In the sprawling metropolis of Houston, navigating the complexities of SR-22 insurance can feel like driving through rush hour traffic. This high-risk auto insurance requirement, mandated by the Texas Department of Public Safety, isn’t optional for drivers with specific violations on their record.

Understanding its nuances—from obtaining coverage to maintaining compliance—is crucial for regaining driving privileges and avoiding further penalties. This guide dissects the intricacies of SR22 insurance in Houston, providing clarity on costs, providers, and the application process.

From identifying reputable insurers and comparing their offerings to understanding the factors influencing premium costs, this comprehensive overview aims to empower Houston drivers to make informed decisions. We’ll explore the application process, coverage limitations, and common misconceptions surrounding SR-22 insurance, equipping readers with the knowledge to navigate this often-daunting process with confidence.

SR-22 Insurance Definition in Houston

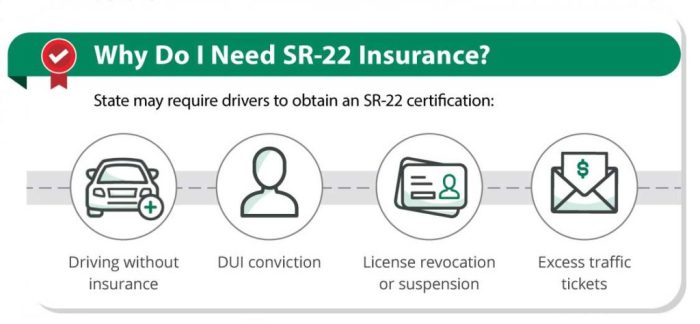

SR-22 insurance is a certificate of financial responsibility required by the Texas Department of Public Safety (DPS) for drivers who have been convicted of certain driving offenses or have had their driving privileges suspended or revoked. It’s not a standalone insurance policy but rather proof to the state that the driver maintains the minimum required liability insurance coverage.

This ensures that drivers who pose a higher risk to the public are financially responsible for any accidents they may cause.SR-22 insurance requirements in Texas stem from the state’s commitment to public safety and its efforts to hold drivers accountable for their actions on the road.

The certificate acts as a safeguard, guaranteeing that individuals with a history of driving infractions maintain adequate insurance coverage to compensate victims of potential accidents. Failure to maintain an active SR-22 filing can lead to further penalties, including license suspension or revocation.

Purpose of SR-22 Insurance

The primary purpose of SR-22 insurance is to demonstrate proof of financial responsibility to the state. This means the insured driver carries liability coverage at or above the minimum limits set by Texas law, protecting potential victims in the event of an accident caused by the insured.

The SR-22 serves as verification that this insurance is in place and actively maintained. It’s a crucial step in reinstating driving privileges after a serious traffic violation or suspension.

Requirements for Obtaining SR-22 Insurance in Texas

Obtaining SR-22 insurance in Texas typically involves several steps. First, the driver must meet the minimum liability insurance requirements set by the state. Second, they must find an insurance provider willing to file the SR-22 form with the Texas DPS on their behalf.

This form confirms the driver’s insurance coverage and notifies the state of any changes in their policy status. Third, the driver must maintain continuous coverage for the duration specified by the court or DPS, usually a period of three years.

Failure to maintain continuous coverage can result in license suspension.

Comparison of SR-22 Insurance and Standard Auto Insurance

SR-22 insurance is not a separate type of insurance but rather an addendum to a standard auto insurance policy. It primarily differs in its purpose: standard auto insurance protects the insured and others involved in an accident, while SR-22 insurance serves as proof of financial responsibility to the state.

The cost of SR-22 insurance can be higher than standard auto insurance due to the increased risk associated with drivers who require this certificate. This increased cost reflects the higher risk the insurance company assumes in insuring these drivers.

Both types of insurance require the driver to maintain minimum liability coverage, but the SR-22 necessitates a formal filing with the state to demonstrate compliance.

Finding SR-22 Insurance Providers in Houston

Securing SR-22 insurance in Houston is a crucial step for drivers who have experienced certain driving infractions. Finding the right provider requires careful consideration of price, coverage, and reputation. This section details reputable providers and compares their offerings to aid in informed decision-making.

