Dental care is an essential aspect of overall health, and the cost of these services can quickly add up. This is where dental plan insurance comes into play, offering a financial safety net for individuals seeking preventative, restorative, and even cosmetic dental treatments. While the term “dental insurance” is often used interchangeably, it’s important to understand the nuanced differences between dental insurance and dental plans, each offering varying levels of coverage and benefits.

Navigating the dental plan insurance landscape can feel like a maze of options and terminology. This guide will provide a comprehensive overview of dental plan insurance, demystifying its complexities and equipping you with the knowledge to make informed decisions about your oral health and financial well-being.

What is Dental Plan Insurance?

Dental plan insurance is a type of health insurance that covers the cost of dental care. It helps individuals and families pay for various dental services, including checkups, cleanings, fillings, extractions, and more. Dental plan insurance is designed to make dental care more affordable and accessible.

Dental Insurance vs. Dental Plans

Dental insurance and dental plans are often used interchangeably, but there are key differences.

Dental insurance is a type of health insurance that typically covers a wide range of dental services, including preventive, restorative, and major procedures. It usually involves a deductible and co-insurance, where you pay a portion of the cost.

Dental plans, on the other hand, are more focused on providing coverage for specific services. They often have lower premiums than dental insurance, but may have limited coverage. They might have pre-determined benefits for specific procedures, like cleanings or fillings, and may not cover major procedures like implants or crowns.

Common Types of Dental Plans

Dental plans are available in different forms, each with its own features and benefits. Some common types include:

- HMO (Health Maintenance Organization): HMO dental plans require you to choose a specific dentist within their network. You usually pay a low monthly premium and have a low co-pay for covered services. They typically offer preventive care benefits and limited coverage for major procedures.

- PPO (Preferred Provider Organization): PPO dental plans allow you to see any dentist, but you’ll pay a lower co-pay if you choose a dentist within their network. They generally offer more coverage than HMO plans, including for major procedures, but you may have a higher monthly premium.

- Dental Savings Accounts (DSAs): DSAs are tax-advantaged accounts that allow you to save money for dental expenses. You can contribute pre-tax dollars to your DSA and use the funds to pay for eligible dental services. These plans offer flexibility and can be a good option for individuals who want to save for specific dental procedures.

Benefits of Dental Plan Insurance

Dental plan insurance offers numerous advantages that can significantly benefit individuals and families, particularly in managing the costs associated with dental care. By providing financial protection and access to a network of dental professionals, dental plan insurance can help individuals maintain optimal oral health while minimizing out-of-pocket expenses.

Coverage Offered by Dental Plans

Dental plans typically provide coverage for a range of dental services, encompassing preventative care, restorative treatments, and, in some cases, cosmetic procedures.

- Preventative Care: Dental plans often cover routine checkups, cleanings, and x-rays, which are essential for maintaining oral health and detecting potential issues early on. These services are typically covered at 100% or with a small co-pay, encouraging regular visits and proactive care.

- Restorative Treatments: Dental plans commonly cover restorative procedures such as fillings, crowns, root canals, and extractions. Coverage for these treatments may vary depending on the plan, with some plans offering higher coverage for specific procedures. Restorative treatments are crucial for addressing dental issues and restoring functionality.

- Cosmetic Procedures: While not all dental plans cover cosmetic procedures, some may offer partial or full coverage for procedures like teeth whitening, veneers, and dental implants. The extent of coverage for cosmetic procedures often depends on the plan’s specific terms and conditions.

Saving Money on Dental Expenses

Dental plan insurance can significantly reduce out-of-pocket expenses for dental care. By providing coverage for a range of services, dental plans can help individuals avoid high costs associated with unexpected dental issues or extensive treatments. For instance, a simple filling, which can cost hundreds of dollars without insurance, might be covered entirely or with a minimal co-pay under a dental plan. Moreover, dental plans often offer discounts on dental services, further reducing costs for insured individuals.

Types of Dental Plans

Dental plans vary widely in their coverage, costs, and limitations. Understanding the different types of dental plans available can help you choose the one that best meets your needs and budget.

Types of Dental Plans

Dental plans are categorized into two main types:

- Dental Insurance: Dental insurance is a type of health insurance that helps pay for dental care. It typically covers a percentage of the cost of dental services, such as cleanings, fillings, and extractions.

- Dental Discount Plans: Dental discount plans are not insurance. Instead, they provide discounted rates on dental services from a network of participating dentists.

