Owning a home is a significant investment, and protecting it with the right insurance is crucial. Finding the best home insurance quotes can feel like navigating a labyrinth, with numerous providers, coverage options, and premiums to consider. This guide will demystify the process, empowering you to make informed decisions and secure the optimal protection for your property.

We’ll explore the fundamentals of home insurance, delve into the factors that influence premiums, and guide you through the process of obtaining quotes from reputable providers. From understanding the key elements of a quote to negotiating coverage and making claims, this comprehensive guide will equip you with the knowledge and tools to secure the best possible home insurance for your needs.

Understanding Home Insurance

Home insurance is a crucial financial safety net that protects your most valuable asset: your home. It provides financial compensation for losses incurred due to unforeseen events, such as fire, theft, or natural disasters. By having home insurance, you can safeguard your financial well-being and peace of mind, knowing that you have a plan in place to rebuild your life should the unexpected happen.

Common Types of Home Insurance Coverage

Home insurance policies typically include various coverage options to address different aspects of your home and belongings. Understanding these coverage types helps you determine the appropriate level of protection for your specific needs.

- Dwelling Coverage: This is the most essential part of home insurance, providing financial protection for the physical structure of your home, including the walls, roof, plumbing, electrical systems, and other attached structures. It covers damages caused by covered perils such as fire, windstorms, hail, and vandalism.

- Liability Coverage: This coverage protects you from financial responsibility if someone is injured on your property or if you accidentally damage someone else’s property. For example, if a visitor slips and falls on your icy driveway, liability coverage would help cover their medical expenses and legal fees.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. It reimburses you for the cost of replacing or repairing these items if they are damaged or stolen.

Factors Influencing Home Insurance Premiums

The cost of your home insurance premium is determined by several factors. Understanding these factors can help you make informed decisions and potentially reduce your premium.

- Location: Home insurance premiums are often higher in areas prone to natural disasters, such as earthquakes, hurricanes, or wildfires. The likelihood of these events occurring in your area directly impacts your risk profile and, consequently, your premium.

- Age of Home: Older homes are generally considered riskier than newer homes due to potential issues with aging infrastructure and building materials. Therefore, premiums for older homes may be higher than for newer homes.

- Coverage Amount: The amount of coverage you choose for your home and belongings directly impacts your premium. Higher coverage amounts mean higher premiums. It’s crucial to select coverage levels that adequately protect your assets without exceeding your budget.

Finding the Right Insurance Provider

Selecting the right home insurance provider is crucial to ensuring you have adequate coverage in case of unforeseen events. A thorough understanding of the various providers, their offerings, and customer feedback is essential for making an informed decision.

Reputable Home Insurance Providers

A multitude of insurance providers cater to the home insurance market, each with its unique offerings and strengths. Some of the well-regarded providers include:

- State Farm: Known for its extensive network of agents, competitive rates, and comprehensive coverage options.

- Allstate: Offers a wide range of coverage options, including specialized policies for unique homes, and has a strong reputation for customer service.

- Liberty Mutual: Provides competitive rates and comprehensive coverage, and is particularly known for its focus on customer satisfaction.

- Farmers Insurance: Offers a variety of insurance products, including home, auto, and life insurance, and has a strong network of agents across the country.

- USAA: Primarily serves military personnel and their families, offering competitive rates and excellent customer service.

Comparing Features and Benefits

It’s essential to compare the features and benefits offered by different providers to find the best fit for your needs. Some key factors to consider include:

- Coverage options: Different providers offer varying levels of coverage for different perils, such as fire, theft, and natural disasters.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles generally lead to lower premiums.

- Premiums: The premium is the amount you pay for your insurance policy. Factors such as your home’s value, location, and coverage options can influence your premium.

- Discounts: Many providers offer discounts for various factors, such as safety features, multiple policy bundling, and good driving records.

- Customer service: It’s crucial to consider the provider’s reputation for customer service, including their responsiveness, helpfulness, and ease of filing claims.

Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into a provider’s performance and customer satisfaction. Reputable sources for gathering this information include:

- J.D. Power: A leading provider of consumer insights and ratings for various industries, including insurance.

- Consumer Reports: An independent organization that conducts rigorous testing and provides unbiased reviews of products and services.

- The Better Business Bureau (BBB): An organization that accredits businesses and provides consumer reviews and ratings.

Obtaining Home Insurance Quotes

Securing home insurance quotes is a crucial step in protecting your biggest investment. This process involves gathering necessary information, exploring various providers, and comparing quotes to find the best fit for your needs and budget.

Gathering Necessary Information

Before seeking quotes, gather essential details about your property and coverage requirements. This information helps insurers accurately assess your risk and provide tailored quotes.

- Property Details: This includes your address, square footage, year built, type of construction, and any renovations or additions.