Reputable SR-22 Insurance Providers in Houston

Several reputable insurance providers offer SR-22 insurance in the Houston area. Choosing a provider depends on individual needs and budgetary constraints. The following list presents some well-established options, but it’s crucial to conduct independent research before committing to a policy.

Note that availability and specific offerings can change.

| Provider | Approximate Monthly Premium Range (Example: for a 25-year-old with a clean driving record except for the SR-22 requirement) | Coverage Options | Contact Information |

|---|---|---|---|

| Progressive | $150

|

Liability, Uninsured/Underinsured Motorist | 1-800-PROGRESSIVE (1-800-776-4737) Website: progressive.com |

| State Farm | $120

|

Liability, Uninsured/Underinsured Motorist, Collision, Comprehensive | 1-800-STATEFARM (1-800-782-8332) Website: statefarm.com |

| Geico | $100

|

Liability, Uninsured/Underinsured Motorist | 1-800-947-AUTO (1-800-947-2886) Website: geico.com |

*Note: Premium ranges are estimates and vary significantly based on individual driving history, age, vehicle type, and coverage selected. Contacting providers directly for personalized quotes is essential.*

SR-22 Insurance Pricing and Coverage Comparison

The table above provides a general overview of pricing and coverage options. It is crucial to understand that these are examples only, and actual costs will differ depending on individual circumstances. Factors such as the driver’s age, driving history (beyond the incident requiring SR-22), the type of vehicle, and the chosen coverage levels significantly impact the final premium.

For instance, a driver with multiple accidents or violations will likely face higher premiums than someone with a clean record, even with the SR-22 requirement. Similarly, adding comprehensive or collision coverage will increase the cost compared to only carrying liability coverage.

Factors Affecting SR-22 Insurance Costs in Houston

Securing SR-22 insurance in Houston, like elsewhere, involves a complex interplay of factors that significantly influence the final premium. Understanding these factors empowers drivers to make informed choices and potentially mitigate costs. This section details the key elements that insurance providers consider when calculating SR-22 rates in the Houston metropolitan area.Driving Record Significantly Impacts Premiums.

A driver’s history is the most crucial determinant of SR-22 insurance costs. Multiple violations, particularly those involving accidents or driving under the influence (DUI), substantially increase premiums. Conversely, a clean driving record can lead to lower rates.

The severity and frequency of past offenses directly correlate with the premium. For instance, a single speeding ticket will generally have less impact than a DUI conviction coupled with multiple accidents.

Driving History and Its Impact on SR-22 Costs

The impact of a driver’s history on SR-22 premiums is substantial. Insurance companies assess the risk associated with each driver based on their past driving behavior. A history of accidents, traffic violations, or DUI convictions will result in higher premiums compared to a driver with a clean record.

The recency of violations also plays a role; more recent offenses carry more weight than those from several years ago. For example, a driver with a DUI conviction from five years ago may face lower premiums than a driver with a recent speeding ticket.

This is because insurance companies consider the likelihood of future incidents.

Age and Experience Influence Premium Calculations

Age and driving experience are strongly correlated with insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. Conversely, drivers with extensive, accident-free driving histories often qualify for lower rates.

This reflects the established correlation between experience and safer driving habits. For example, a 60-year-old with a clean driving record for 40 years would likely receive a much lower rate than a 20-year-old with a recent accident.

Vehicle Type and Its Relation to Insurance Costs

The type of vehicle insured also influences SR-22 insurance costs. Higher-performance vehicles, sports cars, and luxury automobiles are typically associated with higher premiums due to increased repair costs and a perceived higher risk of accidents. Conversely, less expensive and less powerful vehicles generally result in lower premiums.

For example, insuring a high-performance sports car will almost certainly cost more than insuring a compact sedan, even with identical driving records.

Comparison of SR-22 Insurance Costs Across Texas Cities

While precise cost comparisons across Texas cities require specific quotes from individual insurers, general trends suggest that SR-22 insurance in Houston may fall within the average range for larger Texas cities. Factors like population density, traffic patterns, and the overall cost of living influence premiums.