Dental Insurance Plans

Dental insurance plans are further categorized into three main types:

- Dental HMO (Health Maintenance Organization) Plans: These plans require you to choose a primary care dentist from their network. You will pay a monthly premium and a co-pay for each visit. They typically have lower premiums but may have limited coverage for certain procedures.

- Dental PPO (Preferred Provider Organization) Plans: These plans give you more flexibility to choose your dentist. You can see dentists both in and out of the network. You will pay a monthly premium and a co-pay for each visit. You will generally pay a higher co-pay for out-of-network dentists.

- Dental EPO (Exclusive Provider Organization) Plans: These plans are similar to HMO plans, but they offer a wider network of dentists. You must choose a dentist from the network. You will pay a monthly premium and a co-pay for each visit. They typically have lower premiums than PPO plans but may have limited coverage for certain procedures.

Dental Discount Plans

Dental discount plans offer discounted rates on dental services from a network of participating dentists. They typically have lower monthly premiums than dental insurance plans, but they do not cover any of the cost of dental services. You will pay the discounted price for the service, which is usually a percentage of the dentist’s usual fees.

Comparing Dental Plans

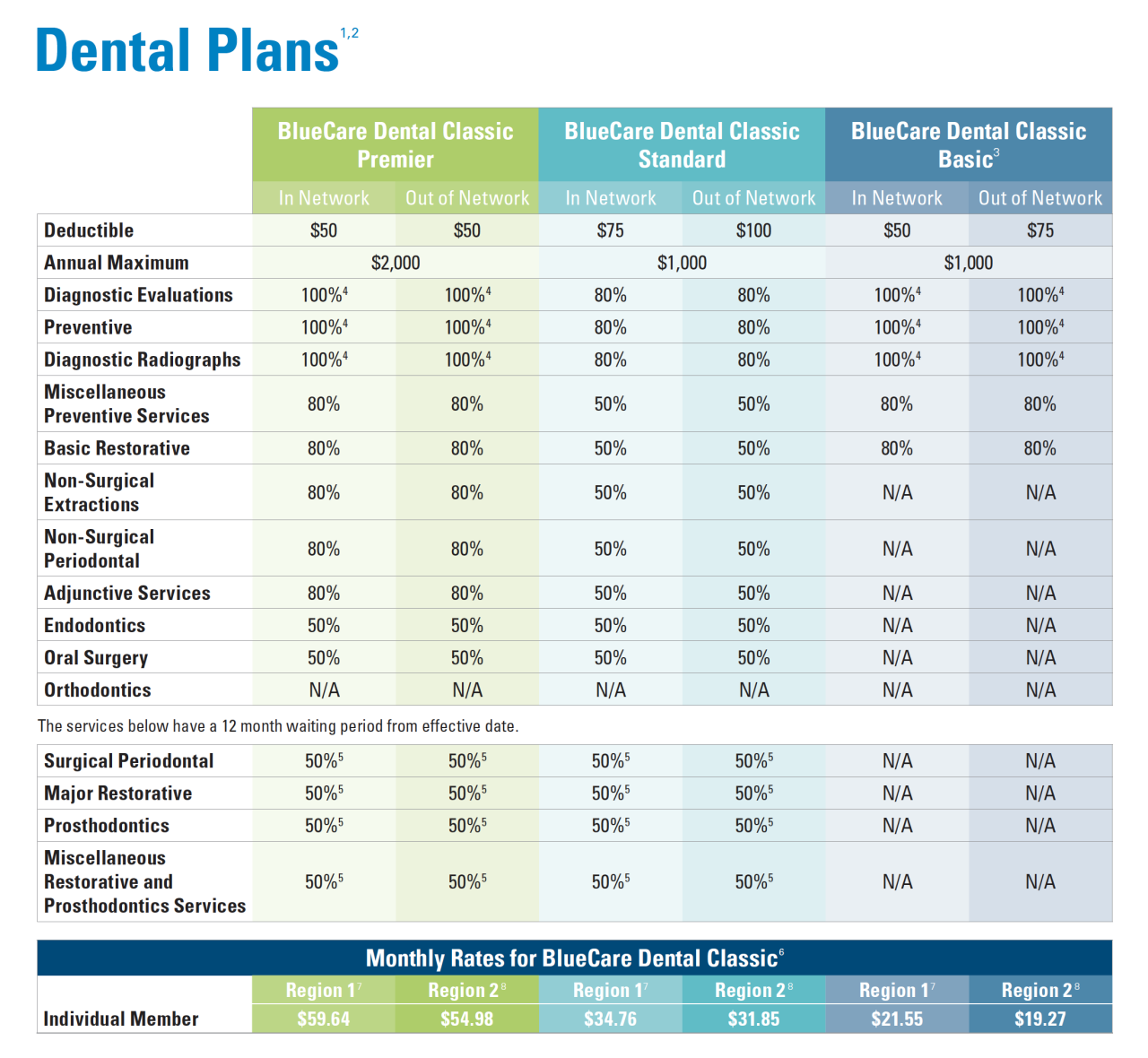

The following table compares the different types of dental plans:

| Plan Type | Coverage | Costs | Limitations |

|—|—|—|—|

| Dental HMO | Covers a percentage of the cost of dental services from a network of dentists. | Lower premiums, co-pays for each visit. | Limited coverage for certain procedures, must choose a dentist from the network. |

| Dental PPO | Covers a percentage of the cost of dental services from both in-network and out-of-network dentists. | Higher premiums, co-pays for each visit. | Higher co-pays for out-of-network dentists. |

| Dental EPO | Covers a percentage of the cost of dental services from a network of dentists. | Lower premiums, co-pays for each visit. | Limited coverage for certain procedures, must choose a dentist from the network. |

| Dental Discount Plan | Does not cover any of the cost of dental services, but offers discounted rates on services from a network of participating dentists. | Lower monthly premiums. | No coverage for dental services, must pay the discounted price for the service. |

Choosing the Right Dental Plan

The right dental plan for you will depend on your individual needs and budget. Consider the following factors when choosing a plan:

* Your dental needs: How often do you need dental care? Do you have any specific dental needs, such as braces or implants?

* Your budget: How much can you afford to pay for a dental plan?

* The plan’s network: Does the plan include dentists in your area?

* The plan’s coverage: What services are covered by the plan? What are the co-pays and deductibles?