- Coverage Needs: Consider the level of coverage you require, such as dwelling coverage, personal property coverage, liability coverage, and optional add-ons like flood insurance or earthquake insurance.

- Personal Information: You will need to provide your name, contact information, and any relevant insurance history, such as previous claims.

Using Comparison Websites

Comparison websites are valuable tools for streamlining the quote-gathering process. They allow you to enter your information once and receive quotes from multiple insurers simultaneously.

- Time-Saving: Comparison websites eliminate the need to contact each insurer individually, saving you time and effort.

- Competitive Quotes: By comparing quotes from different providers, you can identify the most competitive rates and coverage options.

- Transparency: These websites typically display the key features and limitations of each policy, promoting transparency and informed decision-making.

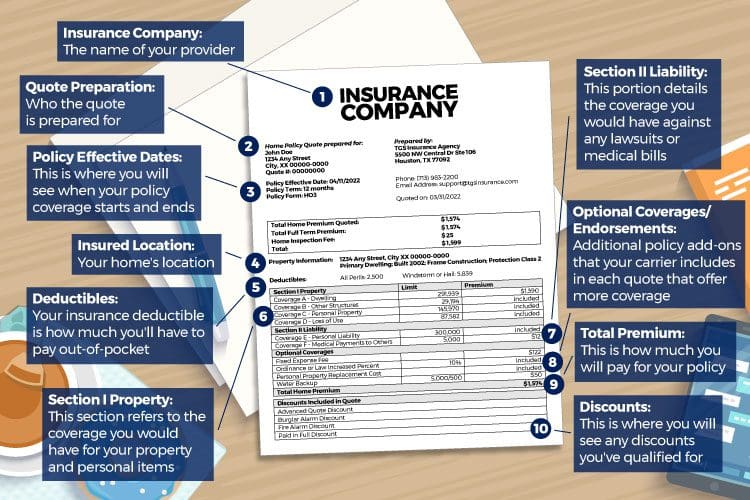

Understanding Quote Components

A home insurance quote provides a breakdown of the estimated cost of your insurance policy. Understanding the key components of a quote will help you compare different policies and make informed decisions.

Premium

The premium is the amount you pay to your insurer for coverage. The premium is determined by a variety of factors, including your home’s value, location, coverage options, and your risk profile.

The premium is the price you pay for your insurance coverage.

Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible leads to a higher premium.

The deductible is the amount you pay before your insurance covers the rest.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for a covered loss. The coverage limits for different types of losses, such as damage to your home’s structure or personal property, can vary significantly.

Coverage limits set the maximum your insurer will pay for a covered loss.

Coverage Options

The cost of your insurance policy can be influenced by the coverage options you choose. For example, you can choose to include coverage for specific perils, such as earthquakes or floods, which will increase your premium.

Coverage options, like earthquake or flood coverage, affect your premium.

Reviewing the Policy Details

It’s crucial to carefully review the details of your policy before purchasing it. Ensure you understand the coverage limits, deductibles, exclusions, and other terms and conditions.

Thoroughly review your policy before purchasing it.

Negotiating and Choosing Coverage

You’ve compared quotes and understand the different components, but before you commit, remember that negotiating and choosing the right coverage is crucial to securing the best possible home insurance policy.

Negotiating with Insurance Providers

Negotiating with insurance providers can help you secure a better rate or more comprehensive coverage. Here are some tips:

- Shop around: Get quotes from multiple insurance providers and compare their rates and coverage options. This will give you a better understanding of the market and help you identify the best deals.

- Bundle your policies: Combining your home and auto insurance with the same provider can often result in discounts. Ask about bundling options and see if it’s a cost-effective choice for you.

- Increase your deductible: A higher deductible means you pay more out of pocket in case of a claim, but it can also lead to lower premiums. Carefully consider your financial situation and risk tolerance when deciding on a deductible.

- Ask about discounts: Many insurance providers offer discounts for various factors, such as safety features, security systems, and good driving records. Inquire about all applicable discounts and see if you qualify.

- Be prepared to walk away: Don’t feel pressured to accept the first offer you receive. If you’re not satisfied with the terms, be prepared to walk away and explore other options.

Choosing the Right Level of Coverage

Choosing the right level of coverage is essential to ensure you’re adequately protected in case of a covered loss.

- Consider your home’s value: The coverage amount should be sufficient to rebuild or repair your home in case of damage or destruction. Over-insuring can be wasteful, but under-insuring could leave you with a significant financial burden in case of a major event.

- Evaluate your personal property: Determine the value of your belongings, including furniture, electronics, jewelry, and other valuable items. Consider adding additional coverage for specific items, such as expensive jewelry or artwork.