However, significant variations can occur based on the factors previously discussed. Direct comparisons would need to account for the individual driver’s profile and the specific insurance provider. Cities with higher crime rates or accident rates might see higher average SR-22 costs, although this is not always the case.

The SR-22 Insurance Application Process

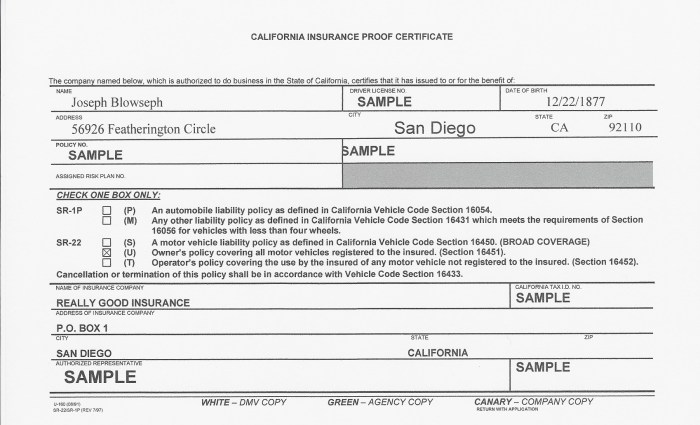

Securing SR-22 insurance in Houston involves a straightforward yet crucial process for reinstating driving privileges after a serious traffic violation. Understanding the steps involved and the necessary documentation can streamline the application and minimize potential delays. This section details the application procedure, outlining the required documents and providing a step-by-step guide.The application process for SR-22 insurance in Houston generally involves several key steps, beginning with selecting an insurer and culminating in the filing of the certificate with the Texas Department of Public Safety (DPS).

The complexity can vary depending on the individual’s driving history and the specific requirements imposed by the court or DPS.

Required Documents for SR-22 Insurance Application

Gathering the necessary documentation beforehand significantly accelerates the application process. Missing documents often lead to delays. Insurers typically require a comprehensive set of information to verify the applicant’s identity, driving history, and insurance eligibility.

- Valid Driver’s License:A current, unexpired Texas driver’s license is essential to verify the applicant’s identity and legal residency.

- Vehicle Identification Number (VIN):The VIN uniquely identifies the vehicle to be insured, ensuring accurate coverage.

- Proof of Address:Documents such as a utility bill, bank statement, or lease agreement are necessary to confirm the applicant’s current address.

- Court Order or Notice of Suspension:This document Artikels the specific requirements for SR-22 insurance, including the duration of the requirement.

- Previous Insurance Information:Details from previous insurance policies, including policy numbers and dates of coverage, may be requested.

- Driving Record:A copy of the applicant’s driving record, obtained from the Texas DPS, provides a complete history of driving violations and accidents.

Step-by-Step Guide to Completing the SR-22 Application

The application process typically involves direct interaction with the chosen insurance provider. While the specifics might vary slightly between companies, the general steps remain consistent.

- Select an SR-22 Provider:Research and compare quotes from multiple insurers offering SR-22 coverage in Houston. Consider factors like price and customer service.

- Provide Necessary Information:Complete the insurance application form accurately and completely, providing all the required documents listed previously.

- Complete a Driving History Review:The insurer will conduct a review of the applicant’s driving history to assess the risk and determine appropriate premiums.

- Pay the Premium:The initial premium payment is usually required before the policy is activated and the SR-22 certificate is filed.

- Receive and File the SR-22 Certificate:Once the application is approved, the insurer will issue the SR-22 certificate, which must be submitted to the Texas DPS within the specified timeframe.

Understanding SR-22 Insurance Coverage

An SR-22 filing in Houston, like elsewhere, isn’t insurance itself; it’s a certificate proving you maintain the minimum liability insurance required by the state. The actual insurance policy providing that coverage operates independently, and its specifics determine the extent of your protection.

Understanding these nuances is crucial for drivers required to obtain an SR-22.The coverage included in an SR-22 policy is dictated by the underlying liability insurance policy. It doesn’t offer additional coverage beyond what’s mandated by Texas law or what the individual policyholder purchases.