* The plan’s limitations: Are there any limitations on the plan, such as waiting periods or exclusions?

Flowchart for Choosing the Right Dental Plan

[Illustration: A flowchart depicting the process of choosing the right dental plan. The flowchart should include questions about the individual’s dental needs, budget, and preferences. The flowchart should also include options for different types of dental plans, such as dental insurance plans and dental discount plans.]

Factors to Consider When Choosing a Dental Plan

Choosing the right dental plan is crucial for ensuring comprehensive oral health care at an affordable price. Several factors need careful consideration to find a plan that best suits your individual needs and budget.

Coverage

The coverage provided by a dental plan determines the services it covers and the amount it will pay for those services. It is essential to understand the specific details of the plan’s coverage, including:

- Preventive care: This includes routine checkups, cleanings, and X-rays. Most dental plans cover these services at 100%, encouraging regular visits for early detection of issues.

- Basic care: This covers procedures like fillings, extractions, and root canals. Coverage for basic care can vary, with some plans offering higher coverage than others.

- Major care: This includes more complex procedures like crowns, bridges, and implants. Major care services typically have higher out-of-pocket costs and may have limitations on coverage.

- Orthodontics: Coverage for orthodontic treatments like braces or Invisalign varies greatly. Some plans may have separate waiting periods or limitations on coverage.

Costs

Dental plans have different cost structures, impacting your overall expenses. Key factors to consider include:

- Monthly premium: This is the recurring cost you pay for the plan, regardless of whether you use it or not.

- Deductible: This is the amount you need to pay out-of-pocket before the plan starts covering services. Lower deductibles mean lower out-of-pocket costs but higher premiums.

- Co-pays: These are fixed amounts you pay for specific services, such as checkups or cleanings.

- Co-insurance: This is a percentage of the cost of services you are responsible for after the deductible is met.

- Maximum benefit: This is the total amount the plan will pay for covered services in a year. Understanding the maximum benefit can help you budget for potential out-of-pocket expenses.

Network of Providers

A dental plan’s network of providers is a critical consideration. It determines which dentists you can use for covered services.

- In-network providers: These dentists have agreed to accept the plan’s negotiated rates. Using in-network providers generally results in lower out-of-pocket costs.

- Out-of-network providers: These dentists are not part of the plan’s network. Using out-of-network providers can lead to significantly higher out-of-pocket costs. Some plans may cover out-of-network services, but with lower reimbursement rates.