- Assess your liability risks: Liability coverage protects you against claims from others who are injured on your property. Consider your lifestyle and the potential for accidents when determining the appropriate level of liability coverage.

- Think about potential natural disasters: If you live in an area prone to earthquakes, floods, or other natural disasters, you may need additional coverage to protect your home and belongings.

Understanding Your Insurance Policy

Once you’ve chosen a policy, it’s crucial to understand its terms and conditions.

- Read the policy carefully: Familiarize yourself with the coverage limits, deductibles, exclusions, and other important provisions. Pay close attention to any limitations or restrictions on coverage.

- Ask questions: If you’re unsure about anything, don’t hesitate to contact your insurance provider for clarification. It’s better to be safe than sorry.

- Keep your policy updated: Make sure to update your policy if you make significant changes to your home, such as renovations or additions. You may also need to update your policy if you acquire new valuable items or experience a change in your risk profile.

Making a Claim

The process of filing a home insurance claim can be daunting, but understanding the steps involved can help you navigate it smoothly. It’s crucial to act quickly and efficiently to ensure a timely and successful resolution.

Documentation is Key

Thorough documentation of the damage and losses is essential for a successful claim. This documentation serves as evidence for the insurance company and helps to expedite the claims process.

- Take photographs and videos of the damaged property from various angles, capturing the extent of the damage. Include close-up shots of any specific details, such as cracks, water damage, or broken items.

- Create a detailed inventory of all damaged or lost items, including their purchase date, price, and any receipts or warranties. This helps the insurance company assess the value of your losses.

- Keep all communication with the insurance company, including emails, phone calls, and letters, in a secure location. This documentation will be valuable in case of any disputes or disagreements.

Navigating the Claims Process

Once you have documented the damage, follow these steps to initiate and manage the claims process:

- Contact your insurance company as soon as possible after the incident. Report the damage and provide them with the necessary details, such as the date, time, and location of the event.

- Follow the instructions provided by your insurance company. They will likely ask you to file a claim online or by phone, and may require you to submit additional documentation, such as police reports or contractor estimates.

- Be patient and persistent. The claims process can take time, especially for major events. Stay in contact with your insurance company to follow up on the progress of your claim.

- Consider hiring a public adjuster if you are having difficulty navigating the claims process or if you feel the insurance company is not offering a fair settlement. Public adjusters are licensed professionals who specialize in helping homeowners with insurance claims.

Maintaining Coverage

Your home insurance policy is a crucial financial safety net, safeguarding your most valuable asset. However, as your life and circumstances change, so too should your insurance coverage. Regularly reviewing and updating your policy ensures that it continues to provide the right level of protection.

Reviewing Your Policy Regularly

Regularly reviewing your home insurance policy is essential for ensuring that it remains adequate. Over time, your needs and circumstances may change, impacting the level of coverage required. A thorough review helps identify any gaps in coverage and ensures that your policy aligns with your current situation.

- Changes in Home Value: The value of your home can fluctuate due to market conditions, renovations, or additions. A reassessment of your home’s value is crucial to determine if your current coverage is sufficient.

- Personal Property Value: Your belongings, including furniture, electronics, and valuables, may increase in value over time. Adjusting your coverage limits to reflect these changes is essential.

- Changes in Risk Factors: Factors such as the addition of a pool, the installation of a security system, or a change in occupancy can impact your insurance premiums and coverage. Inform your insurer about these changes to ensure your policy remains accurate.

- New Laws or Regulations: Changes in building codes, environmental regulations, or insurance laws can affect your policy’s coverage. Staying informed about these updates is vital.

Making Coverage Adjustments

As your needs evolve, adjusting your home insurance coverage is essential. You may need to increase or decrease coverage limits, add or remove specific perils, or modify deductibles.

- Increasing Coverage: If your home’s value increases, you may need to increase your dwelling coverage to ensure adequate protection in case of damage or loss. Similarly, if you acquire new valuables, you may need to adjust your personal property coverage.

- Decreasing Coverage: If your home’s value decreases or you sell some of your belongings, you may be able to reduce your coverage and potentially lower your premiums.

- Adding or Removing Coverage: Specific perils, such as earthquakes or floods, may require additional coverage. Alternatively, if you no longer need certain coverage, you can remove it to reduce your premiums.

- Modifying Deductibles: Increasing your deductible can lower your premiums. However, it also means you will be responsible for a larger portion of the cost if you make a claim. Carefully consider your risk tolerance and financial capacity before making this adjustment.

Maintaining Adequate Protection

Staying proactive about your home insurance coverage is crucial for maintaining adequate protection.

- Review your policy annually. Even if no significant changes have occurred, a yearly review helps ensure your policy remains relevant and covers your current needs.

- Consider bundling your policies. Bundling your home and auto insurance with the same insurer can often result in significant discounts.