Therefore, the level of protection varies significantly depending on the chosen policy.

Liability Coverage in SR-22 Policies

Texas law mandates minimum liability coverage limits, which typically include bodily injury and property damage liability. Bodily injury liability covers medical bills and other damages for injuries you cause to others in an accident. Property damage liability covers the cost of repairing or replacing the property of others damaged in an accident caused by you.

The specific limits, such as 30/60/25 (meaning $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 for property damage), are determined by the individual policy and state regulations, not by the SR-22 filing itself.

Higher limits are available and recommended for enhanced protection. For instance, a driver might opt for 100/300/100 coverage for greater financial security.

Limitations of SR-22 Insurance Coverage

SR-22 insurance only covers the minimum liability requirements. It does not include other types of coverage, such as collision, comprehensive, uninsured/underinsured motorist, or medical payments coverage. These optional coverages, often purchased separately, provide broader protection for the policyholder’s vehicle and medical expenses.

A driver with only the minimum liability coverage mandated by the SR-22 might face significant financial hardship if they are at fault in an accident causing substantial damage or injury. For example, if a driver with only minimum liability coverage causes a multi-vehicle accident resulting in serious injuries, they could be sued for damages exceeding their policy limits, leading to personal financial ruin.

Coverage Variations Among Providers

Different insurance providers in Houston offer varying levels of service and policy options, even within the minimum liability coverage required for an SR-22. Some providers might offer more flexible payment plans or provide additional customer support resources. However, the core coverage—the minimum liability—remains largely consistent across providers, adhering to Texas state regulations.

Price comparison is key, as rates can fluctuate significantly based on factors like driving history, age, and the vehicle itself. For example, one provider might offer a lower rate for a specific profile, while another may offer better customer service or more convenient payment options.

Drivers should compare quotes from multiple insurers before selecting a policy.

Maintaining SR-22 Insurance Compliance

Securing an SR-22 certificate in Houston is only the first step; maintaining its validity is crucial for reinstating driving privileges. Failure to comply can lead to significant repercussions, including license suspension and further legal complications. Understanding the duration of the requirement and the steps to ensure continuous coverage is paramount for drivers in Houston.The duration of the SR-22 requirement varies depending on the circumstances leading to its mandate.

It’s typically imposed for a period ranging from one to three years, dictated by the Texas Department of Public Safety (TxDPS) based on the severity of the driving offense. For example, a first-time DUI conviction might necessitate a two-year SR-22 requirement, while multiple offenses or more serious violations could extend this period.

The insurance provider will file the certificate with the TxDPS, and the agency will notify the driver when the requirement is fulfilled. It’s essential to confirm the exact duration with the TxDPS and the insurance company.

Duration of SR-22 Insurance Requirements

The length of time an SR-22 is required is determined by the state and the nature of the driving infraction. In Texas, this period can range from one to three years, sometimes longer depending on the severity of the violation.

The driver is responsible for maintaining continuous coverage throughout this mandated period. A lapse in coverage, even for a short period, can result in serious penalties. It’s vital to proactively monitor the expiration date of the SR-22 certificate to avoid unintentional non-compliance.

Consequences of Failing to Maintain SR-22 Insurance

Non-compliance with SR-22 requirements in Houston carries severe consequences. Failure to maintain continuous coverage throughout the mandated period can result in the immediate suspension of the driver’s license. This suspension remains in effect until the driver secures a new SR-22 certificate and demonstrates proof of continuous insurance coverage for the remainder of the original requirement period.

Furthermore, drivers may face additional fines and penalties levied by the TxDPS, potentially including court appearances and increased insurance premiums in the future. In some cases, a driver’s vehicle may be impounded until compliance is achieved.

Ensuring Continuous Compliance with SR-22 Insurance

Maintaining SR-22 compliance requires proactive measures. Drivers should promptly notify their insurance provider of any address changes or other relevant information updates to prevent lapses in coverage. Regularly reviewing the SR-22 certificate’s expiration date and paying premiums on time are crucial.