- Provider availability: It’s essential to ensure that there are dentists in your network who are conveniently located and specialize in the services you need.

Waiting Periods

Dental plans may have waiting periods before you can access certain services.

- Preventive care: Typically, there are no waiting periods for preventive services like checkups and cleanings.

- Basic and major care: Waiting periods for these services can range from a few months to a year. This means you may need to pay out-of-pocket for these services until the waiting period is over.

- Orthodontics: Orthodontic services often have extended waiting periods, sometimes requiring a year or more before coverage begins.

Questions to Ask Potential Dental Plan Providers

To ensure informed decision-making, it’s crucial to ask potential dental plan providers specific questions.

- What is the monthly premium for the plan?

- What is the deductible for the plan?

- What are the co-pays and co-insurance for various services?

- What is the maximum benefit for the plan?

- What are the waiting periods for different services?

- What is the network of providers for the plan? Are there dentists in my area who are in-network?

- What are the coverage limitations for specific services, such as orthodontics or implants?

- Are there any exclusions or limitations on coverage?

- What are the procedures for filing claims and receiving reimbursement?

Comparing Dental Plans

Comparing different dental plans is crucial before making a choice. It allows you to identify the plan that best meets your individual needs and budget. Consider factors such as coverage, costs, network of providers, and waiting periods when comparing plans.

Dental Plan Coverage

Dental insurance plans cover a wide range of dental procedures, helping individuals manage the costs associated with maintaining oral health. Understanding the specific coverage details of your plan is crucial to make informed decisions about your dental care.

Types of Covered Procedures

Dental insurance plans typically cover a variety of preventive, diagnostic, and restorative procedures. Common examples include:

- Cleanings: Regular dental cleanings, also known as prophylaxis, are essential for removing plaque and tartar buildup, preventing gum disease, and maintaining oral hygiene. Most dental plans cover two cleanings per year.

- Fillings: Fillings are used to repair cavities and restore damaged teeth. Dental plans generally cover fillings made from various materials, including amalgam, composite resin, and gold.

- Crowns: Crowns are caps placed over damaged or weakened teeth to restore their shape, size, and strength. Dental plans often cover crowns, but may have limitations on the type of material used, such as gold or porcelain.

- Extractions: Extractions are procedures to remove teeth that are severely damaged, decayed, or impacted. Dental plans typically cover extractions, but may have limitations based on the reason for the extraction.

Exclusions from Coverage

While dental plans cover many essential procedures, certain services are often excluded from coverage. Common exclusions include:

- Cosmetic Procedures: Procedures primarily for aesthetic purposes, such as teeth whitening, veneers, and dental implants for cosmetic reasons, are typically not covered by dental plans.

- Pre-existing Conditions: Dental plans may not cover pre-existing conditions, such as extensive tooth decay or gum disease, that were present before the policy’s effective date.

- Experimental Procedures: New or experimental dental procedures, which have not been widely accepted by the dental community, may not be covered by dental plans.

Annual Maximums and Deductibles

Dental insurance plans often have annual maximums and deductibles that influence the amount of coverage provided.

Annual Maximums

- An annual maximum is the total amount of benefits the insurance plan will pay out for covered dental procedures in a calendar year. Once the annual maximum is reached, the insured individual is responsible for the remaining costs.

- For example, a dental plan with an annual maximum of $1,500 will cover up to $1,500 worth of dental procedures during the year. If the insured individual incurs $2,000 in dental expenses, they will be responsible for paying the remaining $500.

Deductibles

- A deductible is the amount of money the insured individual must pay out-of-pocket before the insurance plan starts covering dental expenses.

- For example, a dental plan with a $100 deductible requires the insured individual to pay the first $100 of dental expenses before the insurance plan begins to cover the remaining costs.

Cost of Dental Plan Insurance

The cost of dental plan insurance varies depending on several factors, including the type of plan, your age, location, and the insurer you choose. Understanding these factors and how they impact the cost can help you find a plan that fits your budget and needs.

Factors Influencing Dental Plan Costs

Several factors influence the cost of dental plan insurance.

- Age: Younger individuals generally have healthier teeth and require less dental care, leading to lower premiums. As you age, the likelihood of needing more dental services increases, which can result in higher premiums.

- Location: The cost of living, including healthcare costs, varies by location. Areas with higher costs of living often have higher dental insurance premiums.