- Shop around for better rates. Don’t be afraid to compare quotes from different insurers to ensure you are getting the best value for your coverage.

- Invest in home safety measures. Installing security systems, smoke detectors, and fire extinguishers can lower your premiums and reduce the risk of damage or loss.

Illustrating Home Insurance Coverage

Understanding the different types of coverage offered by home insurance is crucial for ensuring adequate protection for your property and financial well-being. Home insurance policies typically include a range of coverages designed to address various risks associated with your home and belongings.

Comparing Home Insurance Coverage Options

Home insurance policies typically offer a variety of coverage options, each designed to protect specific aspects of your home and belongings. Understanding these coverage options is essential for ensuring you have adequate protection. Here is a comparison of common home insurance coverage options:

| Coverage Option | Description | Coverage Limits | Examples of Covered Events |

|---|---|---|---|

| Dwelling Coverage | Protects the physical structure of your home, including the attached structures, against damage from covered perils. | Typically expressed as a percentage of the dwelling’s replacement cost value (RCV), which is the cost to rebuild your home at current market prices. | Fire, lightning, windstorm, hail, vandalism, theft, and other perils specified in the policy. |

| Liability Coverage | Protects you from financial liability for injuries or property damage caused to others on your property. | Typically expressed as a dollar amount, such as $100,000 or $300,000. | A visitor slips and falls on your icy driveway, a tree falls on your neighbor’s car, or your dog bites a guest. |

| Personal Property Coverage | Protects your personal belongings, such as furniture, clothing, electronics, and jewelry, against damage or loss from covered perils. | Typically expressed as a percentage of the dwelling coverage, with separate limits for specific items like jewelry or fine art. | Fire, theft, vandalism, and other perils specified in the policy. |

Illustrating Home Insurance Scenarios

Understanding the different scenarios that can arise when dealing with home insurance is crucial for making informed decisions about your coverage. This section explores several common situations and the potential outcomes, highlighting the importance of carefully considering your specific needs and circumstances when choosing a policy.

Home Insurance Scenarios and Potential Outcomes

To understand the practical implications of home insurance, consider these scenarios:

| Scenario | Type of Claim | Potential Coverage Amount |

|---|---|---|

| A fire damages your kitchen, requiring extensive repairs and replacement of appliances. | Fire Damage | The policy’s coverage limit for fire damage, minus any deductible. |

| A tree falls on your roof during a storm, causing significant structural damage. | Windstorm Damage | The policy’s coverage limit for windstorm damage, minus any deductible. |

| A pipe bursts in your basement, leading to water damage and mold growth. | Water Damage | The policy’s coverage limit for water damage, minus any deductible. |

| A thief breaks into your home and steals valuable belongings, including jewelry and electronics. | Theft | The policy’s coverage limit for theft, minus any deductible, subject to specific limits on certain items. |

| You accidentally slip and fall on your property, causing a serious injury. | Liability Claim | The policy’s coverage limit for liability claims, minus any deductible, subject to the terms of the policy. |

It’s important to remember that these are just a few examples, and the specific coverage provided by a home insurance policy can vary widely. Carefully review your policy documents to understand the limits and exclusions of your coverage.

Illustrating the Importance of Home Insurance

Home insurance is a crucial financial safety net, protecting homeowners from devastating financial losses in the event of unforeseen circumstances. It provides financial compensation for damages to your property and possessions, helping you rebuild your life after a disaster. While the cost of home insurance may seem like an unnecessary expense, the potential financial consequences of not having it can be far more significant.

The Financial Impact of Not Having Home Insurance

The lack of home insurance can expose you to substantial financial risks, potentially leaving you with significant out-of-pocket expenses to cover repairs or replacement costs. Here’s a table highlighting the potential financial consequences of not having home insurance:

| Event | Estimated Cost of Repair or Replacement | Potential Financial Impact Without Insurance |

|---|---|---|

| Fire | $100,000 – $500,000+ | Total loss of home and belongings, potentially leading to bankruptcy. |

| Natural Disaster (Hurricane, Tornado, Flood) | $50,000 – $1,000,000+ | Significant financial burden to rebuild or replace damaged property. |

| Theft | $5,000 – $50,000+ | Loss of valuable possessions, including electronics, jewelry, and furniture. |

| Liability Claim (e.g., someone injured on your property) | $10,000 – $1,000,000+ | Potentially substantial legal fees and medical expenses. |

Last Recap

Finding the right home insurance is a critical step in protecting your most valuable asset. By understanding the fundamentals of coverage, comparing quotes from reputable providers, and negotiating effectively, you can secure the peace of mind that comes with knowing your home is adequately protected. Remember, this is not a one-time process. Regularly reviewing your policy and making adjustments as needed ensures your coverage remains aligned with your evolving needs and circumstances.