It is also advisable to obtain confirmation from the TxDPS that the SR-22 certificate has been properly filed and is actively in effect. Choosing a reputable insurance provider who specializes in SR-22 insurance can provide added support and ensure smooth compliance.

Proactive communication and diligent record-keeping are essential for avoiding potential penalties.

Common Misconceptions about SR-22 Insurance

SR-22 insurance is often shrouded in misunderstanding, leading to unnecessary anxiety and confusion among drivers in Houston. Many misconceptions circulate, impacting how individuals approach this requirement. Clarifying these inaccuracies is crucial for navigating the SR-22 process effectively.

SR-22 Insurance is a Separate Type of Car Insurance

This is a prevalent misconception. SR-22 insurance is not a distinct type of car insurance policy; rather, it’s a certificate or proof of financial responsibility filed with the Texas Department of Public Safety (DPS). It verifies that the driver maintains the minimum liability insurance coverage mandated by the state, or higher as determined by the court or DMV.

The SR-22 itself doesn’t provide coverage; it’s a confirmation that existing auto insurance meets the state’s requirements. A driver must still maintain a standard auto insurance policy to be compliant. Failure to maintain both the insurance policy and the SR-22 filing will result in penalties.

SR-22 Insurance Automatically Increases Premiums

While obtaining an SR-22 often accompanies a premium increase, it’s not an automatic consequence. The increase is a reflection of the driver’s higher risk profile, as demonstrated by their past driving record that necessitated the SR-22 filing in the first place.

Insurers assess risk based on various factors, including driving history, age, and vehicle type, not solely on the presence of an SR-22. A driver with a clean driving record after fulfilling the SR-22 requirement may see their premiums decrease over time.

In short, the SR-22 itself doesn’t automatically inflate premiums; the underlying risk factors do.

Only High-Risk Drivers Need SR-22 Insurance

This is inaccurate. While SR-22s are frequently associated with drivers who have committed serious driving offenses like DUI or reckless driving, they are also mandated in other situations. For example, drivers who let their insurance lapse, have multiple accidents within a short period, or are involved in hit-and-run accidents may also be required to obtain an SR-22.

Essentially, any driver who fails to meet the state’s minimum financial responsibility requirements might be ordered to file an SR-22, irrespective of the severity of their driving infractions. The requirement is about demonstrating financial responsibility, not solely about punitive measures for reckless behavior.

SR-22 Insurance and Driving Restrictions

Securing SR-22 insurance in Houston, or any other jurisdiction, significantly impacts driving privileges. It’s not simply a matter of purchasing a policy; it’s a signal to the state that a driver has met specific requirements following a serious driving offense or accident.

The implications extend beyond the financial commitment, directly affecting a driver’s ability to operate a vehicle legally.SR-22 insurance acts as a form of proof of financial responsibility, demonstrating to the state that the driver can cover potential damages or injuries resulting from future accidents.

This mandatory insurance requirement often follows incidents like DUI convictions, multiple traffic violations, or at-fault accidents resulting in significant damage or injury. The presence of SR-22 insurance on a driver’s record directly influences their driving privileges, often entailing specific limitations and restrictions.

Driving Privileges with SR-22 Insurance

Drivers mandated to carry SR-22 insurance generally face limitations on their driving privileges compared to those without such requirements. The duration of these restrictions varies depending on the nature of the offense and state regulations. For instance, a driver convicted of a DUI might face a period of restricted driving, such as limitations on driving time or location, before regaining full driving privileges.

The SR-22 requirement acts as a probationary period, ensuring the driver maintains financial responsibility and demonstrates responsible driving behavior. Failure to maintain continuous SR-22 coverage can lead to license suspension or revocation, further restricting driving privileges. Maintaining compliance is crucial for retaining the ability to legally operate a vehicle.

Comparison of Driving Restrictions

The key difference lies in the level of monitoring and the potential consequences of non-compliance. A driver without SR-22 insurance is subject to standard driving laws and regulations. Violation of traffic laws results in fines or other penalties, but their driving privileges aren’t inherently tied to maintaining a specific insurance policy.