- Plan Type: Different types of dental plans offer varying levels of coverage and benefits, impacting the cost. Plans with more comprehensive coverage and lower deductibles typically have higher premiums.

- Insurer: Different insurance companies have different pricing structures and coverage options. Comparing quotes from multiple insurers can help you find the most affordable option.

Comparing Dental Plan Costs

When comparing dental plans, consider the following:

- Monthly Premiums: This is the regular payment you make for coverage. Lower premiums might seem attractive, but consider the coverage and out-of-pocket expenses.

- Deductibles: This is the amount you pay out-of-pocket before the plan starts covering your dental expenses. Lower deductibles generally mean higher premiums.

- Co-pays: These are fixed amounts you pay for specific services, such as cleanings or fillings. Plans with higher co-pays might have lower premiums.

- Out-of-Pocket Maximum: This is the maximum amount you’ll pay for dental care in a year. Plans with lower out-of-pocket maximums offer more protection against high dental bills.

Finding Affordable Dental Plan Options

Here are some tips for finding affordable dental plan insurance:

- Compare Quotes: Obtain quotes from multiple insurers to compare premiums, coverage, and out-of-pocket expenses. Online comparison tools can streamline this process.

- Consider Group Plans: If you work for a company that offers group dental insurance, explore the options and benefits. Group plans often have lower premiums than individual plans.

- Evaluate Your Needs: Consider your dental health history and future needs. If you anticipate needing extensive dental work, a more comprehensive plan might be worthwhile, even if it has higher premiums.

- Look for Discounts: Some insurers offer discounts for non-smokers, good dental hygiene, or healthy lifestyle choices. Inquire about potential discounts during the quote process.

Finding a Dental Plan

Finding a dental plan that meets your needs and budget can be a daunting task, but it doesn’t have to be. Several resources are available to help you find the right plan, each with its own advantages and disadvantages.

Online Marketplaces

Online marketplaces are a convenient way to compare different dental plans from multiple insurance providers. These platforms allow you to filter plans based on your location, budget, and desired coverage. Examples of popular online marketplaces include:

- eHealth

- HealthMarkets

- Policygenius

The benefit of online marketplaces is that they provide a centralized platform for comparison shopping, allowing you to quickly and easily find the best plan for your needs. However, it’s important to carefully read the terms and conditions of each plan before enrolling.

Insurance Brokers

Insurance brokers are independent professionals who can help you find and compare dental plans. They have access to a wide range of plans from different insurance companies and can provide personalized advice based on your individual needs. Brokers can help you navigate the complexities of dental insurance and ensure you understand the terms and conditions of each plan.

Employer-Sponsored Plans

Many employers offer dental insurance as part of their benefits package. This can be a cost-effective option, as employers often negotiate group rates with insurance companies. Employer-sponsored plans typically provide a wider range of coverage than individual plans.

Step-by-Step Guide to Enrolling in a Dental Plan

Once you’ve identified a few dental plans that meet your needs, you can follow these steps to enroll:

- Gather your information: You’ll need to provide your personal information, including your name, address, and Social Security number. You may also need to provide information about your dependents if you’re enrolling them in the plan.

- Review the terms and conditions: Carefully read the terms and conditions of the plan, including the coverage details, premiums, and any limitations or exclusions.

- Choose your plan: Once you’ve reviewed the terms and conditions, you can choose the plan that best suits your needs and budget.

- Pay your premium: You’ll need to pay your premium either monthly, quarterly, or annually, depending on the plan’s terms.

- Receive your ID card: Once you’ve enrolled in the plan, you’ll receive an ID card that you can use to access your dental benefits.

Understanding the Terms and Conditions

It is crucial to understand the terms and conditions of your dental plan before enrolling. These terms and conditions Artikel the coverage details, including:

- Annual maximum: This is the maximum amount the insurance company will pay for your dental care each year.

- Deductible: This is the amount you must pay out-of-pocket before your insurance coverage kicks in.

- Co-insurance: This is the percentage of the cost of your dental care that you’ll pay after your deductible has been met.

- Waiting period: This is the period of time you must wait after enrolling in the plan before you can use your dental benefits.

- Exclusions: This is a list of dental procedures that are not covered by the plan.

By understanding these terms and conditions, you can ensure that you’re getting the coverage you need at a price you can afford.

Dental Plan Claims

Dental insurance claims are a crucial part of the process, allowing you to access the benefits you’ve paid for. Understanding how to file a claim and navigate potential issues is essential.

