For high-net-worth individuals, a $5 million life insurance policy isn’t just about financial protection; it’s a sophisticated tool for estate planning, wealth preservation, and legacy building. This comprehensive guide navigates the complexities of securing such substantial coverage, exploring policy types, eligibility requirements, cost considerations, and the strategic implications for long-term financial well-being.

From understanding the nuances of term versus whole life insurance to navigating the intricacies of underwriting and beneficiary designations, we’ll delve into the crucial aspects of obtaining and managing a $5 million life insurance policy. We’ll also examine the interplay between life insurance and other high-value financial instruments, providing readers with the knowledge to make informed decisions aligned with their unique circumstances.

Policy Types and Features

Securing a $5 million life insurance policy necessitates a thorough understanding of the available options and their associated features. The choice between term life, whole life, and universal life insurance significantly impacts both premiums and the overall benefits received. This analysis will compare these three policy types, outlining their key differences and typical riders, along with premium considerations at this substantial coverage level.

Term Life Insurance with a $5 Million Death Benefit

Term life insurance provides coverage for a specified period (term), typically ranging from 10 to 30 years. Upon policy expiration, coverage ceases unless renewed, often at a higher premium. A $5 million term life policy offers substantial death benefit protection at a relatively lower premium compared to permanent life insurance options. However, this lower cost comes with the understanding that the coverage is temporary. The suitability of a term policy depends heavily on the insured’s long-term financial goals and risk tolerance. For example, a young family might prioritize affordable coverage for a set period, aligning with their mortgage or children’s education expenses. Conversely, an individual with significant long-term wealth transfer needs would likely find a term policy insufficient.

Whole Life Insurance with a $5 Million Death Benefit

Whole life insurance provides lifelong coverage, offering a guaranteed death benefit and a cash value component that grows tax-deferred. The cash value accumulates over time, offering potential access to funds through loans or withdrawals. A $5 million whole life policy represents a significant financial commitment, with substantially higher premiums than term life insurance. The premiums remain level throughout the insured’s lifetime. The cash value component provides an element of long-term savings, but the growth rate is typically modest. A high-net-worth individual seeking both lifetime coverage and a tax-advantaged savings vehicle might consider this option, potentially using the cash value for retirement planning or estate preservation.

Universal Life Insurance with a $5 Million Death Benefit

Universal life insurance combines the flexibility of adjustable premiums and death benefits with lifetime coverage. Policyholders can adjust their premium payments within certain limits, and the death benefit can often be increased or decreased. This flexibility makes it attractive to those with fluctuating income or changing financial needs. A $5 million universal life policy offers a balance between affordability and lifetime protection, though the premiums are generally higher than term life insurance but potentially lower than whole life, depending on the chosen premium payment strategy and the underlying investment performance (if the policy includes a cash value component with investment options). This type of policy allows for greater customization than whole life, making it suitable for individuals seeking a balance between protection and financial planning flexibility.

Riders for a $5 Million Life Insurance Policy

Several riders can enhance a $5 million life insurance policy, but they come at an additional cost. These riders typically include accelerated death benefits (allowing access to a portion of the death benefit while still alive for specified critical illnesses), long-term care riders (providing coverage for long-term care expenses), and waiver of premium riders (waiving future premiums if the insured becomes disabled). The cost of these riders varies depending on the insurer and the specific terms of the rider. For example, a long-term care rider on a $5 million policy could significantly increase the annual premium, adding thousands of dollars annually. The specific cost depends on factors such as the insured’s age, health, and the extent of coverage provided by the rider.

Premium Payments for a $5 Million Life Insurance Policy

Premium payments for a $5 million policy vary dramatically across policy types. Term life insurance typically has the lowest premiums, reflecting its temporary nature. Whole life insurance commands the highest premiums due to its lifelong coverage and cash value accumulation. Universal life insurance premiums fall somewhere in between, offering more flexibility but generally higher premiums than term life. The actual premium amount will depend on factors such as the insured’s age, health, smoking status, and the specific policy features selected. A 40-year-old healthy non-smoker might pay significantly less than a 60-year-old smoker with pre-existing health conditions, even with the same policy type and death benefit. Illustrative examples would need to be obtained from individual insurance providers, as rates are not standardized.