Conversely, a driver with SR-22 insurance faces the added pressure of maintaining continuous coverage. Non-compliance not only results in standard penalties for traffic violations but also carries the significant risk of license suspension or revocation, representing a complete loss of driving privileges.

This added layer of responsibility underscores the seriousness of the offenses that necessitate SR-22 insurance.

Limitations on Drivers with SR-22 Insurance

While the specific limitations vary by state and the nature of the offense, common restrictions associated with SR-22 insurance include limitations on driving time, geographic restrictions (such as limited driving to work or school), and the mandatory use of an ignition interlock device (IID) for DUI convictions.

These limitations are intended to reduce the risk of further incidents and demonstrate a commitment to responsible driving. The duration of these restrictions is determined by the court or the Department of Motor Vehicles (DMV) and is typically tied to the length of the SR-22 requirement.

For example, a driver might be limited to driving only during daylight hours or only within a specific radius of their home for a specified period. Failure to adhere to these restrictions can result in further penalties, including extended license suspension.

Filing a Claim with SR-22 Insurance

Filing a claim with SR-22 insurance in Houston follows a similar process to filing a claim with standard auto insurance, but the specifics might vary depending on your insurer. Understanding the process and having the necessary documentation readily available can expedite the resolution of your claim.

Remember, prompt action is key.The process generally involves reporting the accident to your insurer immediately, providing detailed information about the incident, and cooperating fully with the investigation. Failure to comply with the insurer’s requests could delay or even jeopardize your claim.

Required Documentation for an SR-22 Claim

Providing comprehensive documentation is crucial for a smooth claims process. Incomplete or missing information can lead to delays. It’s advisable to gather all relevant materials before contacting your insurer.

- Police Report:A copy of the official police report documenting the accident, including details of the incident, involved parties, and any citations issued.

- Photographs and Videos:Visual evidence of the accident scene, vehicle damage, and any injuries sustained. Clear images are essential for assessing the extent of the damage.

- Witness Statements:Contact information and written statements from any witnesses to the accident. Their accounts can corroborate your version of events.

- Medical Records:If injuries were sustained, comprehensive medical records detailing the treatment received, diagnoses, and prognosis. This includes bills and receipts.

- Vehicle Repair Estimates:Detailed estimates from reputable repair shops outlining the cost of repairs to your vehicle. Multiple estimates are often beneficial.

- Insurance Information:Your SR-22 insurance policy details and the contact information of your insurer. This includes your policy number and the claims department contact information.

Effective Claim Handling Strategies

Proactive steps can significantly impact the outcome of your SR-22 insurance claim. Clear communication and documentation are paramount.

- Report the Accident Promptly:Contact your insurer immediately after the accident to initiate the claims process. Timely reporting is vital.

- Gather Evidence Thoroughly:Collect all relevant evidence as soon as possible. This includes photographs, witness information, and medical records.

- Maintain Open Communication:Keep in regular contact with your insurer and provide updates as needed. Respond promptly to their requests for information.

- Be Honest and Accurate:Provide accurate and truthful information throughout the claims process. Any discrepancies could negatively impact your claim.

- Follow Up Regularly:If you haven’t heard back from your insurer within a reasonable timeframe, follow up to inquire about the status of your claim.

- Consider Legal Counsel:In complex cases or if you are facing significant challenges, consulting with a personal injury attorney can be beneficial.

Choosing the Right SR-22 Insurance Provider

Securing SR-22 insurance in Houston, while mandatory, doesn’t necessitate settling for the first provider encountered. A strategic approach to selecting an insurer can significantly impact both cost and the overall experience. Careful consideration of several key factors is crucial for finding the best fit.Choosing the right SR-22 insurance provider requires a multi-faceted approach.

Factors such as financial stability, customer service responsiveness, and premium pricing all play significant roles in determining the most suitable insurer. A thorough comparison of various providers is essential before making a commitment.

Provider Financial Stability and Reputation

Assessing a provider’s financial strength is paramount. A financially sound insurer minimizes the risk of claims denials or insolvency, ensuring coverage when needed. This can be evaluated by checking independent rating agencies like A.M. Best, Standard & Poor’s, or Moody’s.