Claim Filing Process

Filing a claim typically involves the following steps:

- Contact your dentist. Inform your dentist that you have dental insurance and provide them with your insurance information. They will often file the claim on your behalf, simplifying the process.

- Complete a claim form. Your dentist or insurance company will provide you with a claim form. Fill it out accurately, providing details of the services received, dates of treatment, and any other required information.

- Submit the claim. Once completed, submit the claim form to your insurance company. This can be done through mail, fax, or online portals depending on your insurer’s preferences.

- Review your claim status. After submitting the claim, track its progress. Your insurance company will typically provide updates on the status of your claim through their website or phone.

Documents Required for Claim Submission

To ensure a smooth claim processing experience, gather the following documents:

- Insurance card. This contains your policy details, including your member ID number, which is essential for identifying your coverage.

- Completed claim form. This form serves as a formal request for payment, detailing the services you received and the costs incurred.

- Treatment plan. This document Artikels the recommended dental procedures, including the cost breakdown, which allows your insurer to assess the appropriateness of the treatment.

- Dental bills. These bills, issued by your dentist, provide detailed information about the services performed, the costs associated with each service, and any applicable discounts or adjustments.

Common Reasons for Claim Denials

While most claims are processed smoothly, there are situations where claims might be denied. Common reasons for denials include:

- Pre-existing conditions. Certain pre-existing dental conditions might not be covered by your plan, especially if they weren’t disclosed during enrollment.

- Lack of preventive care. Some plans require regular checkups and cleanings to maintain coverage for more complex procedures. Failure to meet these requirements could lead to denials for certain services.

- Exceeding coverage limits. Each plan has annual and lifetime maximums for coverage. If you exceed these limits, claims for additional procedures may be denied.

- Incorrect coding or billing. Errors in coding or billing information submitted by your dentist can result in claim denials. These errors can be related to the procedure codes, patient information, or billing details.

- Non-covered services. Certain dental services, such as cosmetic procedures or procedures deemed unnecessary by the insurer, may not be covered by your plan.

Appealing a Denied Claim

If your claim is denied, you have the right to appeal the decision. The process for appealing a denied claim is typically Artikeld in your insurance policy. It usually involves the following steps:

- Review the denial letter. Carefully read the denial letter, which explains the reason for the denial and provides instructions on how to appeal the decision.

- Gather supporting documentation. Collect any additional documents that support your case, such as medical records, treatment plans, or expert opinions.

- Submit the appeal. Follow the instructions provided in the denial letter to submit your appeal, including the required documentation.

- Follow up on the appeal. Contact your insurance company to track the status of your appeal and ensure it is being reviewed promptly.

Maintaining Dental Health with Insurance

Dental insurance is a valuable investment in your oral health. It provides financial protection against the costs of dental care, making it easier to access regular checkups, cleanings, and other essential treatments. However, maximizing the benefits of your dental plan requires proactive steps and a commitment to good oral hygiene.

Regular Dental Checkups and Cleanings

Regular dental checkups and cleanings are essential for maintaining optimal oral health. These appointments allow your dentist to identify and address potential problems early on, preventing more serious and costly issues in the future. Dental insurance typically covers the cost of these preventive services, making it easier to prioritize regular care.

- Early Detection of Dental Problems: Regular checkups enable dentists to identify cavities, gum disease, and other issues at their initial stages, when treatment is simpler and less expensive.

- Prevention of Tooth Decay and Gum Disease: Professional cleanings remove plaque and tartar buildup, reducing the risk of tooth decay and gum disease.

- Oral Cancer Screening: During checkups, dentists conduct oral cancer screenings, which can detect early signs of this potentially life-threatening disease.

Good Oral Hygiene Practices

Maintaining good oral hygiene habits is crucial for preventing dental problems and maximizing the benefits of your dental plan. This involves a consistent routine of brushing, flossing, and using mouthwash.

- Brushing Twice Daily: Brush your teeth for at least two minutes, twice a day, using a soft-bristled toothbrush and fluoride toothpaste.

- Flossing Daily: Flossing removes food particles and plaque from between your teeth, where brushing cannot reach.

- Using Mouthwash: Mouthwash helps kill bacteria and freshen breath, contributing to overall oral health.

- Avoiding Sugary Foods and Drinks: Excessive sugar consumption can contribute to tooth decay.

- Quitting Smoking: Smoking damages teeth and gums, increasing the risk of gum disease and oral cancer.