Eligibility and Underwriting

Securing a $5 million life insurance policy necessitates a rigorous underwriting process designed to assess the applicant’s risk profile. This process involves a comprehensive evaluation of various factors to determine eligibility and establish appropriate premium rates. The higher the coverage amount, the more stringent the scrutiny.

The underwriting process for a $5 million policy typically involves a multi-stage evaluation, starting with an application form detailing personal information, health history, lifestyle, and financial details. This initial assessment triggers further investigations to validate the provided information and delve deeper into the applicant’s risk factors.

Medical Examinations and Financial Documentation

Applicants for a $5 million life insurance policy will almost certainly undergo a comprehensive medical examination. This goes beyond a simple blood pressure check and often includes extensive blood work, electrocardiograms (ECGs), and potentially other specialized tests depending on the applicant’s age, health history, and declared activities. The purpose is to identify any pre-existing conditions or potential health risks that could impact longevity and, consequently, the insurer’s payout. Simultaneously, extensive financial documentation will be required to verify the applicant’s income, assets, and net worth. This is crucial for the insurer to assess the applicant’s ability to maintain premium payments over the policy’s duration and to mitigate the risk of fraud. Documentation might include tax returns, bank statements, investment portfolio details, and proof of income from employment or other sources.

Factors Influencing Premium Rates

Several factors significantly influence the premium rates for a $5 million life insurance policy. Age is a primary determinant; older applicants generally face higher premiums due to increased mortality risk. Health history plays a crucial role; pre-existing conditions like heart disease, diabetes, or cancer can lead to significantly higher premiums or even policy rejection. Lifestyle choices, such as smoking, excessive alcohol consumption, or participation in high-risk activities, also contribute to premium calculations. Occupation is another key factor; applicants in high-risk professions (e.g., firefighters, police officers) may face higher premiums due to increased risk of injury or death. Finally, the type of policy chosen (e.g., term life, whole life, universal life) significantly impacts the premium. A whole life policy, for instance, will typically have higher premiums than a term life policy of the same coverage amount due to the added cash value component. For example, a 40-year-old non-smoker in excellent health applying for a $5 million term life insurance policy might receive a significantly lower premium than a 60-year-old smoker with a history of heart problems applying for the same coverage. The difference could be substantial, potentially reaching several thousands of dollars annually.

Cost and Affordability

Securing a $5 million life insurance policy represents a significant financial commitment. Understanding the associated costs and exploring strategies for affordability is crucial for high-net-worth individuals seeking comprehensive coverage. This section details premium structures, budgeting considerations, and methods to manage the expense of such a substantial policy.

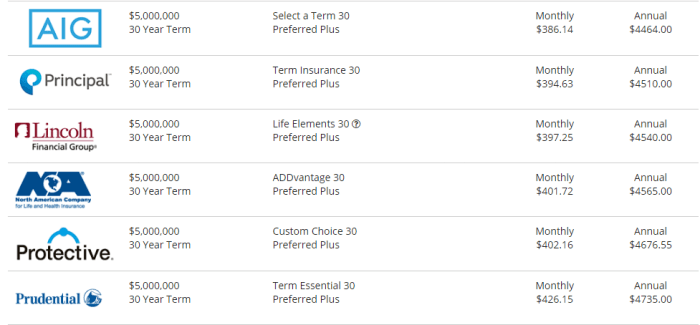

Annual Premiums Across Demographics

The cost of a $5 million life insurance policy varies significantly based on age, health status, and the type of policy chosen. Term life insurance generally offers lower premiums than permanent options like whole life insurance, but provides coverage for a specified period only. Health status plays a critical role; individuals with pre-existing conditions or higher risk profiles will typically face higher premiums.

| Age Range | Health Status | Premium Type | Annual Premium (USD) |

|---|---|---|---|

| 35-40 | Excellent | 20-Year Term | $5,000 – $7,000 |

| 35-40 | Excellent | Whole Life | $25,000 – $40,000 |

| 45-50 | Good | 20-Year Term | $8,000 – $12,000 |

| 45-50 | Good | Whole Life | $35,000 – $55,000 |

| 55-60 | Average | 10-Year Term | $15,000 – $25,000 |

| 55-60 | Average | Universal Life | $40,000 – $70,000 |

*Note: These figures are illustrative and based on hypothetical market conditions. Actual premiums will vary depending on the insurer, specific policy features, and individual risk assessment.*

Incorporating Life Insurance Costs into a High-Net-Worth Financial Plan

A high-net-worth individual might allocate a portion of their investment portfolio specifically to cover life insurance premiums. For example, a hypothetical individual with a $20 million investment portfolio might comfortably allocate 0.5% to 1% annually ($100,000 – $200,000) to cover the premium for a $5 million policy. This allocation would likely be a small percentage of their overall investment returns and could be further adjusted based on investment performance and personal financial goals. This approach ensures the premiums are accounted for without significantly impacting other investment strategies or lifestyle choices.