Providers with high ratings demonstrate a greater capacity to meet their obligations. Checking online reviews and testimonials from previous clients also provides valuable insight into the provider’s reputation for fair claims handling and customer service. Look for consistent positive feedback regarding responsiveness and ease of communication.

Comparison of Quotes from Multiple Providers

Obtaining quotes from multiple SR-22 insurance providers is essential for securing the most competitive premium. This comparative analysis allows for a clear understanding of the market rates and identifies potential cost savings. Online comparison tools can streamline this process, but it’s crucial to verify the accuracy of the information provided with each individual provider.

Don’t hesitate to contact providers directly to clarify any uncertainties or to negotiate potential discounts. Remember that the lowest price isn’t always the best indicator; consider the overall value provided in terms of service and financial stability.

Negotiating Insurance Premiums

While SR-22 insurance premiums are generally higher than standard auto insurance, negotiation remains a viable option. Factors like safe driving history, defensive driving course completion, or bundling with other insurance policies can be leveraged to negotiate lower premiums. Clearly articulate your positive driving record and any relevant factors that demonstrate reduced risk.

Explore options such as paying premiums annually instead of monthly to potentially secure a discount. Be prepared to compare offers from different providers to demonstrate your willingness to switch if a more favorable deal isn’t offered. Persistence and clear communication are key to successful negotiation.

The Impact of Driving Record on SR-22 Insurance Rates

Securing SR-22 insurance in Houston, like elsewhere, is contingent upon a clean driving record. However, past infractions significantly impact the cost of this high-risk coverage. Insurers assess risk based on the severity and frequency of past violations, leading to substantial premium variations.

Understanding this correlation is crucial for drivers seeking to minimize their insurance expenses.The severity of a driving violation directly correlates with increased SR-22 insurance premiums. More serious offenses, such as DUI/DWI convictions or multiple accidents, result in considerably higher rates compared to minor infractions like speeding tickets.

The frequency of violations further exacerbates the issue; multiple offenses within a short timeframe signal a higher risk profile to insurers, leading to even steeper premium increases. This risk assessment is reflected in the insurer’s pricing models, which incorporate actuarial data to determine individual risk profiles.

Driving Violation Impact on SR-22 Premiums

The following table illustrates the potential impact of various driving violations on SR-22 insurance premiums in Houston. Note that these are illustrative examples and actual premiums will vary depending on several factors, including the driver’s age, vehicle type, and the specific insurer.

These figures are estimates based on industry averages and should not be considered definitive quotes.

| Violation | Premium Increase Percentage (Estimate) | Example Impact | Notes |

|---|---|---|---|

| Speeding Ticket (Minor) | 5-15% | A base premium of $1,000 could increase to $1,050

|

Impact varies based on speed and location. |

| At-Fault Accident | 20-40% | A base premium of $1,000 could increase to $1,200

|

Increases significantly with injuries or property damage. |

| DUI/DWI | 50-100% or more | A base premium of $1,000 could increase to $1,500

|

Often requires a lengthy period of high premiums. |

| Driving with Suspended License | Significant Increase (Often uninsurable) | May require a substantial period of SR-22 coverage with high premiums. | This can severely impact the ability to obtain insurance. |

Improving Driving Habits to Reduce Insurance Costs

Maintaining a clean driving record is paramount to minimizing SR-22 insurance costs. Proactive measures, such as defensive driving courses, can demonstrate a commitment to safe driving practices and potentially lead to lower premiums over time.

Consistent adherence to traffic laws, including maintaining safe speeds and avoiding risky behaviors, significantly reduces the likelihood of violations. Furthermore, regularly maintaining the vehicle and ensuring its roadworthiness minimizes the risk of accidents. These steps contribute to a lower-risk profile, potentially resulting in more favorable insurance rates.

Summary

Securing and maintaining SR22 insurance in Houston requires diligence and a thorough understanding of the regulations. By carefully considering the factors that influence costs, choosing a reputable provider, and remaining compliant throughout the mandated period, Houston drivers can regain their driving privileges and avoid further complications.

Remember, proactive planning and informed decision-making are key to successfully navigating the SR-22 insurance landscape.