Importance of Maintaining Good Oral Hygiene

Good oral hygiene is not only essential for maintaining a healthy smile but also plays a crucial role in overall health. Studies have shown a link between poor oral health and other health conditions, such as heart disease, stroke, and diabetes. By practicing good oral hygiene, you can reduce your risk of developing these health issues.

“Maintaining good oral hygiene is not just about having a healthy smile, it’s about maintaining your overall health and well-being.” – Dr. Sarah Jones, Dentist

Dental Plan Insurance for Specific Groups

Dental plan insurance caters to diverse needs, offering specialized options for families, seniors, and individuals with pre-existing conditions. These plans are tailored to address the unique requirements and financial situations of each group.

Dental Plans for Families

Family dental plans provide comprehensive coverage for all members, ensuring affordable access to essential dental care. These plans often include preventive services, restorative treatments, and orthodontics, safeguarding the oral health of every family member.

Family dental plans are designed to address the unique needs of families, offering comprehensive coverage for all members, ensuring affordable access to essential dental care.

Dental Plans for Seniors

Seniors require specialized dental coverage due to their increased susceptibility to dental issues. Senior-specific dental plans often offer coverage for dentures, bridges, and implants, addressing common dental needs in this age group.

Senior-specific dental plans offer coverage for dentures, bridges, and implants, addressing common dental needs in this age group.

Dental Plans for Individuals with Pre-existing Conditions

Individuals with pre-existing conditions may face challenges in securing affordable dental insurance. However, specific dental plans cater to their needs, providing coverage for pre-existing conditions and ensuring access to necessary dental care.

Specific dental plans cater to individuals with pre-existing conditions, providing coverage for pre-existing conditions and ensuring access to necessary dental care.

Dental Plan Insurance Trends

The dental plan insurance market is constantly evolving, driven by changing consumer preferences, technological advancements, and evolving healthcare regulations. Understanding these trends is crucial for individuals seeking dental coverage and for insurance providers navigating this dynamic landscape.

The Rise of Dental Savings Accounts

Dental Savings Accounts (DSAs) are gaining popularity as a flexible and cost-effective way to manage dental expenses. DSAs allow individuals to set aside pre-tax dollars for dental care, reducing their taxable income and providing a tax advantage.

- Tax Benefits: Contributions to DSAs are tax-deductible, and withdrawals for qualified dental expenses are tax-free, making them a financially attractive option.

- Flexibility: Unlike traditional dental plans, DSAs offer greater control over how funds are used. Individuals can choose their dentists and treatments, and they are not restricted to a specific network.

- Cost Savings: DSAs can lead to significant cost savings, especially for individuals with predictable dental needs or those who prefer to pay for their care out of pocket.

Increased Focus on Preventive Care

Preventive dental care, such as regular checkups and cleanings, is increasingly recognized as essential for overall health. This shift in focus has led to a growing demand for dental plans that prioritize preventive services.

- Early Detection and Prevention: Preventive care helps identify dental problems early, when they are easier and less expensive to treat, reducing the need for costly restorative procedures later.

- Improved Oral Health: Regular checkups and cleanings contribute to better oral health, reducing the risk of tooth decay, gum disease, and other dental problems.

- Reduced Healthcare Costs: Studies have shown that preventive dental care can lead to lower overall healthcare costs, as it helps prevent complications and the need for more extensive treatments.

Technological Advancements in Dental Care

Technological advancements are transforming the dental care landscape, impacting dental plan insurance in various ways.

- Telehealth: Telehealth platforms allow individuals to consult with dentists remotely for initial consultations, follow-up appointments, and even certain procedures. This can enhance accessibility, especially for those in rural areas or with limited mobility.

- Remote Monitoring: Wearable devices and mobile applications can track oral health metrics such as brushing habits, gum health, and teeth whitening progress. This data can be used to personalize treatment plans and provide real-time feedback to patients.

- Artificial Intelligence (AI): AI-powered tools are being used to analyze dental images, identify potential problems, and assist dentists in making more accurate diagnoses. This can lead to improved treatment outcomes and reduced costs.

Conclusion

Choosing the right dental plan insurance is a crucial step in ensuring affordable and accessible dental care. By understanding the different types of plans, their coverage, costs, and limitations, individuals can make informed decisions that align with their needs and budgets. Remember, proactive dental care and preventative measures are key to maintaining a healthy smile, and dental plan insurance can be a valuable tool in achieving this goal.