Strategies for Enhancing Affordability

Several strategies can make a $5 million life insurance policy more manageable. These include:

Choosing a term life insurance policy instead of a whole life policy to lower premiums. Consider increasing the coverage amount gradually over time as financial resources allow, instead of purchasing a $5 million policy immediately. Exploring options with different insurers to compare pricing and policy features is crucial. Finally, maintaining a healthy lifestyle can lead to lower premiums through favorable risk assessments.

Beneficiary Designation and Estate Planning

A $5 million life insurance policy presents significant estate planning opportunities, but also potential tax complexities. Careful beneficiary designation is crucial to minimize estate taxes and ensure the intended distribution of funds. This section Artikels a strategic approach to beneficiary selection and highlights the legal and tax ramifications of various choices.

Beneficiary Designation Strategies for Minimizing Estate Taxes

Strategic beneficiary designation is paramount for minimizing estate tax liabilities associated with a large life insurance policy. The goal is to transfer the death benefit outside of the estate, thereby avoiding inclusion in the taxable estate. This can be achieved through several methods, each with its own implications.

- Direct Beneficiary Designation: Naming individual beneficiaries directly avoids probate and keeps the death benefit out of the estate. This is the simplest and often most effective method for smaller policies. However, for a $5 million policy, careful consideration of potential tax implications for the beneficiaries and estate is necessary.

- Trusts as Beneficiaries: Using an irrevocable life insurance trust (ILIT) is a sophisticated strategy often employed for high-value policies. An ILIT holds the policy, and the death benefit is paid to the trust, not the estate. This effectively removes the policy’s value from the taxable estate. Careful planning and legal counsel are essential to establish and manage an ILIT.

- Combination Approach: A blend of direct beneficiaries and trusts can be used to tailor the distribution to specific needs and tax circumstances. For instance, smaller amounts might be paid directly to family members, while a significant portion could flow through an ILIT.

Legal and Tax Implications of Different Beneficiary Designations

The choice of beneficiary significantly impacts both the legal and tax ramifications of the policy. Incorrect designation can lead to protracted legal battles, unintended tax consequences, and delays in distributing the funds.

- Per Stirpes vs. Per Capita: These terms determine how the benefit is distributed among beneficiaries if one predeceases the insured. “Per stirpes” divides the benefit among the deceased beneficiary’s descendants, while “per capita” distributes it equally among surviving beneficiaries. The choice impacts how the funds are allocated and could lead to unexpected outcomes.

- Estate Tax Implications: As previously mentioned, designating the estate as the beneficiary includes the policy’s death benefit in the taxable estate, potentially incurring significant estate taxes. Conversely, using an ILIT or directly naming beneficiaries keeps the proceeds out of the estate, avoiding these taxes.

- Income Tax Implications: The beneficiary’s tax bracket will determine their income tax liability on any interest earned on the death benefit if it is not immediately withdrawn. Furthermore, specific tax rules apply to life insurance proceeds, and professional tax advice is highly recommended.

Importance of Periodic Review and Updating of Beneficiary Designations

Life circumstances change. Marriages, divorces, births, deaths, and changes in financial situations necessitate regular review and updates to beneficiary designations. Failing to do so can result in unintended consequences, including the distribution of funds to individuals no longer appropriate or desired.

Regular review, at least annually or following significant life events, is crucial to ensure the policy aligns with current wishes and minimizes potential legal or tax complications.

Investment Options (if applicable)

Securing a $5 million life insurance policy often involves options beyond simple death benefit coverage. Many high-value policies incorporate investment components, allowing policyholders to accumulate cash value that grows over time. Understanding these investment features is crucial for maximizing the policy’s overall value and aligning it with long-term financial goals. The specific investment options vary significantly depending on the type of policy (e.g., whole life, universal life, variable universal life).

