corporations, and understanding real-world claims helps illustrate the potential exposure and the importance of adequate coverage. Examining case studies provides valuable insights into the factors that contribute to claims, the implications for risk management, and the lessons learned.

The Role of Accounting Irregularities in D&O Claims

Accounting irregularities are a common factor in D&O liability claims. Companies often face scrutiny when their financial statements are found to be inaccurate or misleading. These cases can result in shareholder lawsuits, regulatory investigations, and significant financial penalties.

- Enron Corporation: Enron’s collapse in 2001 was a landmark case involving accounting fraud and corporate governance failures. The company’s executives were accused of using off-balance-sheet entities to hide debt and inflate profits. The ensuing lawsuits resulted in substantial settlements and criminal convictions. The Enron case highlighted the importance of robust internal controls, independent audits, and transparency in financial reporting.

- WorldCom: WorldCom, a telecommunications company, was involved in a massive accounting scandal in 2002. The company’s executives were accused of improperly capitalizing expenses, leading to an overstatement of earnings. This case resulted in significant financial losses for investors and led to a wave of accounting reforms. The WorldCom case emphasized the importance of accurate financial reporting and the need for strong corporate governance.

The Future of D&O Liability Insurance

The D&O liability insurance market is constantly evolving, driven by factors such as regulatory changes, technological advancements, and emerging risks. As we move forward, it’s crucial to understand the trends shaping the future of this critical insurance product.

Emerging Risks and Challenges

The D&O insurance landscape is increasingly complex, with new risks and challenges emerging regularly. These include:

- Cybersecurity threats: Data breaches and cyberattacks are becoming more frequent and sophisticated, exposing directors and officers to potential liability for negligence or failure to implement adequate cybersecurity measures. This has led to an increase in cyber-related D&O claims.

- Environmental, social, and governance (ESG) issues: Companies are facing growing scrutiny over their environmental, social, and governance practices. D&O claims related to ESG issues are expected to rise as investors and regulators become more demanding.

- Social and political activism: Increased activism, particularly on social media, can lead to reputational damage and potential legal challenges for companies. D&O claims related to these issues are likely to increase.

- Regulatory scrutiny: The regulatory landscape is becoming more complex, with new rules and regulations being introduced frequently. This can lead to increased liability for directors and officers who fail to comply.

The Role of Technology and Innovation

Technology is playing a transformative role in the D&O insurance market.

- Data analytics: Insurers are using data analytics to better understand risk, assess premiums, and develop more targeted coverage options. This is allowing them to provide more tailored policies that meet the specific needs of individual companies.

- Artificial intelligence (AI): AI is being used to automate tasks, improve underwriting processes, and detect potential fraud. This is helping to make D&O insurance more efficient and cost-effective.

- Blockchain technology: Blockchain technology has the potential to streamline claims processing and improve transparency in the D&O insurance market.

Closure

D&O liability insurance plays a crucial role in mitigating the financial and reputational risks associated with corporate leadership. By providing a safety net against unforeseen legal challenges, it empowers directors and officers to make informed decisions, pursue strategic initiatives, and ultimately, drive business growth. As the landscape of corporate governance continues to evolve, understanding the intricacies of D&O insurance is essential for all stakeholders, from board members to investors and beyond.