High-value life insurance policies frequently offer cash value accumulation as a core feature. This cash value grows tax-deferred, meaning that you do not pay taxes on the gains until you withdraw them. The growth rate, however, depends on the underlying investment vehicles chosen within the policy, which can range from relatively conservative fixed-income options to more aggressive equity-based investments. Policyholders should carefully consider their risk tolerance and financial objectives when selecting these investment options.

Cash Value Growth and Death Benefit

Investment growth within a cash value life insurance policy directly impacts the overall death benefit. For instance, in a whole life policy with a guaranteed minimum death benefit of $5 million, consistent positive investment returns can lead to a significantly higher death benefit. This increase is often reflected in a higher cash surrender value, which is the amount you would receive if you surrender the policy. Conversely, poor investment performance may result in a death benefit closer to the guaranteed minimum. Consider a hypothetical scenario: A policyholder invests in a variable universal life (VUL) policy with a $5 million death benefit. Over 20 years, consistent annual returns of 7% would substantially increase the cash value and potentially boost the overall death benefit depending on the policy’s terms. Conversely, if returns average 2%, the cash value growth will be significantly less pronounced.

Tax Implications of Cash Value Withdrawals and Loans

Tax implications associated with accessing the cash value are complex and depend on the method of access and the type of policy. Withdrawals from the cash value are generally considered taxable income to the extent that the withdrawal exceeds the policy’s cost basis (premiums paid). Loans against the cash value, however, are not taxed as income. However, interest accrued on the loan must be paid, and failure to repay the loan could result in tax implications and the policy lapsing. For example, if a policyholder borrows $100,000 against their cash value and fails to repay it, the IRS may consider this a taxable distribution, impacting the policy’s death benefit. Proper financial planning and careful consideration of tax implications are essential when utilizing cash value access options.

Policy Surrender and Cash Value

Surrendering a $5 million life insurance policy is a significant financial decision with potentially substantial tax implications and a considerable impact on future financial planning. Understanding the process and the factors influencing cash value is crucial before making such a move. This section details the mechanics of surrender and explores scenarios where surrender might be a strategically sound financial maneuver.

Policy Surrender Procedures and Financial Consequences

Surrendering a life insurance policy involves formally requesting the issuing insurance company to terminate the contract. The insurer will then pay out the policy’s cash value, less any outstanding loans or surrender charges. These charges, often expressed as a percentage of the cash value, are designed to compensate the insurer for the loss of future premiums and the administrative costs associated with managing the policy. The amount received will be considerably less than the $5 million death benefit, especially in the early years of the policy. Furthermore, any accumulated gains within the policy’s cash value may be subject to income tax, depending on the type of policy and the specific circumstances. For example, if the policy was a whole life policy with cash value growth exceeding the premiums paid, the excess would be considered taxable income upon surrender. A financial advisor should be consulted to navigate the tax implications specific to your policy and financial situation.

Cash Value Accumulation

Several factors influence a life insurance policy’s cash value accumulation over time. The primary driver is the policy’s type. Whole life policies, for instance, build cash value steadily through premium payments and investment earnings, generally at a slower rate than some variable options. Universal life and variable universal life policies offer more flexibility, allowing for varying premium payments and potentially higher returns but also exposing the policyholder to greater investment risk. Interest rates play a crucial role; higher interest rates generally lead to faster cash value growth. The insurer’s investment performance, especially for policies with variable investment options, significantly impacts the rate of cash value accumulation. Finally, the policy’s mortality charges (fees that cover the risk the insurer takes) and administrative fees also impact the net cash value growth. A $5 million policy, with its higher premiums, will generally accumulate cash value more rapidly than a smaller policy, all else being equal.

Scenarios Justifying Policy Surrender

Surrendering a $5 million life insurance policy should not be taken lightly. However, certain financial circumstances may justify this action. For example, a sudden and significant unexpected health event, requiring extensive and costly medical treatment, might necessitate liquidating the policy’s cash value to cover medical expenses and maintain living standards. Similarly, a substantial and unexpected financial hardship, such as a job loss coupled with significant debt, might necessitate the release of the policy’s cash value for immediate financial relief. Another example could be a significant change in family circumstances, such as the children becoming financially independent, reducing the need for a large death benefit. In these cases, the immediate financial benefit from surrendering the policy might outweigh the long-term benefits of maintaining it. It’s crucial to note that these decisions should always be made in consultation with a qualified financial advisor who can assess the full financial implications and suggest alternative strategies if possible.

Insurance Agent Selection and Due Diligence

Securing a $5 million life insurance policy necessitates meticulous attention to detail, and the selection of a qualified and trustworthy insurance agent is paramount. The agent’s expertise will significantly influence the policy’s suitability, cost-effectiveness, and overall value. A poorly chosen agent can lead to inadequate coverage, unnecessary expenses, or even a completely unsuitable policy. Therefore, a thorough due diligence process is crucial.

Choosing the right insurance agent for a high-value policy involves more than simply finding someone who offers a low initial premium. It requires a comprehensive assessment of their expertise, experience, and ethical practices. The long-term implications of this decision far outweigh the time investment required for careful selection.

Agent Qualification and Experience Checklist

Selecting an agent requires a methodical approach. A simple checklist can help ensure all necessary aspects are considered. This process minimizes the risk of choosing an unqualified or unethical professional.

- Licensing and Credentials: Verify the agent’s state insurance license and any relevant professional designations (e.g., Chartered Life Underwriter (CLU), Chartered Financial Consultant (ChFC)). Confirm their license is active and in good standing through the state’s insurance department website.

- Experience with High-Value Policies: Inquire about their experience handling policies of comparable value. Seek references from past clients with similar insurance needs.

- Specialization: Determine if the agent specializes in life insurance, particularly high-net-worth individuals. A specialist will possess a deeper understanding of complex policies and estate planning strategies.

- Carrier Relationships: Understand which insurance carriers the agent represents. A diverse range of options provides greater flexibility in finding the best policy for individual needs.

- Client References: Request references from at least three previous clients with similar policy sizes and financial situations. Contact these references to gauge the agent’s responsiveness, expertise, and ethical conduct.

Comparing Quotes and Policy Terms

Obtaining quotes from multiple insurance providers is essential for securing the most competitive terms and coverage. Direct comparison allows for a thorough assessment of policy features, premiums, and overall value. Avoid focusing solely on the lowest premium; instead, prioritize the policy’s long-term value and suitability for individual needs.

- Policy Features: Compare the benefits, riders, and exclusions offered by different policies. Consider factors such as death benefits, cash value accumulation, and policy loan options.

- Premium Costs: Analyze the premium structure, including any potential increases over time. Consider the impact of various payment options, such as annual, semi-annual, or quarterly payments.

- Carrier Ratings: Evaluate the financial strength and stability of the insurance companies offering the quotes. Use independent rating agencies (e.g., A.M. Best, Moody’s, Standard & Poor’s) to assess the insurer’s financial health.

Verifying Agent Credentials and Reputation

Thorough verification of an agent’s credentials and reputation is crucial to mitigate potential risks. This involves going beyond the information provided by the agent and conducting independent research.

- State Insurance Department Website: Check the state’s insurance department website for licensing information, disciplinary actions, and complaints filed against the agent.

- Online Reviews and Testimonials: Review online platforms such as Yelp, Google Reviews, and independent financial advisor review sites to assess the agent’s reputation and client experiences.

- Professional Associations: Check if the agent is a member of any reputable professional organizations, such as the National Association of Insurance and Financial Advisors (NAIFA) or the Million Dollar Round Table (MDRT). Membership in these organizations often signifies a commitment to professional standards and ethics.

- Background Checks: While not always necessary, conducting a background check on the agent, especially for high-value policies, can provide additional peace of mind.

Tax Implications and Estate Planning Strategies

A $5 million life insurance policy significantly impacts estate planning, offering both tax advantages and potential disadvantages depending on policy type and overall financial strategy. Understanding these implications is crucial for high-net-worth individuals seeking to minimize estate taxes and ensure a smooth transfer of wealth to beneficiaries. Proper planning can leverage the policy’s death benefit to offset estate taxes, potentially saving millions for heirs.

Estate Tax Mitigation

Life insurance proceeds paid to named beneficiaries are generally excluded from the deceased’s taxable estate. This exclusion can be particularly beneficial for estates exceeding the federal estate tax exemption, currently set at $12.92 million per individual ($25.84 million for married couples) in 2023. For example, a $5 million policy could significantly reduce or eliminate estate taxes owed on a larger estate, leaving a greater inheritance for the beneficiaries. This strategy is especially relevant in states with their own estate taxes, which can further complicate estate settlement. Careful coordination with estate attorneys and financial advisors is essential to optimize this tax advantage.

Tax Advantages and Disadvantages of Different Policy Types

The tax implications vary depending on the type of life insurance policy. Permanent policies, such as whole life and universal life, often accumulate cash value that grows tax-deferred. However, withdrawals from the cash value may be subject to income tax, and loans against the cash value are generally not taxable until the policy lapses or surrenders. Term life insurance, on the other hand, provides coverage for a specific period, with no cash value accumulation. The death benefit is generally tax-free to beneficiaries. Choosing the appropriate policy type hinges on individual circumstances, risk tolerance, and long-term financial goals. A comprehensive financial plan should consider the trade-off between tax-deferred growth and immediate coverage needs.

Impact of State and Federal Tax Laws on Death Benefits

Federal law generally excludes life insurance death benefits from the gross estate, provided the policy isn’t owned by an irrevocable trust or other complex entity. However, state laws may vary. Some states impose inheritance taxes or estate taxes on the death benefit, depending on the beneficiary’s relationship to the insured. Therefore, careful consideration of both federal and state tax laws is essential when planning the beneficiary designation and overall estate strategy. Consulting with a tax professional familiar with both federal and state regulations is strongly advised to ensure compliance and minimize tax liabilities.

Common Misconceptions about $5 Million Life Insurance

Securing a $5 million life insurance policy is a significant financial undertaking, often shrouded in misconceptions that can deter individuals from adequately protecting their families and legacies. Understanding the realities surrounding such policies is crucial for informed decision-making. This section clarifies three prevalent misunderstandings.

High Premiums Are Always Unaffordable

The assumption that a $5 million life insurance policy automatically translates to exorbitant premiums is a common misconception. Premium costs are highly individualized and depend on several factors, including age, health, lifestyle, policy type (term, whole, universal), and the length of the coverage term. While premiums for a $5 million policy will naturally be higher than those for smaller policies, a comprehensive financial plan, exploring various policy options and insurers, can often reveal surprisingly affordable solutions. For example, a healthy 35-year-old non-smoker might find premiums significantly lower than someone older with pre-existing health conditions. Furthermore, leveraging financial instruments like trusts can help manage the cost burden and ensure the policy remains in place.

Only the Ultra-Wealthy Need $5 Million in Coverage

The belief that only high-net-worth individuals require such substantial coverage is inaccurate. The need for a $5 million policy is determined not solely by current wealth but also by future financial obligations and the desired legacy for dependents. Consider scenarios like business owners with significant liabilities, families with substantial college education expenses planned, or individuals with complex estate plans needing to cover potential estate taxes. In these cases, a $5 million policy acts as a crucial safety net, ensuring financial security for beneficiaries even if the insured’s assets fall short of covering all obligations. A successful entrepreneur with a growing business might need this level of coverage to ensure the continuity of the enterprise and provide for their family, regardless of their current net worth.

The Application Process Is Excessively Complex and Time-Consuming

While the application process for a $5 million policy is undoubtedly more rigorous than for smaller policies, characterizing it as excessively complex and time-consuming is an oversimplification. While thorough medical examinations and financial documentation are required, reputable insurance brokers and financial advisors can streamline the process. They can guide applicants through each stage, from initial consultations and application completion to navigating underwriting requirements and securing the most suitable policy. The perceived complexity can be mitigated with proactive planning and professional guidance. Choosing a reputable and experienced agent is critical to navigating the process efficiently and effectively.

Illustrative Scenarios and Case Studies

Understanding the practical implications of a $5 million life insurance policy requires examining specific scenarios. The following examples illustrate the financial benefits and challenges associated with such coverage, highlighting its potential role in estate planning and business continuity.

High-Net-Worth Family with $5 Million Life Insurance Policy

Consider the Miller family, with a combined net worth of $20 million, including a successful tech business, real estate holdings, and substantial investment portfolios. Mr. Miller, the primary income earner, secures a $5 million life insurance policy. In the event of his untimely death, the policy proceeds provide liquidity to cover estate taxes, potentially avoiding forced asset sales that could trigger capital gains taxes and disrupt the family’s long-term financial strategy. The funds also ensure the continuation of the children’s education and maintain their current lifestyle without significant financial disruption. Furthermore, the policy’s death benefit allows for the orderly transfer of the business ownership, avoiding potential disputes among heirs and preserving the company’s value.

Family Without Adequate Life Insurance Coverage

Conversely, consider the Garcia family, with a similar net worth but lacking sufficient life insurance. Mr. Garcia, the sole breadwinner, dies unexpectedly. The family faces immediate financial challenges. Outstanding mortgage payments, children’s college tuition, and ongoing living expenses significantly strain their resources. Without life insurance, they are forced to sell assets, potentially at a loss, to meet their financial obligations. The family’s financial stability is severely compromised, leading to potential lifestyle changes and long-term financial insecurity. This scenario highlights the critical role life insurance plays in protecting a family’s financial future against unforeseen events.

Utilizing a $5 Million Policy for Business Debts and Estate Taxes

A $5 million life insurance policy can be a powerful tool for business owners and high-net-worth individuals. For instance, a business owner with substantial debt could use the policy as collateral, securing favorable loan terms. Upon the owner’s death, the death benefit can be used to pay off these debts, preventing the business from being forced into liquidation. Similarly, a substantial estate may incur significant estate taxes. The life insurance proceeds can provide the liquidity needed to pay these taxes without forcing heirs to sell assets prematurely, thereby preserving the family’s wealth. This strategic use of life insurance ensures both business continuity and the efficient transfer of assets to future generations.

Comparison with Alternative Financial Instruments

Securing a $5 million life insurance policy represents a significant financial commitment, and understanding its place within a broader investment strategy requires comparing it to alternative high-net-worth instruments. This analysis contrasts the policy with trusts and annuities, highlighting the advantages and disadvantages of each to guide informed decision-making.

A $5 million life insurance policy offers a death benefit, potentially tax-advantaged growth (depending on policy type), and in some cases, cash value accumulation. Trusts, conversely, primarily focus on asset protection, estate planning, and wealth transfer. Annuities, on the other hand, provide a guaranteed stream of income, often with tax-deferred growth. The optimal choice hinges on individual financial goals, risk tolerance, and time horizon.

Trusts versus $5 Million Life Insurance Policy

Trusts provide a framework for managing and distributing assets, offering significant control over wealth transfer and minimizing estate taxes. A $5 million life insurance policy, while providing a substantial death benefit, lacks the same level of control over asset distribution. The beneficiary designation within the life insurance policy dictates how the death benefit is disbursed, offering less flexibility than a trust which can incorporate complex distribution schedules and conditions. However, the life insurance policy offers a readily available lump sum death benefit, whereas the assets within a trust may require liquidation, potentially impacting their value. The choice between a trust and life insurance depends on the priority: immediate liquidity versus long-term control and asset protection. A high-net-worth individual might utilize both, using a trust to manage existing assets and a life insurance policy to ensure a substantial death benefit.

Annuities versus $5 Million Life Insurance Policy

Both annuities and $5 million life insurance policies can offer tax-advantaged growth and a source of future funds, but they achieve this in different ways. Annuities provide a guaranteed income stream, often with a choice between fixed and variable options. The income stream provides financial security in retirement, but the growth potential might be lower than a whole life insurance policy with cash value accumulation. A $5 million life insurance policy, particularly a whole life policy, can offer cash value growth that can be accessed during the policyholder’s lifetime (though potentially subject to tax and penalties). However, this growth is not guaranteed, and the death benefit remains the primary focus. The decision between an annuity and life insurance often rests on the balance desired between guaranteed income and potential growth. For instance, an individual prioritizing a stable retirement income might favor an annuity, while someone seeking potential capital appreciation might choose the life insurance policy.

Situations Favoring Specific Instruments

The ideal choice among these financial instruments is highly contextual. If immediate liquidity upon death and a substantial death benefit are paramount, a $5 million life insurance policy might be the most suitable. If long-term asset protection and complex wealth distribution strategies are prioritized, a trust becomes more attractive. When a guaranteed income stream in retirement is the primary goal, an annuity emerges as the leading option. Furthermore, a comprehensive financial plan might integrate all three instruments to maximize the benefits of each, tailoring the approach to specific circumstances and goals.

Last Word

Acquiring a $5 million life insurance policy requires careful planning and a thorough understanding of the available options. This guide has illuminated the key considerations, from selecting the appropriate policy type and navigating the underwriting process to strategically managing beneficiaries and minimizing tax implications. By understanding the financial landscape and leveraging the expertise of qualified professionals, high-net-worth individuals can effectively utilize a $5 million life insurance policy as a cornerstone of a robust financial strategy, securing their legacy and providing for their loved ones.